- About

- Subscribe Now

- New York,

June 26, 2020

Luux Media's explores how COVID-19 is impacting the consumer behavior of UHNWI consumers. Image courtesy of Luux Media

Luux Media's explores how COVID-19 is impacting the consumer behavior of UHNWI consumers. Image courtesy of Luux Media

As the world emerges from lockdown, 80 percent of ultra-high-net-worth individuals plan to travel within the first three months of reopening, hinting at a positive recovery for high-end hospitality.

Seventy-one percent of UHNWIs expect their travel habits to be the same as before, if not more, according to a new report from Luux Media. Eighty-two percent stay in five-star hotels instead of a private residence if they are traveling for business, but only 48 percent stay in a luxury hotel when traveling for pleasure.

“There is definitely a huge amount of excitement around being able to travel again, visiting their favorite restaurants and spending quality time with their loved ones,” said Chris Wilson, director of Luux Media, London.

“From a business perspective, a lot of the UHNWIs we are connected with are watching particular spaces and asset classes very closely and seeing where their expertise and financial power could really bring value to struggling businesses/assets,” he said.

“We are also seeing a huge preference towards renting private homes, private islands and private aircraft in order that people can remain socially distanced throughout their vacation.

"So when reaching out to HNW clients, luxury travel brands should be gearing their marketing towards this and how they can manage the whole process seamlessly through a network of trusted service providers.”

Indeed, this sign says more than anything else: 79 percent of those surveyed said they would be more likely to travel via private jet than before.

Forty-four percent of UHNWI are considering buying a luxury car. Bentley Continental GT image courtesy of Luux Media

Forty-four percent of UHNWI are considering buying a luxury car. Bentley Continental GT image courtesy of Luux Media

Spending on luxury

According to the research, UHNWIs are ready to start spending and their desires to spend are across industry sectors.

Forty-two percent of those surveyed are excited to go shopping on the high street and 74 percent plan to spend the same amount or more on luxury purchases than they did before the coronavirus outbreak.

Some 56 percent of these UHNWIs have considered buying a new luxury watch in recent weeks and 47 percent have considered investing in fine art, per the report.

Forty-four percent have considered buying a new luxury car and another 44 percent are shopping online for a new holiday home.

Nineteen percent have considered buying jewelry, and 16 percent a yacht.

Luxury brands should be communicating with consumers in these quiet times to help build connections for reopening.

“They need to be showcasing how they are prioritizing the safety of their guests and proactively communicating their new health and safety protocols, crisis-response activities, and the steps they’re taking to keep the experience level the same, if not higher than before,” Mr. Wilson said.

Seventy-one percent of UHNWIs have considered doing renovations to their home.

“These people have been able to have a much longer period of time within their own homes, which has led to a desire for a refresh,” Mr. Wilson said. “They are so often regularly traveling that I don’t think they get the time to really think about certain rooms or areas of their house that they want to improve.

“A part of it is also the fear that COVID-19 is going to stick around for a long time, and people will be hosting much more within their homes, so they want to ensure they look their best,” he said.

“Finally, now that lockdown has stretched into three months in some countries, consumers are increasingly considering ways in which they can make the most of their time at home, and the data we have collected suggests improvement projects are an avenue many have chosen.”

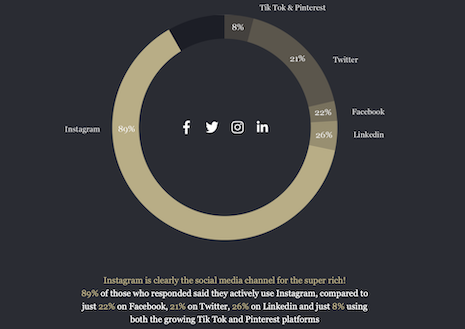

Eighty-nine percent of UHNWI consumers regularly use Instagram. Image courtesy of Luux Media

Eighty-nine percent of UHNWI consumers regularly use Instagram. Image courtesy of Luux Media

Insta-ready

As luxury brands look to connect with UHNWIs, they should know the channel of choice: 89 percent actively use Instagram and only 22 percent Facebook.

Interestingly, only 21 percent are active on Twitter, 26 percent on LinkedIn and a mere 8 percent are using both TikTok and Pinterest.

Sixty-three percent said they have engaged with social media more since the lockdown began and 40 percent had purchased a product directly from a company’s Web site after seeing an ad on a social media platform in the last eight weeks.

Thirty-four percent said the ad had influenced their purchase at a later date.

Curiously, none said that advertising on social media has made them feel negatively about a brand, product or service.

“Instagram has allowed brands to accelerate their digital investments and shift marketing spend to online channels, with a focus on customer activation rather than just brand building,” Mr. Wilson said.

“With many of our luxury brand clients' stores being closed across the world, there's been a definite realization that Instagram is a crucial channel when it comes to keeping sales up, communicating with customers and forging a sense of community around a brand,” he said.

“Instagram offers luxury brands one of the biggest opportunities to date when targeting HNW [high-net-worth] audiences. [However], being reliant on Instagram's behavior or demographic data alone is just not enough for luxury brands to remain targeted to this well-travelled, wealthy demographic.”

Share your thoughts. Click here