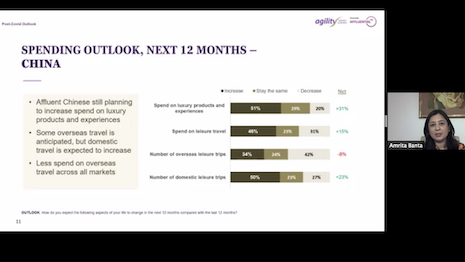

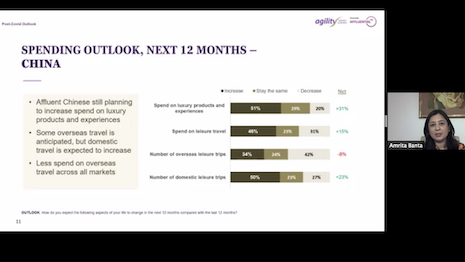

Amrita Banta, managing director and cofounder of Agility Research & Strategy shares spending outlook in China. Image credit: Agility Research

By Dianna Dilworth

A strong sense of purpose is at the root of being a luxury brand, and now more than ever consumers are looking to luxury brands to inspire hope and direction in establishing a new normal post-pandemic.

Consumers today are evaluating their priorities, according to an Agility Research & Strategy webinar with speakers from Moët Hennessy and Japan Airlines . The challenge and opportunity for luxury brands is to provide consumers with a new sense of purpose and hope for a new and better world.

“Luxury brands are about making people dream, now is the time for all of us to be a little more awake about what the new world looks like,” said Rane Xue, chief marketing officer of Moët Hennessy in Asia Pacific and chief transformation officer in China, Hong Kong.

“Uncertainty is going to be part of the new normal,” she said. “Even when one day we can all finally say that this is all finally behind us, I don't think we will ever really go back to a pre-COVID time. There will be a new normal.

“As they say in Chinese, every crisis comes with an opportunity.”

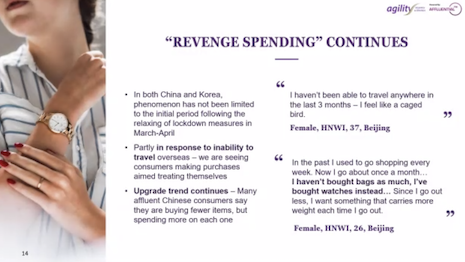

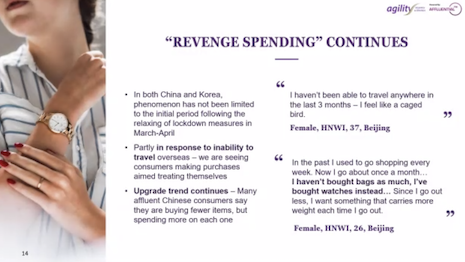

Revenge spending continues. Image credit in Asia: Agility Marketing & Research

Revenge spending continues. Image credit in Asia: Agility Marketing & Research

Revenge spending

The impact of COVID-19 is being felt across categories and markets and revenge spending is continuing in South Korea, China and Japan.

While overseas travel has suffered across the regions, sales on certain luxury goods have increased as consumers look to pamper themselves and feel better in uncertain times.

“After people came out of the lockdown they were really looking to gain some sense of normality and they were really shopping with kind of a vengeance,” said Amrita Banta, managing director and cofounder of Singapore-based

Agility Research & Strategy during a webinar.

“The spending continues, which is really a good sign,” she said. “There has been a sense that brands have talked about their sales, besides travel and hospitality and entertainment, getting back to 2019 sales levels.”

Many affluent Chinese consumers say they are buying fewer items but they are spending more on the products.

Some are buying more expensive things and even upgrading on products such as shifting from buying handbags to purchasing watches.

“There is this feeling of upgrading,” Ms. Banta said. “I think this will happen in travel. They will be going on fewer trips but will be upgrading the hotels they stay in.”

Fashion, electronics and cosmetics are on the rise in spend in China, while sales of luxury cars and travel have dropped.

In Japan, travel and leisure and fashion spend is down, but car sales are up. In South Korea, cars sales are up and leisure and sports goods sales are on the rise, but travel is down.

“Electronics have definitely bounced back much more than before,” Ms. Banta said. “People have been staying at home and quarantining and a lot of younger millennials who travel a lot are shifting their spend to goods from travel.”

In China, affluent Chinese consumers say they will increase their spend on skincare, makeup, fashion and jewelry in the next six months.

Digital connections have accelerated under lockdown and live streaming events have become really popular. Even expensive watches have sold online.

“People have gotten used to shopping online,” Ms. Banta said. “Even clients like Harry Winston which do not have an online store have been able to have online events to connect with consumers and create sales.”

Life priorities have shifted and living a healthy lifestyle and children’s education rank ahead of financial success in all three markets. In Japan having fun was important pre-COVID-19 and remains key.

“We looked at what does luxury mean and is that changing and evolving with the consumer and as we look at three of these big markets in Asia Pacific, we find that the definition of luxury hasn’t really changed,” Ms. Banta said. “It is still about quality of life, uniqueness, taste, creators and designers.”

Roz Mitsumasu, vice president of global marketing at Japan Airlines, talks about opportunity despite challenges. Image credit: Agility Research

Roz Mitsumasu, vice president of global marketing at Japan Airlines, talks about opportunity despite challenges. Image credit: Agility Research

Travel

People in Asia are beginning to feel comfortable traveling within their own countries and domestic travel is picking up across the Asia-Pacific region.

While overseas travel is still in decline, for Japan Airlines, this offers an opportunity to promote destinations within Japan that are less popular and may offer new sites to citizens more used to a global playground.

“The opportunity is for people to visit less visited regions of Japan that will not be crowded,” said Roz Mitsumasu, vice president of global marketing at Japan Airlines, Tokyo.

And despite losing out on the opportunity of the Olympics this year, the brand has high hopes for 2021. The airline plans to do a lot of testing and look for new opportunities with partners.

“There is a huge opportunity to use the COVID-19 crisis to adopt agile practices,” Mr. Mitsumasu said. “Another thing that will be important, besides making people feel safe, is to collectively create hope, and not necessary optimism, but hope that something new and better will emerge after the crisis.

“How do we use this opportunity to sort of reset ourselves and think of better alternatives,” he said. “How would we rebuild things to make them more engaging and more attractive to our customers.”

Amrita Banta, managing director and cofounder of Agility Research & Strategy shares spending outlook in China. Image credit: Agility Research

Amrita Banta, managing director and cofounder of Agility Research & Strategy shares spending outlook in China. Image credit: Agility Research

Revenge spending continues. Image credit in Asia: Agility Marketing & Research

Revenge spending continues. Image credit in Asia: Agility Marketing & Research Roz Mitsumasu, vice president of global marketing at Japan Airlines, talks about opportunity despite challenges. Image credit: Agility Research

Roz Mitsumasu, vice president of global marketing at Japan Airlines, talks about opportunity despite challenges. Image credit: Agility Research