- About

- Subscribe Now

- New York,

August 7, 2020

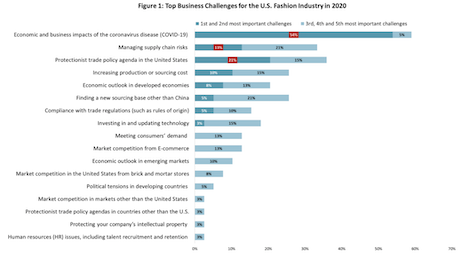

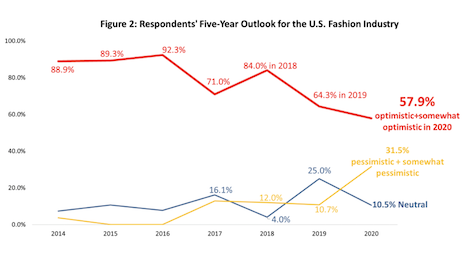

Economic and business impacts are the biggest challenges facing US fashion companies this year. Image courtesy of United States Fashion Industry Association

Economic and business impacts are the biggest challenges facing US fashion companies this year. Image courtesy of United States Fashion Industry Association

Economic and business impacts of the coronavirus outbreak are the top challenge for fashion companies this year, as they continue to navigate the uncertain waters of a pandemic and recession year.

These issues are the biggest obstacle as fashion marketers try to adapt to prepare for the medium-to long term impact of the health crisis, according to the United States Fashion Industry Association’s 2020 Benchmarking Study. The pandemic has caused supply chain disruptions "ranging from a labor shortage, shortages of textile raw materials, and a substantial cost increase in shipping and logistics," per the report.

"The business difficulties caused by COVID-19 will not go away anytime soon, and U.S. fashion companies have to prepare for a medium to the long-term impact of the pandemic," said Sheng Lu, Newark, DE-based associate professor at the Department of Fashion and Apparel Studies at the University of Delaware and author of the report.

"Affected by COVID-19 and the worsened business environment, respondents are more conservative about the outlook of the fashion industry in the next five years," she said.

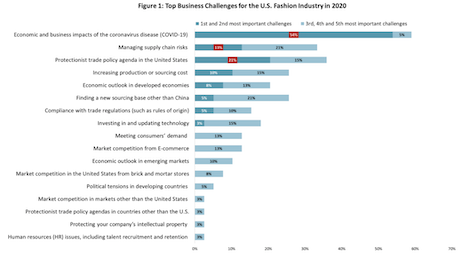

Sourcing orders are being cancelled or postponed this year due to COVID-19. Image courtesy of United States Fashion Industry Association

Sourcing orders are being cancelled or postponed this year due to COVID-19. Image courtesy of United States Fashion Industry Association

Revenue decreases

Sales are plummeting this year, with 96 percent of those fashion companies surveyed for the study reporting that they expect their revenues to decrease in 2020.

The coronavirus is responsible for sales declines and order cancellation across the U.S. fashion industry. One hundred percent of respondents to the survey said they have ordered less and postponed or canceled sourcing orders.

Almost half of those surveyed said these cancellations go beyond second-quarter 2020, and 40 percent expect order cancellation to last into fourth quarter and beyond. Vendors in China, Bangladesh and India are most impacted by these delays and cancellations.

“Respondents say they are trying multiple approaches to mitigate the financial impact of COVID- 19 as much as they can, including exploring alternative sourcing options, leveraging free trade agreement or trade preference programs, and taking advantage of customs rules like duty drawback and first sale for export,” the report said.

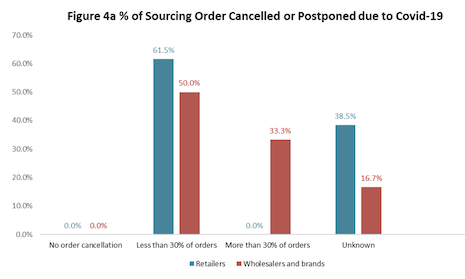

The fashion business is anticipating bad outcomes over the next several years and have been more conservative in their five year projections.

Fashion insiders that feel optimistic or somewhat optimistic about the next five years dropped from 65.3 percent in 2019 to a 57.9 percent, a new low.

Almost one-third have a pessimistic or somewhat pessimistic outlook about the future of the fashion industry, the highest score since the survey launched in 2014.

Despite pessimism rising, there is a bright side.

Almost 90 percent of respondents still plan to increase hiring in the next five years, similar to last year and higher than the 80 percent average from 2014- 2017.

“The job market appears to be the sole positive aspect of the U.S. fashion industry during the pandemic,” the report said.

The five-year outlook on the fashion industry is losing its optimism. Image courtesy of United States Fashion Industry Association

The five-year outlook on the fashion industry is losing its optimism. Image courtesy of United States Fashion Industry Association

Sustainability is still key

Even as the U.S. fashion industry faces challenging times, it is not turning away from sustainability efforts.

In fact, the report revealed that more than 70 percent of insiders said they plan to give more resources to sustainability and social compliance through 2022, up from 63 percent in 2019.

Fashion firms identify “suppliers not being fully cooperative or willing to share information,” “the special nature of the textile and apparel industry makes it not practical to gain visibility beyond the 1st tier supplier,” and “insufficient internal budget/staff to map supply chain” as the top challenges for mapping supply chains.

"Sustainability is becoming ever more important for the fashion industry," Ms. Lu said.

"Fashion is not just about making beautiful clothing," she said. "What makes this sector unique and critical is its enormous social and economic impacts on people, from job creation, poverty reduction to improving gender equality, particularly in the developing world.

"On the other hand, while COVID-19 has imposed an unprecedented economic challenge to fashion companies, it also created new opportunities for building a more sustainable fashion industry."

Every fashion company surveyed for the report said that they audit their suppliers, with 65 percent saying they use both a third-party certification program and an in-house compliance team, up from 50 percent last year.

“U.S. fashion companies are actively exploring new approaches to improve sustainability and social compliance in sourcing, including contributing to the building of a circular economy,” the report said.

“In response to the changing business environment, U.S. fashion companies will continue to adjust their sourcing bases and sourcing practices."

Supply chain disruptions during the pandemic are making consumers revisit their processes and many U.S. fashion companies are exploring sourcing opportunities at home. Twenty-five percent of those surveyed expect to increase U.S. sourcing in the next two years, the highest level since 2016.

Fashion companies are also taking less advantage of U.S. free trade agreements (FTAs) and trade preference programs.

U.S. apparel imports entering under FTAs dropped to only 15.1 percent in the first five months of 2020, the lowest since 2008. One major factor contributing to this trend is fashion companies’ reduced sourcing volume.

"What is particularly sensitive to fashion companies’ sourcing decision this year is the U.S.-China trade war," Ms. Lu said. "For example, all respondents this year say they have 'moved some sourcing orders from China to other Asian suppliers,' up from 77 percent in 2019.

"As one respondent commented, 'Diversification began with the tariffs and will continue as negative (U.S.) consumer sentiment on China product builds,'" she said. "Another adds, 'The cost of the (Section 301) penalty tariffs was the direct cause of our resourcing at least 20 percent of our production outside of China. The US-China trade war has forced our company.'"

"On the other hand, the reported forced labor in Xinjiang is another recently surfaced and highly sensitive issue, which may potentially hold back U.S. fashion companies’ sourcing from China to dramatically reduce China sourcing."

Please click here to download the PDF of the 2020 Fashion Industry Benchmarking Study

Share your thoughts. Click here