By Carolyn Cohen

Much has changed over the course of the year.

In a study published in 2016, NPD found that millennials were less concerned with brand names when it comes to luxury bags, putting more focus on quality and style. The younger generation was reportedly more considerate when it came to choosing a bag, taking longer to decide which to buy.

Getting a handle

We equated this shopper journey closer to buying a car than a fashion accessory: 41 percent of customers indicated that they started thinking about their most recent handbag purchase more than a month in advance.

Each handbag needed to represent her tastes and personality, while still achieving its functional purpose. She was willing to scour the market, read dozens of reviews and product details, try new products, and make store visits before making her final selection.

At the same time, it appeared that designer brands were more concerned with protecting their core luxury consumer and questioned if shifting strategies to attract millennials would alienate their base.

Gucci, as we all recognize, was the first to take the plunge and lead the way, proving that speaking to and designing for millennials was essential and the only way brands could remain relevant and secure their future.

We can all tip our hat to Gucci as not only did it transform its business, it simultaneously ignited the broader market.

By 2020, millennials are projected to spend $1.4 trillion, per Statista, representing 30 percent of retail sales within the United States, and even coined “HENRY’S” or “High Earners, Not Yet Rich”.

Brands who reach out and relate to these soon-to-be affluent consumers will reap the benefits as, even today, many have sizable spending power and no dependents as of yet.

Brands will begin to feel confident about pushing barriers to break the code of the next generation.

Generation Z will be a new force to reckon as they are slated to be 25 percent of the population by 2020, and many studies have projected that they will hit a spending power of 40 percent, making them the single most important consumer group in the U.S.

These hyper-connected, ethnically diverse consumers are already becoming luxury seekers. Social media provides greater access to high-end brands, and developing and cultivating their personal brand is intrinsic to their DNA.

The proof is in

These shifts are now clearly showing up in retail sales.

Over the past year, on a national level, the accessories market has been a highly challenged market, specifically among multi-brand wholesale retailers within the U.S.

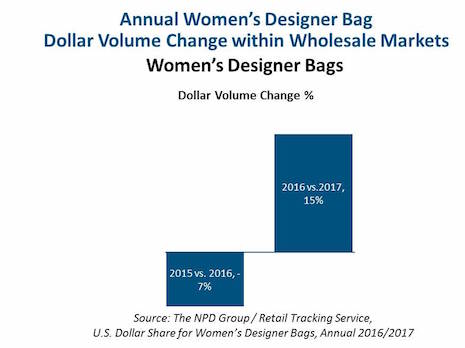

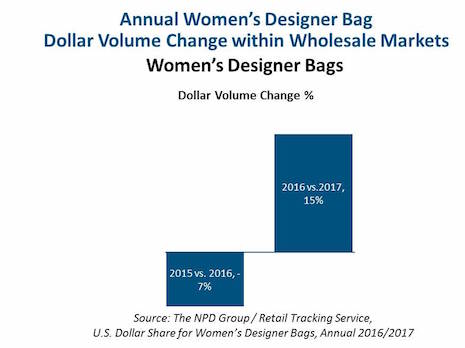

However, designers’ elevated vision, renewed and refreshing relevance, and accessibility to the millennial consumer has thrust forward momentum for designer brands after the few years of flat sales.

Annual women's designer Dollar Volume change within wholesale markets. Source: The NPD Group / Retail Tracking Service, U.S. Dollar Share for Women’s Designer Bags, Annual 2016/2017

Annual women's designer Dollar Volume change within wholesale markets. Source: The NPD Group / Retail Tracking Service, U.S. Dollar Share for Women’s Designer Bags, Annual 2016/2017

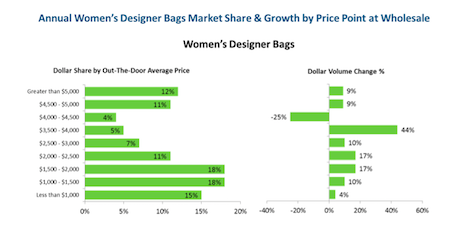

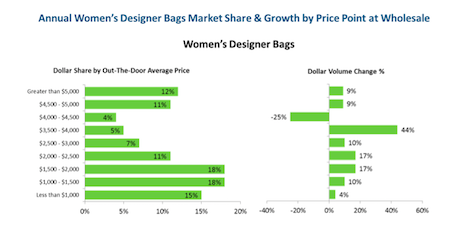

Furthermore, as growth slows among lower-priced items (less than $1,000), with the exception of $4,000 to $4,500, price points out-the-door are elevating across the board. Growth is notable for $1,500 to $2,500 and $3,500 to $4,000 – seemingly sweet spots for the industry.

Source: The NPD Group/Retail Tracking Service, U.S. Dollar Share for Women’s Designer Bags, Annual 2016/2017

Strong organic growth seen in secondary markets

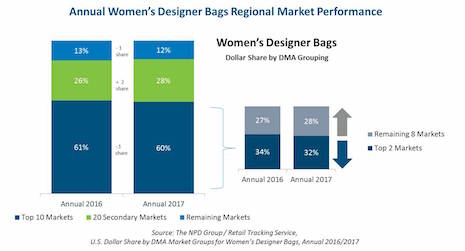

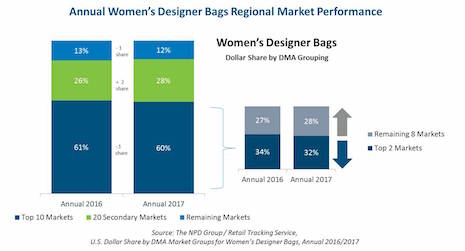

The brand halo and focus on millennials is not the only thing that is working, as the ground game becomes equally important, and is shifting to secondary markets.

Annual women's designer bags regional market share. Source: The NPD Group / Retail Tracking Service, U.S. Dollar Share by DMA Market Groups for Women’s Designer Bags, Annual 2016/2017

Annual women's designer bags regional market share. Source: The NPD Group / Retail Tracking Service, U.S. Dollar Share by DMA Market Groups for Women’s Designer Bags, Annual 2016/2017

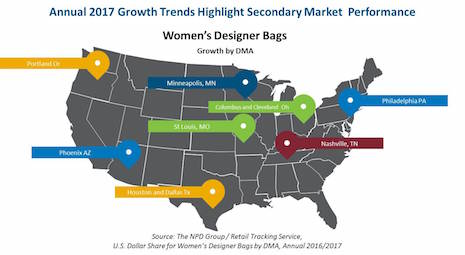

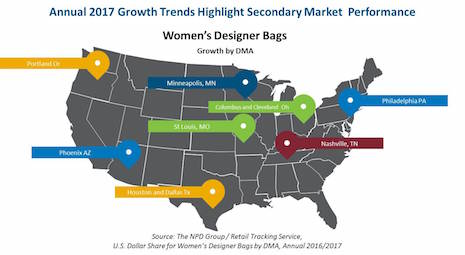

Annual 2017 growth trends highlight secondary market growth. Source: The NPD Group / Retail Tracking Service, U.S. Dollar Share for Women’s Designer Bags by DMA, Annual 2016/2017

Annual 2017 growth trends highlight secondary market growth. Source: The NPD Group / Retail Tracking Service, U.S. Dollar Share for Women’s Designer Bags by DMA, Annual 2016/2017

Last year, much of the market could not have predicted such seismic shifts in the luxury market.

Not only do we see these trends continuing, but in fact, growing.

According to the most recent month sales reporting, December 2017 was even more stellar and we believe this market has much more steam and opportunity ahead.

DESIGNER BRANDS should continue to liberate from past conversion while also developing their presence in lesser likely secondary markets.

NPD's Retail Tracking Service is based on point-of-sale data provided by participating retailers representing a majority of national multi-brand retailers of the accessories market. This fact-based data provides important directional perspective on the marketplace for brands and retailers.

Carolyn Cohen is director of business development for luxury and fashion accessories at The NPD Group, New York. Reach her at [email protected].

{"ct":"yNXF9v0nzpwztSLbLnoumD\/CFRkv+C2Z7QZNAfM0p4n8BuxvHo41DD\/egufHktYL+SAs0AlVbaNG7I598e\/RrzNUEzWxDEc92uB55NOQTCTEcrR2kPlZ866wWZZAtRJj+\/wBILr3lQyMlfFZhZp+\/EkyyuMQA6Y9twtMWMT\/N\/9wmJnRv0DqD\/z+fmHrCI2j3kdzcF2NUG0ezk263\/jp3fqrdcktlgvu53y5gETSXF0+DnKfTF+IaS4fy+4T5puunjvIsoZeRLvmi4jsQNxujUN9H4DZEkYRFG9MNZciY99dZhvq5FLDXB5Sujkh2qZfhRVD1tkazKgvyiHFJ3tXw+tl8ZrBv0EpXwQ66z4PHFgxzkxO8aOVot5JpFNAcsFCyAqnDas39YIUc\/WcFoUJfYEwsKeTmiz0nzPkLm\/vOjjqTVA45DcnXd1vUJdza55Cq4jo1Xq2v+m+I1KKDpn+e+r6POLeX9H8U8ArW15rxkqOaFS1FTuSSZU1zrlXIIY0GXJl8VhR24cLfJPzPqm+GMoCXaE+ggg6006luUiRM0zV\/2CzYUqUCQ3HKYzJrdKkodz4wkUhNFfg60k2b1\/GQbgXbFdVk2bu8Rq9JzrqWzJtzY5RjVotOjvB73MwvzGjRBdvrdbadYdCuZJ18fqYgYCcFZQgiDRojOpK+5DPMXvWnwr8CZCCIbvJWykwXQCCrgxrh8aiMxBOXhLfpHs+2SQK4XXjWoonAa31OnzfJHLrt0w44h3U+kg15scbqTAW7whUR2IhEzJ5mZxv2JSGk558AiLvHZJwTB7nu3qnYa6aKsViKrqsM\/oi\/PtDUzChZ4lYnjfpBwl4g5iLMekVWJJTiD+ysXXB+zxsoWc5ozpu35zNyu61fts0WgyQTtopBL\/D9B4NRaEUFlkvqGW6itCHuTSM96LxozfX1dQon8s4gM8Etd9xm2PisP5LOyXu0tIR\/WKYl85iMUG4j15SJ7y4ghgm7yzgTgLYkFFsUqcJ4aT9hWR\/PTAlqA7vXz2U1B9fObZpMfieRHpIMs2pL6OxMEi2v7dtjKnM0pcyM6ueuXd0GWxgxry2\/HMPl0OjSNp13MObYfX3DHlAvKZR\/qOQQgKpIbKjl3Up+B05xu9Ah2tmVfpx+Z3kau\/yK3f8AgwOBUH40ovcme6yCt0129Jwqrc\/j5NTcC4++oYhQ8+LgHBM5dzhJ\/eNNRabT+kvo6RByyDbjU6qPvgMfWsC\/fbBCgqQwvYmhuRTdmC0eRvwe7QyOa63UgqO8jwdu5fjDZwRXi\/aijBsjaY6rd1fzARYMRq+bxFeMThpRpxnBUh3pMDSWjzbyTKinZ7JMiV2up8qb+zElPP2k0c5hztD3soDc+P+31KlgtXuH\/Mli8yCEt8PA3n4IJj6ZG3+IX2yjEejuT\/dVdwmewjS0bj1svNnbrX1XTaVcvfsb3N57MD1LVFaUYkIg2wbVjdN+T5gtYjN3SBzj+WV5AXlRkP32g5POeiLlKowFb26U851rTd3PeaoCInEc4lDkdvsGlW0lbmT\/4\/MVOldS5EoSzlvG25hP0zZxV33WAJi5Jstzr4S\/Di1o5Ov9JB0Cq6FOkixz9n\/p+rnxjlRZ2jGRPE2n\/lqVJ+aEaECvb1kIYyWYG7IdXOcTRNFNErlcXaH8o66Yz45OTgI82riT6RjvFF1FBcd8mT\/SkC5jkGQ3eypex6njksu1wrb6CxnexpT+k7xb0\/K\/dfARKMHcPh2PPgI3T0JHWbzIPni9aSzBKLARS57AuUPOVniN2zjNTH7cVApVc7Fkv1s+0AuqsMQGF0JCQWNfXNB+5hZP3ZYc552EtkbgrFU2TtDnsjO6XkTYZL3a9HMIAxoSPBd+zFcMx2PQE89zitYyN6tjolLaW7sYu8gVF4iyHOLC0dYYmXjtTBcmYVZXTdcVe1R1WduoIwWCjhwQaV7TFfaLFgeBRH8LTnhD\/x7hoYnVehVaHwyjB44+LlzKtizlv\/L28CagZFWb0XBlLSQ9S5gfWABh+8UIDbX8hype32cOUAB7N2TeWJXJ1XD03KlukJj0GvJDgTjk\/GBcuopa5O9VPRoVbZN3939nl8gWzk1jhV7FpEf+20598SEofttRGZv+xM6tnfmGplXn6EZJNarcw0sbIjj6KuGh2vMniD+bFJhu8VGSfYTPtwErxB6KjHdx7Orf34pAzJvuZfMyS3DhCL1YkdBMvt9ASk6mFGxymCKcrPLzgYRL9fehl7In45zJZIW\/kB1RNEcPtJ4cn7hHxGXFhqfKTJd9uvKqmz4c8rLD3Os54kcuf8KTdjOZbFcij5WU1OuYP8E0W+8gDCuUUouqNAhEWkTen7By8vcpwM3cZ0LCHeViQx0vGwIb3rWWIqRp2L\/ak2fXqVd3LwBtl+7cMhow0vUkNMrdD13nnBHpKmUUJHQ7XkNH+FFru4xGf6gLsv9mqHEXCnpNoMFmID0jJpOwFsb1KtmID3gg4VmqY\/4PalvJGsD6IGZpH+h8KEhQTg4baPaAlcKz0\/jRDYWt81fk4TnLqFZ6wUFY36s9Tj4Si4PZSUwgUYFH6qwudSMRvcX819Y1uHNQtxd9p2uavcM+PKMM5txtKxl0NDzp\/W9ToaIDL5VENGUuIZUljEfDzMm3\/DtWvS5tosVQBLal0YLkItOevq4I7FoWyo81jUrJLRQMcsHrlcD0p7CNzvVUx+UQyiCqOpCiE7xl7lkjj\/s2j\/1HxNwHHSTiBcGUj\/UYRRZwwiLAZwG2WSaeRvHyCKafLr8y0OeCBaa2zevR1AtxWxxXm981Fcdxecx6UDNoGs+rouB+LnxLYzl\/BY\/wkN1DblT+2JSH\/bfW3dyGUepa\/S5P02wVrtpNj6CAarcBIGOpTeqMXwfgjb0bwXPvLvx\/aw8hxgMxb4DyLl4M22rcz2rxZMxGS9VKM2CoZZImaxuCiWGfb1AGtZAO6pv9IsWQ4RSD8AQkzjpBRoeBciyqZzZ9qhjfZoD\/2\/is2lvmncBI5SYeSJGtxPvZo22dWboJ9Ll4J87mOkNikH4sL2hfFODMBDon5NlZDQMeo9hV+GTlxqlM560mGzk7yY6MvEGierUbgYExzyv3EzIp\/xuN7OYRm11yGO1cQuqxTwqInCwuwAc41LCMr8OeSVufSw7dHBgr4UuynJS6eUxYIrxVOq1Sz7I+1alBTUTbHtsglNi0gw96IdWhBv6d8PgNngR8l6JnZumgObqqBjs1cD+2DHGk0SFQIroTJ1+\/EepySB8bfBDV56dw6I7cAUlsyVd7zTKdV9uRRm\/Rik6gII\/Inf\/G6PL9yXP\/5LVazzUuejeOay1AxSepZDHZiH5ZRfpFsvlejmUsiVdstrwE\/cEdGlB6xfBU9Giwx9SO3\/5OoiWfWLmHmQl5voxBg\/1zAOgBWfOh\/5c\/\/oRcPGFn2m+Ef7m53YI7SsVruEBQZlI7XSTj6P7rHFP3BVkjc\/T7wo1haR5wm5U8vCBjM+fKUKJ2mrLEBrLy883va5aRCErzo5CSnvWl9FIXh8AN4T1pXIkRyVtQkDkTBwv4bghz6Dj4Slwr3HyYE53fhZudtPaUsPUG45tBSCwOrxfh4ViQYK7b4zVrFQKs1sw095X3Tz1rl3O4atRdP6jbF\/LECvFMH5cKmNVoK2AbEOnX3fhtTAw6WUvf4fXUKpXnQ3TsU9CnKWx2MvgUzeH9UcrGGcZDPvk1ioSV1hzcfn2fwsC\/cdiR7iICYL3NodenV54NltYOYENFPGMxyjwKUaPZNtGdUTI4H0blccCKoM9Why85qiW6e92yCoFeeZ0r62vXNcXsfgR263Wplunszx2o29fLSMFXHbnzu7GJbe9PxeMK+GoMtc4xwSMs9GMEuoJRENmDhEHoCtMMQPDaOX\/4nUSuzBFOOLehQPp7SXa1Iw4OSlp+4WV33cyYa9y1vIvl2400oxeKDunWA7nNWguPFmCe\/LTGZ+1QeOnqlFpdLtoN7xUXoMAnbSpBC3PwB1WwrEMCJd83e5\/+LTzvPktP2V8+NSukFhvGgKzxz8iGhXD+2ihVAYyakyZM0suAPIESfBU0fj7j\/QXJmadnYy37aEBlZaEUMNr953S51IZlJS8SW51vylMdxMbv5rF0crm0Vb5d43zSGxA\/tKKVbCdP5UOnMvuZdJ8ZQjh0SbzQQyVXe3BYsX7J03\/CbhLcsL9mhMKxB6UZWMmfixnV1UYG+QBsdJPEjLjzGwbbq0NLoGrRyjExQoJLmetyMiNOtuFGK3RrJ+PgianVP50Ykhn17Au5Td0q1yjQDF2eV5biGqan7gMm\/OLvrdKDHCbvZw3WTpKs+IBwXkKm2vEtMvx1QCLocGCtw26oz93Ajz6RRcw\/gYjgFA215zkBelLVdS6lJ1SOcvHYyS3IbmOLKYATNbzROKjX\/AgCmplH\/QGHuBpso2SRxpHtGLeetM\/1tid078cHpT3ZVRuBpP307Ij46\/ZiRrsJCF988t4+8qWlnXZI7Kb8CMlja9\/Hxw4y49Df+YQ0PeedQ3Qs86dP9YSGzoQodmcCGo80BhyPB\/vt9Q6YYIsACxIx\/eav\/jR0ykbZSgP0FVOlNB0XY5u8b7daYMAVHc9aGrOz2hZ0v6ojwQ\/r5IJq0aHOBtplZFSWSxHy32d+OFaLS1WSObvrTWmIv8n664kV5rImkTiap00UfZu8yvmHq68U\/bdUdGft7M0EOhpDSv2xuMfYMnXvh5PnxqOHy\/ME24Zy8N5WJsEy0pF5PY5MYMM7lyMOt0dUpuPZc9bidhmbCqIIDYGINH6LjmXf2SD3fAIsF1BGdGn9JZMvNkzIXNqYpPEqgdtnvooTvfsJVoWnZIbYj4gL+\/QQ\/DMV5VmaXC+gsZdWrKitxUFoQ3btQ\/+3CBXJN5lDNejaoQN+ZCdV6hOn2yQygWhPvyRGe5Ncy4o\/SWJ7oQLwENWLtedoLjLyiB29bV53cL3tdTUpjfq0KzZS2maZSaQ\/ACor0UlRcAN2dO7KB3NyefIOBSRIOd59FfhKvK75J\/ER\/ttNvl7QPNwFE6bK5rSjjJPgvaM7BdacMOGk+NwmphMHGhZ5ywbZiuAZBObTyBPYgbHxVSp7gCD648Hfl+jIpwQpOwuf+rxFbrw\/hlWbBa1Mt0Vy8EpFKFa+FEBYFNnmM2uYmbCiof14Oh62ntzKoim0GTyGTdlvYW3030JRoV+K42+6S52w4VhemLyy40TxfzCzGvEahcu1y0JIwnoviJ\/V1JeP0bH9i6ny\/g1tANHtq7n9tNvBSLWj7oVWc84Zu04nKSHBtKXbR9pmKTQFkUwm2iMzOslb\/GtV463J0IKUFGeFCEWsTqoGumwP+efS+Sa+IUTwZQ6qEx9SepkVynDmf7XOMTENNf3l0xMq5xbyWJo\/F33EXP3FJWpa2ihDQ6zdbQjLpzP1KUpUQS0YuEIMYn3jY8tjIcaiRzl4LqpDwbjCO8xV4xr2\/wH0PAmKymTYzpg9K0ANUmYZL9TOatdzgpcwOQIBJfuYum8Tc96MuDLs272Uh9\/sS5yLBAK3fY6qPbZ\/+gWxFg1OudVUntSTh8a9rV383iC2vy8unUOAT7wHevT4vW80yxxPzwTHGUzWwk575lzcFLk6srExY5LAWA9Yz5HEDYZJccJwuZvjNm\/k+yjjoTQCyNpyb+ApmG1\/ZiRDfzCmJu\/IuuIjEPkPA9EPKDoCPUJrsggnAnTAd\/PRAsECVjXUxeE\/taRvVPAZ1Wm5XTrM+Q\/vjpfMKxHeTQbRrUEl\/YviNrfxi0Hlr74ZJVFy2qWXNITUK0M\/bB1pEJ8kIVbV1Bd8i8FpAO0phH\/pdNxCx\/e4KPu6h48dquuCQsBANWpx85CKW8aKG9R4AcXzzj47MMvuYPWTdVsxwfadlOadAJjlN0tPO0vbl8bHhAOptzpSsJw6I+oQaEGlYnfVFx4HZtaujV9UEFndQAdKhyTnOMQsrOT7ltggKKFjsqvTlHnQpxF2UUjpRYyLlzZjGdYOcvsqdQO57lSkCiIlvTm7FHzuWU1QGey6c8jj4M+dvhimPXKrOm5IqoEZ8boyepHM15ZEDYLVB4yQZ\/5TJA3w81UD4ugAylUwwQ3mahSlEP18C6AUA\/d4vokOxAyEoS31mc46W7obvq5hyrAoqYrc2j44UZdDZcJMIMeL9e9l9wyc4BKtodd\/HFDOax9k2S2Z5Cb53L0nak5dmBNC8BlvPqTp61XU9KVD2DIbEBx2ro11\/5ilqqznfC0AxqEUQtAvBlyCAAcl+fvyueQAphUd2IPNxjhvRJAsq3fo3Jf\/vAGDC\/tT5mhm1oHTFad4CKlCp5RaOM6cplnEVdZbVkQMy8gcpeMr52NogqO2IkA2MAdCMkdpJgZE0ai2eqULm0v+YYkxN0VejynzWrVe5RTMasD9wbSGcL6fhmEvefGTS3AbthjoHbghhP+AVuAUrf1QyC\/+m1jjloyTknQ28T0fAB\/YA6sr3cCJKBbxVs13pwIp98hqRgfBe4LXpQmUiy2Q6Q6av2AWgHmAkfx3YNfQLzUMlGk\/miQrXFH3oLJG\/k0qO+TlcVzjMpsRVkD1D2DvyVxH9CwfLofOlB8bgz49nU\/WQnI9jD6uxvptzmiQpACPUcR8WVdxMIcijpj8dV+Z0yjQZ6cUB75iqh6DGRyqlwxdMlTssM0rmVH1U06AH2CCZZI3DKvhUgMvI88L+4wQ5ysuYtZjbIe1F4A3Kzp2sUtzX\/0tBE2rdGSbfCblXAIzFQ3sUQQC51j403qo9OKjBfgNxDPtzEFidnRNBVhCCS7L5Xw1H4pajWzdMFZYwmdqzfeVAndfRyFhUDQGo33raEK5P50uB7wI09j3NaUrjOJNH4z0aVZUzAL1lF5aJGEFmMxZTPlLlk6QbnOm\/B5KAxbdoxC5NaMJb6VE27JaxcFuDjjmx3DpMCPs4VMO7XrcLZ7AiPYEssMp4PcJJd5zOBVUj+encd8pWXYmn6YUsD2sH9Q04k5YWnfxMl3qKgRZAZNGqrb36bFfb9RAXp3DdkOeVpam+0zzGK4h+ZV\/Ag+bPUlRCLJ+s+66wSttVQPiDoWLdKlE5T2xDOteX2Y0FYSx4e4wnWA3zk1yPzS0\/8yXV2SxCxBoZgRb+itlDmo\/LLQHbPHpdrIdI8dLY1gEJXPa6dTxvPKcu3AF1jxmMXfqHM2aszeo4ABDreN34Fo8ejNyFpoXQRknTusoTthJGSRxU8fseZty7GdvRAqsRCyu7hziykGf5eZNvwZn\/A2jBOO0i8RNXxP5mF1f5ZmwBAL+P3\/zrNAHSgyeEY+XEj0IsJK+Q8SNFnUd1U2UwALSph4+HTjQWvDsQn55e\/HV6ZPzbg4NsiCkF4+1RjwHqzAz3B+1MpPk6j3jc3JH0hceDZ02xWd9JmzPC2qwh\/BJO76eggpAG0PYCALpyjyrYbQdPCfiwuC1rra8P0K7enwyg80Ao82UBtB3C2Ys6FqZjuIAquyD\/ea9+T3QYr7Ld2wjF53bd4D1UDkaWk4zGTDY9tOk7XQJNCL+oHHAIFZKAtYHoM9FA8z17BJG\/TBx6YXjn1J45AdvKpz3\/6Z1eLp8r\/tQU53T1UBOyYwaSGBgEx+zmUuqa\/rfxEDsO1v38mC6KDTBp55O\/DBlLw3rnCClqB3ituEZXzMtic10SKlnyRCfevCno+6LN+WV4vszuvnYWoA3RzEdLNwF9IBY\/IOTmjq9U4ET1i0QVgk0m6WdKAt1oKWLiTJSuUebLAAlzzkpA+1oI\/HhQwe83El5k7AWd79yiThjTMtczustQzh+EPLe3n1uRCwvASR7zLWVIelGFla20VHe+C3CbPzzr15HUtA5C+48LA\/rrR46tMve7u5EGuWnkhSTVbawZNX4MqUgtTeT+zMlblCZwlsko9SQH+Ov27UHL6Q\/il6CTH+Ej75JPtoxzItOgp7hhv80Rulf62jRBWvwGouK1ja2ILgVCkirEwTTX08IEIw92S73vMu5CLBqzOU8f0r9Iry1deWik3oMjTcQN2f5OnYkbbQ+Z\/QuE7qAY8IawEV7u7KdCy2mafh3h5urlyvwlEyidhhUPbsrS8gpXP4WY+ZkBKzxe5xD1xi3Olf1omK8KQWD948D+isqqulwpk6mybA7eRdjZP1meCTgNDAFOlMzk1BrqNUvMi+eYCOBJVzmlDKrE7RnKKCLPDh59AQyCMBDtbsOKWuncBb6o+XMXkMNo9cZUcxtNNTg7twMPufcgKshQaWv\/6paxWEN9qvsxelCE2S8WLOWSbnvsA93Ri5bjGiMYL6UEAmUWq2vw6G99eq0qaqZntnRuZHitV+qODcgvT6tl1hVZR4vC08+bRMecR2chPvv3PAxGTekR5ar2p+DmVxkW7VaKqlwVRfUkvjYtb7gNofhZlYcQyvdLoMf02cwRiJ6BzVxTkqyaUA1rZDSFOl1FZbiyuhUHoMnzg6WrcaFD4bdra8T3mQ3Hb\/QlT2VLXUpESP5ZNmhWEBou1JQf\/sq3NU2Q8wz42nc1MQuW1MtTtUKRA2UdWJMCNPq+jqETlec04MoEMszVOv69K1POsbC6SqZPm7ICnHnbyq9v3s3lh4SbllcO0r\/KCnssJSLLouzLvwFBsjflqUv6aYTH2YqF899TO9OrbWSFwq\/EH4xcDhSZUFX\/abkFISKurZhIFi6q4BG+2EvRak1dzKn24zoFJJKwTKEvh5EV+dGKadXN8ovYYEO6F\/Je8HLZb4q\/wLJvvd96Rk6jeZxQokxzxchVKNXQRpNqdYJtm4\/bwQUVJZA6pFjvX9NTlFShuQn7uO92Qe6Y8vqEDHjFJj5M\/92WzlkaJQI2OXBrQpUUvWrEtWs54OOZNUEPefKVuFM7VO8\/\/lRu9bLy\/fs6VaaA+nbAsEUmuSGuCibl0xy60nuCOW0koZ3+gqGijI1zIJhKyIHf5LleZZAXph7766E5O56MEl85MMm6ybNgyhlMB9b9dBwRIJ8E5484klp9Zm0x1XMifpAGdo4IL7pf43hnjRN7RtFAHjBMYUqfoQX+wXQm4W2hSbztocoy4tMy9Zr7xNctMl4wQgyWLq8TNWyQMZEKnU6nOeEzM5NWUszrkVIHptUojs5ZhlAU7zTNHExg0O1pQ1atuExcAAGG94gB+EO3LOj2T9UNLz","iv":"9d275c7d212e4b324071ec60491409d7","s":"50d22a2713174cf5"}

Carolyn Cohen is director of business development for luxury and fashion accessories at The NPD Group

Carolyn Cohen is director of business development for luxury and fashion accessories at The NPD Group

Annual women's designer Dollar Volume change within wholesale markets. Source: The NPD Group / Retail Tracking Service, U.S. Dollar Share for Women’s Designer Bags, Annual 2016/2017

Annual women's designer Dollar Volume change within wholesale markets. Source: The NPD Group / Retail Tracking Service, U.S. Dollar Share for Women’s Designer Bags, Annual 2016/2017

Annual women's designer bags regional market share. Source: The NPD Group / Retail Tracking Service, U.S. Dollar Share by DMA Market Groups for Women’s Designer Bags, Annual 2016/2017

Annual women's designer bags regional market share. Source: The NPD Group / Retail Tracking Service, U.S. Dollar Share by DMA Market Groups for Women’s Designer Bags, Annual 2016/2017 Annual 2017 growth trends highlight secondary market growth. Source: The NPD Group / Retail Tracking Service, U.S. Dollar Share for Women’s Designer Bags by DMA, Annual 2016/2017

Annual 2017 growth trends highlight secondary market growth. Source: The NPD Group / Retail Tracking Service, U.S. Dollar Share for Women’s Designer Bags by DMA, Annual 2016/2017