- About

- Subscribe Now

- New York,

April 23, 2020

A picture of Russia's wealthy population. Image courtesy of Wealth-X

A picture of Russia's wealthy population. Image courtesy of Wealth-X

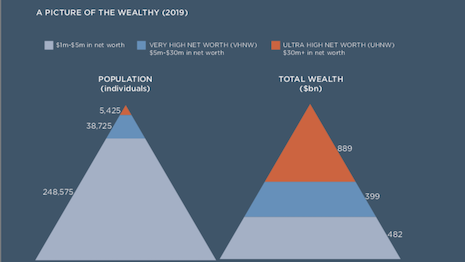

Russia was home to 293,000 high-net-worth (HNW) and almost 5,500 ultra-high-net-worth (UHNW) individuals in 2019, making it the fourth-ranking country for billionaires in the world just behind the United States, China and Germany.

Per a new report from Wealth-X, Russia has 5,425 people worth more than $30 million and 38,725 worth $5-30 million. The rest are worth $1-5 million.

“Similar to other emerging markets, Russia’s pattern of wealth accumulation and the number of wealthy has been volatile at times,” the Wealth-X report said.

The country’s HNW population reached an all-time high in 2013, counting 397,000 individuals, driven partly by high energy prices following the global financial crisis.

This number dropped the following years as falling oil prices, international sanctions and capital flight impacted the wealthy and their businesses. Since 2017, that number has been inching back up.

But the economic situation is still volatile.

“The COVID-19 pandemic is seeing many of them grapple with the business(es) they own or run,” the report said.

Ninety-three percent of Russia's ultra-wealthy consumers are male and the average age is 55. Image courtesy of Wealth-X

Ninety-three percent of Russia's ultra-wealthy consumers are male and the average age is 55. Image courtesy of Wealth-X

Rich young men

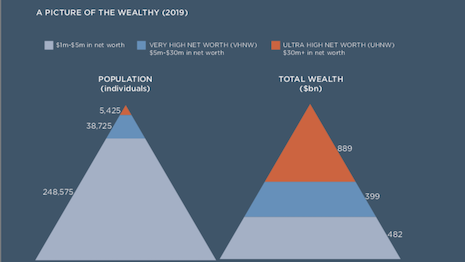

Russia’s ultra wealthy are much younger than the ultra-wealthy in other countries. The average age of the ultra wealthy is 55, with 54.7 percent of the ultra wealthy ages 50-65. A sizable 25.8 percent are ages 35-50.

Additionally, most of these UHNW individuals are self-made, with self-created wealth the source of 96 percent of the wealth of ultra-wealthy individuals.

Both features are a tribute to the wealth accumulation of the last 30 years, following the collapse of the Soviet Union and subsequent privatization of the state-run economy.

The ultra-wealthy population is also highly dominated by men, with women accounting for only 7 percent of such individuals, much lower than the 15 percent average globally.

Banking and finance are the most common primary industries among Russia’s ultra-wealthy, a similar pattern seen in other countries. This is followed by energy and real estate.

“Known for an abundance of natural resources – and despite the economy’s dependence on this – the energy sector represents just a little over 10 percent of the ultra wealthy population’s primary industry,” the report said.

Wealth distribution in the top 2 cities in Russia. Image courtesy of Wealth-X

Wealth distribution in the top 2 cities in Russia. Image courtesy of Wealth-X

Inequality among the wealthy

In Russia, there is a high level of inequality among the wealthy, which stems from the country’s transition to a market economy in the 1990s. The changes led to a high concentration of equity ownership which continues today.

The ultra-wealthy account for only 2 percent of HNW individuals in Russia, and these people own 50 percent of this total wealth.

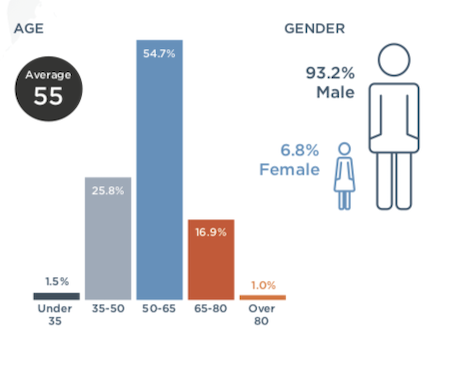

Russia’s two largest cities, Moscow and St. Petersburg, are home to about one third of the country’s wealthy people. The rest are widely dispersed throughout the nation.

“Reflecting the unequal distribution of wealth among this population (not to mention with the general population), both cities show a very high proportion of individuals whose wealth is at the top end of their wealth tier,” read the report.

For instance, Moscow is home to 27 percent of people worth $100 million-plus in the world, ranking No. 7 on the global list of the UHNW population in 150 major cities.

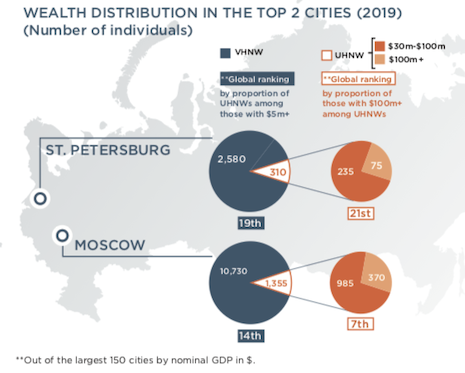

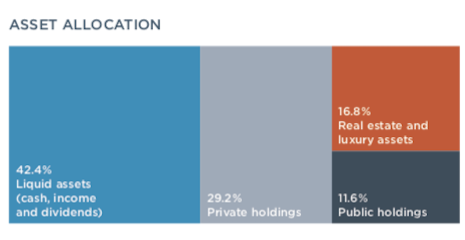

Russia’s ultra-wealthy hold a far greater proportion of their wealth in liquid assets and real estate than the global average. Forty-two percent of their assets are liquid, 29 percent are private holdings, 16.8 percent are real estate/luxury assets and 11.6 are public holdings.

“Much of this reflects the often volatile economy as well as its domestic politics – causing the wealthy to often prioritize their ability to move their wealth at short notice or hold it in property (which is seen as a safe asset), over the potential returns of investing in public holdings or privately owned companies,” the report said.

The majority of Russia's wealth is kept in assets liquid. Image courtesy of Wealth-X

The majority of Russia's wealth is kept in assets liquid. Image courtesy of Wealth-X

Share your thoughts. Click here