- About

- Subscribe Now

- New York,

October 20, 2014

Hong Kong population statistics

Hong Kong population statistics

Hong Kong is seeing a rise in ecommerce trends due to low government restrictions and because the city’s consumers are becoming more familiar with Western brands through travel, according to a report by Borderfree.

The Hong Konger is typically well educated and fluent in both Cantonese and English, and with Google and Facebook as the top search engine and social media platform within the region, luxury brands can easily enter the country through already familiar online tactics. Borderfree's “Hong Kong Country Report” highlights digital trends in Hong Kong and offers insights for luxury marketers trying to reach the Chinese consumer through Hong Kong.

“For luxury brands looking to make headway into China, Hong Kong serves as a very attractive gateway,” said Mary Ransom, senior vice president, global marketing & consumer products at Borderfree.

“A blend of the East and West, Hong Kong is one of the most cosmopolitan and fashionable cities in the world,” she said. “The high concentration of wealth and a very fashion conscious culture combine to make Hong Kong number one globally in clothing and footwear expenditures per capita. With the highest average order values in Asia and high cross-border sales volumes, there is significant appetite for high-priced, luxury goods in Hong Kong.

“Hong Kong is also a top vacation destination for tourists from mainland China. Each year nearly 50 million tourists travel to Hong Kong, with more than 70 percent of those visitors coming from mainland China.”

Borderfree’s report includes its Index, based on a composite score for five criteria: consumer appetite for buying outside of the country, household income and purchasing power, relative currency strength, ease of import and expected market growth.

Western influencers

The protests in Hong Kong that flared up during the summer and have grown more contentious and have since threatened to upend the city’s stability.

Protesters first gathered in the streets to criticize Beijing’s attempts to declaw Hong Kong’s energetic political landscape by proposing a procedure that would require candidates for the top leadership position to first be vetted by the government in Beijing. As the demonstrations grew, protesters defied the government’s warnings to abandon the streets, setting the stage for some sort of showdown (see story).

“While many are forecasting that political unrest could negatively impact luxury brands in the short-term, it’s difficult to say what the long-term effects, if any, will be,” Ms. Ransom said.

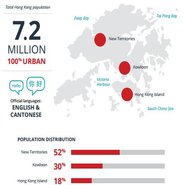

Borderfree's Hong Kong Country Report focuses on the 7.2 million people who live in the urban setting of Hong Kong. This population represents the ninth largest trading economy in the world, the third largest GDP of Asia.

Social media in Hong Kong

Hong Kongers primarily use Google as their search engine and prefer Facebook, Google+ and Instagram as their social media sites. The prevalence of these sites allows Western brands to easily integrate into Hong Kong’s Internet and ecommerce.

There is 73 percent Internet penetration in Hong Kong, which is similar to the United States’ 79 percent. Hong Kongers spend an average of two hours and 31 minutes online per day.

Offline, there is free trade in Hong Kong, meaning no duties, import charges or taxes on orders. Online purchasing is similar to that in Western countries.

Hong Kong's popular brands

The average order value in 2013 in Hong Kong was $321, compared to $183 for the rest of the world. The most popular brands in the region are Prada, Valentino, Stuart Weitzman, Jimmy Choo and Christian Louboutin.

Also, since Hong Kong citizens can travel visa free to over 140 countries, Hong Kongers develop awareness and relations with brands outside of their city.

Hong Kong itself sees 50.4 million tourists annually, 75 percent of those from mainland China. Also, an increase in credit cards have left more than half of Hong Kong citizens preferring credit or debit cards for shopping.

Turning to Hong Kong

Entering China can be tricky, but through Hong Kong brands can step into Chinese commerce with some confidence before they head to mainland China. As a result, a large display of brands and events has been set in the region.

For instance, 13 top watchmakers returned to Hong Kong Sept. 30 through Oct. 2 for the second annual Watches & Wonders exhibition.

The haute horlogerie fair was invitation only and provides watchmakers with a nice space to display their timepieces among a discerning Asian audience. Given that the event was private, brands were assured that their pieces were seen by true brand enthusiasts and watch collectors (see story).

Although Hong Kong offers familiarities, entering the region in any capacity requires some change from brands.

“It is a common misperception that because English is an official language of Hong Kong, everyone is fluent.” Ms. Ransom said. “Investing in at least partial translation into Cantonese, the other official language of Hong Kong, is advisable to extend audience reach, engagement and conversion.

“Also, social media penetration in Hong Kong is high, with 71 percent of the population using Facebook, Google+, Instagram, Seino Weibo and Twitter,” she said. “Having a presence and dialogue across these channels will help to reach the widest potential customer base, and is critical given the strength of word of mouth marketing in the region. “

Final Take

Nancy Buckley, editorial assistant on Luxury Daily, New York

Share your thoughts. Click here