- About

- Subscribe Now

- New York,

July 31, 2020

Australia was the strongest-performing region in Q2 2020 for prime real estate. Image credit: Knight Frank

Australia was the strongest-performing region in Q2 2020 for prime real estate. Image credit: Knight Frank

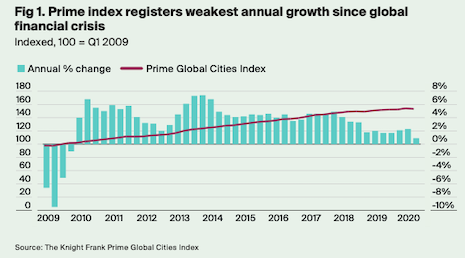

As the coronavirus pandemic became widespread during the second quarter of 2020, worldwide prime real estate prices reached their lowest rate of annual growth since the worst of the global financial crisis in Q4 2009.

According to Knight Frank’s Prime Global Cities Index for Q2 2020, prime residential real estate prices increased by 0.9 percent on average in the year to June 2020, a fall from 2.3 percent in March. The five cities which experienced the weakest growth are all in Asia, the continent first impacted by COVID-19.

Knight Frank tracks the top 5 percent of housing sales in 46 cities around the world for its quarterly Prime Global Cities Index.

Pandemic impact

Two-thirds of the cities on the Index registered flat or positive annual price growth in Q2 2020. However, a closer look at quarter-over-quarter changes reveals more of the pandemic’s impact.

Twenty cities saw average prime prices decline in the second quarter, including nine in Europe and seven in Asia — up from 15 price declines in the first quarter of 2020. This contributed to the Index’s overall dip of 0.6 percent in prices during Q2.

Most prime real estate markets experienced flat or positive annual price growth in Q2 2020. Image credit: Knight Frank

Most prime real estate markets experienced flat or positive annual price growth in Q2 2020. Image credit: Knight Frank

Weakening European prime prices is a significant change from a year ago, when those cities were the most competitive.

In Q2 2019, more than three-quarters of cities saw year-over-year price growth. Berlin and Frankfurt were the only markets with double-digit annual growth, but the German cities remained steady over the last three months (see story).

A year later, cities in Australia and North America showed the most resilience overall in the three months to June 2020.

In Australia, Brisbane, Perth, Sydney and the Gold Coast all saw increases in prices year-over-year and quarter-over-quarter. Melbourne was an exception, with prime prices dipping 1.0 percent from Q1 to Q2 2020.

In the United States and Canada, Vancouver, Toronto, Miami, Los Angeles and San Francisco all saw annual and quarterly growth in prime real estate prices.

Cape Town, South Africa had the strongest quarterly growth at an average price increase of 3.7 percent.

Meanwhile, Bangkok, Thailand’s prices continue to fall. Prices fell 1.4 percent quarter-over-quarter, contributing to the city’s annual decline of 5.8 percent.

While the pandemic’s impact on the global prime real estate market continues to unfold, super-prime sales have continued amid lockdowns.

More than 150 residential real estate purchases above $10 million have been completed since COVID-19 lockdowns began in March, showing the strength of the super-prime market.

According to Knight Frank, super-prime residential markets outperformed expectations but transaction levels for H1 2020 are well below levels from the same time period in 2019. The research is based on residential sales in 12 super-prime markets around the world (see story).

Share your thoughts. Click here