- About

- Subscribe Now

- New York,

November 1, 2019

Picture of the Chinese wealthy (2019E). Source: Wealth-X

Picture of the Chinese wealthy (2019E). Source: Wealth-X

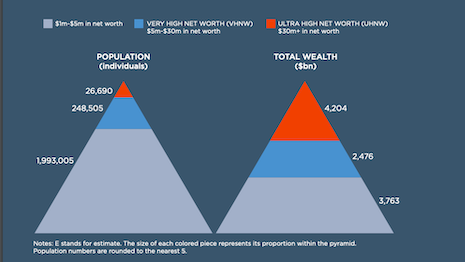

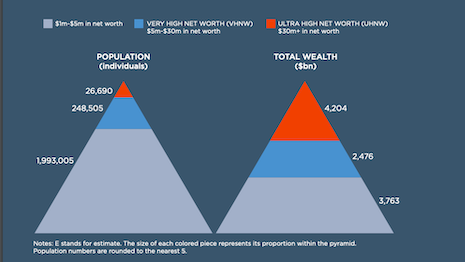

There are substantially more wealthy individuals in China than previously thought – 46 percent more at the ultra-wealthy level.

That was data intelligence provider Wealth-X’s discovery after recent expansions to its global database on the wealthy in China. The company identified nearly 270,000 wealthy Chinese individuals, growing its total dataset by more than 22 percent and expanding its coverage in China nearly 18-fold.

“The world’s second-largest wealth market continues to provide huge opportunities,” Wealth-X said in its “The Wealthy in China” report update.

Unprecedented wealth growth in China has led the country to overtake Japan as the second-largest wealth market, with an estimated 2.3 million high-net-worth individuals including 27,000 ultra-high-net-worth consumers this year.

While the market is considerably smaller than the United States, China’s wealth at a total $4.2 trillion shows that the net worth of those at the ultra level is greater than the wealth of the 2 million individuals at the lowest wealth tier.

Wealth spread across more Chinese cities

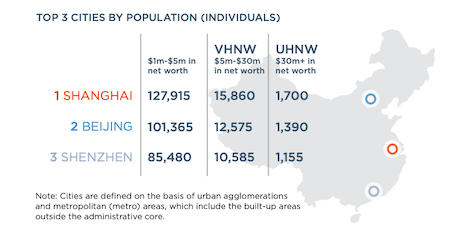

An examination of the affluent ($1 million to $5 million), very-high-net-worth (VHNW, $5 million to $30 million) and ultra-high-net-worth (UHNW, $30 million-plus) population by city shows Shanghai topping Beijing and Shenzen in all three groups.

Shanghai has 127,915 affluents, 15,860 VHNW and 1,700 UHNW.

Beijing has 101,365 affluents, 12,575 VHNW and 1,390 UHNW.

Shenzen has 85,480 affluents, 10,585 VHNW and 1,155 UHNW.

That said, only Shanghai makes it into the top 30 global cities list by wealth, according to Wealth-X.

Top 3 cities by wealthy Chinese population (individuals). Source: Wealth-X

Top 3 cities by wealthy Chinese population (individuals). Source: Wealth-X

The report stated that strong wealth creation is occurring across China, which now has more than 100 cities with a population of more than 1 million people.

In yet another finding, in contrast to Tokyo, which accounts for 40 percent of all of Japan’s ultra-wealthy consumers, Shanghai is home to only 6 percent of the total Chinese ultra-wealthy population.

Private holdings lead

Where do these wealthy Chinese park their assets and investments?

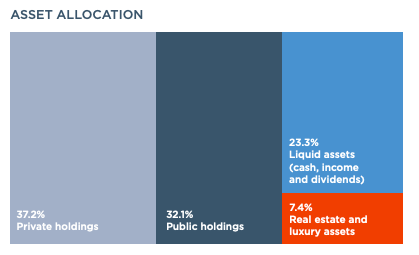

Per Wealth-X, UHNW individuals in China hold a greater proportion of their wealth in private and public holdings than the global average.

“This is due in part to its younger population, many of whom are still in the midst of ventures that drive wealth creation, as well as a trend for the wealthy in China to invest their savings into real estate,” the report said.

Asset allocation among Chinese wealthy. Source: Wealth-X

Asset allocation among Chinese wealthy. Source: Wealth-X

Young and entrepreneurial

Indeed, this is a young and highly entrepreneurial group.

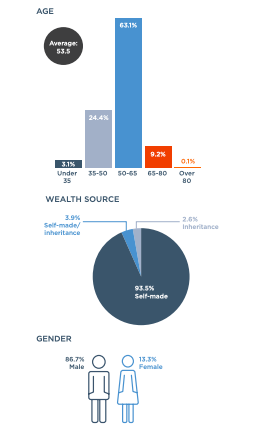

More than a quarter of ultra-wealthy Chinese are 50 years or below as compared to the global average of 13 percent – a situation unique to the country where economic liberalization has had only a 40-year run so far.

The average age of this demographic is also lower.

An estimated 63.1 percent of the Chinese ultra-wealthy are in the 50-65 years band, while 9.2 percent are between 65 and 80 years and 0.1 percent are more than 80 years old.

Encouraging, 24.4 percent of Chinese ultra-wealthy are in the 35 to 50 years bracket and 3.1 percent under 35 years.

The average age of the Chinese ultra-wealthy is 53.5 years.

Not surprisingly, self-made is the dominant theme, given the youth of the open Chinese economy and its wealthy class.

Nine in 10 ultra-wealthy Chinese consumers created their wealth via their own efforts, with private and family-owned businesses being only a relatively recent development, Wealth-X found.

In fact, 93.5 percent of the ultra-wealthy Chinese are self-made, and only 3.9 percent have a combination of self-made and inheritance and 2.6 percent inherited.

Age, wealth source and gender: progress in some, lagging in others. Source: Wealth-X

Age, wealth source and gender: progress in some, lagging in others. Source: Wealth-X

Mind the gap

Much progress, however, as to be made from a gender standpoint.

Men account for 86.7 percent of all Chinese ultra-wealthy and women the rest.

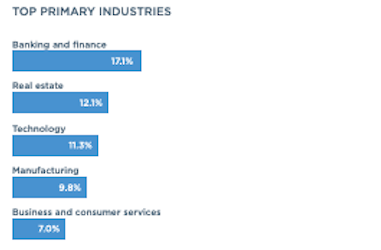

Banking/finance, real estate and tech among top 5 industries

Manufacturing, business and consumer services are among the top five primary industries. This undoubtedly reflects China’s specialties, but technology is also a growth area and an influence globally.

Banking and finance account for 17.1 percent of the China ultra-wealthy, real estate 12.1 percent, technology 11.3 percent, manufacturing 9.8 percent, and business and consumer services 7 percent.

No surprises: Tech, manufacturing among top 5 industries for Chinese wealthy. Source: Wealth-X

No surprises: Tech, manufacturing among top 5 industries for Chinese wealthy. Source: Wealth-X

Tee time

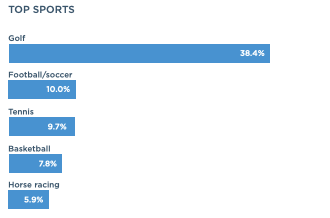

And for leisure?

The Chinese ultra-wealthy, it would seem, are similar to their peers in the U.S. and Japan in terms of their preference for golf, at 38.4 percent choosing that as their sport of choice. Ten percent prefer football/soccer, 9.7 percent tennis, 7.8 percent basketball and 5.9 percent racing.

Making the link: Golf is top sport for Chinese wealthy. Source: Wealth-X

Making the link: Golf is top sport for Chinese wealthy. Source: Wealth-X

Share your thoughts. Click here