Consumers may be in a shopping mood this holiday season. Image credit: Unsplash

By Mickey Alam Khan

With less than 70 days until Black Friday, retailers are preparing for a holiday shopping season with higher stakes than usual with the hopes of recovering losses from months of store closures.

Tinuiti’s “2020 Holiday Trends Report” examines how consumers’ habits have changed ahead of the crucial fourth quarter, including shopping budgets and reliance on ecommerce. Retail giant Amazon also looms large over the holiday shopping season, even among the high-spenders luxury brands rely on.

“As retailers attempt to cope with fundamentally new realities, they’ll do so alongside traditional competitive and seasonal challenges that promise to make 2020 a year like no other,” the report said. “Pandemic-induced shutdowns are having ripple effects throughout the economy, impacting consumer confidence and budgets.”

The report is based on a survey of more than 2,000 consumers.

Shopping trends

Tinuiti has identified several trends that will impact the upcoming holiday shopping season.

To start, brands and retailers are facing a compressed holiday calendar, with only 29 days between Thanksgiving and Christmas. Many stores will remain closed for Thanksgiving due to COVID-19.

The COVID-19 pandemic has led to foundational changes to the retail industry, and economic uncertainty has continued in the United States. Months of nationwide protests about racial and social inequality have also led a significant number of consumers to evaluate their spending habits.

Consumer confidence may be shaky heading into the holiday shopping season as a result of the economic and social upheaval, but most consumers will still be in a giving mood.

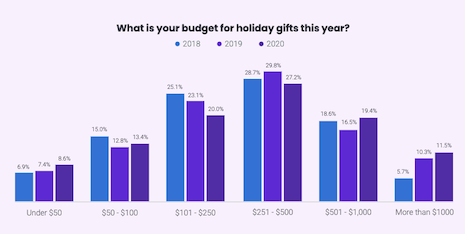

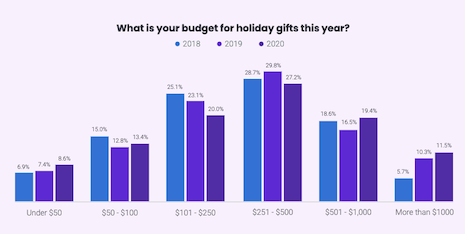

More than eight in 10 shoppers are planning to spend the same or more on holiday gifts, the highest mark in three years. Consumers’ decreased spending on experiences, such as travel and dining, may have contributed to this increase.

The amount of “Super Spenders” has also grown by 15.3 percent since 2019. More than three in 10 shoppers have budgeted $500 or more for holiday gifts, including 11 percent of all consumers who have budgets of at least $1,000.

The number of Super Spenders during the holidays is on the rise. Image credit: Tinuiti

The number of Super Spenders during the holidays is on the rise. Image credit: Tinuiti

Although the pandemic has accelerated consumers’ shift towards omnichannel — with more than 45 percent of respondents will be shopping more online because of COVID-19 — shoppers are expected to return to in-store shopping.

More than 22 percent will shop equally online and in-store, and almost 52 percent of consumers plan to use buy-online-pickup-in-store (BIPOS) services. This includes 55 percent of Super Spenders.

Super Spenders are the most dedicated online shoppers, with less than a quarter planning to do most or all of their holiday buying in-store.

However, Super Spenders are not a monolith and demographic differences inform their habits. Almost 39 percent of shoppers older than 40 are Super Spenders, compared to less than 20 percent of consumers under 40.

The generational divide also impacts which devices online shoppers prefer. Among consumers under 40 years of age, 62.4 percent will shop on mobile devices and 63.4 percent of shoppers above 40 will use desktops or laptops.

It is still rare for consumers to use voice-enabled devices for shopping, but more than 7 percent of high-spenders plan to use “smart speakers” this holiday season, including 16.5 percent of those under 40.

Tinuiti also found that younger consumers with less spending power are more likely to use “buy now, pay later” services such as Klarna for their holiday shopping.

While COVID-19 curtailed experiential spending throughout the year, consumers will be buying the same types of holiday gifts they did in 2019. Six in 10 shoppers plan to give clothing as presents, and electronics have overtaken gift cards as the second-most popular choice.

Amazon impact

Ecommerce giant Amazon will be a wildcard this holiday season, as even affluent consumers have come to rely on it for their shopping needs.

Tinuiti expects Amazon will host its 2020 Prime Day in October, an early kickoff for the holiday season.

In just five years’ time, Amazon has solidified its Prime Day holiday as a mammoth shopping event, and its impact is felt across every corner of the retail sector.

With more than 150 million United States Prime members, Prime Day has become one of the biggest U.S. shopping holidays. Shoppers spent $4.2 billion on Prime Day in 2019, up 33 percent year-on-year (

see story).

Now Amazon has launched its luxury outpost, as it makes another bid to become a trusted destination for high-end shoppers as online shopping thrives in a post-COVID world.

Luxury Stores is now available by invitation-only to select Prime subscribers in the United States. The ecommerce platform will empower brands to independently manage their own inventory, selection and pricing, while providing merchandising technology to personalize content and engage consumers.

With physical stores struggling due to the coronavirus pandemic, it may be an optimal time for Amazon to introduce its Luxury Stores concept (

see story).

Consumers may be in a shopping mood this holiday season. Image credit: Unsplash

Consumers may be in a shopping mood this holiday season. Image credit: Unsplash

The number of Super Spenders during the holidays is on the rise. Image credit: Tinuiti

The number of Super Spenders during the holidays is on the rise. Image credit: Tinuiti