The affluent Asian consumer is more optimistic, more resilient and more loyal to brands that showed genuine concern. Image courtesy of Agility Research & Strategy

By Luxury Daily News Service

How has the COVID-19 coronavirus pandemic affected the affluent consumer mindset and behavior in key Asian markets?

To understand the consequences of the health crisis and navigate the new status quo, Singapore-based Agility Research & Strategy conducted the second wave of its TrendLens study where the company interviewed a cross-section of Asian affluent and high-net-worth consumers.

This study from one of the affluent-focused leading market researchers aims to understand the implications of COVID-19 on them and what has changed from January this year since Agility’s first wave of research was conducted to the present time.

In this wave, the market researcher spoke with more than 4,000 affluent and high-net-worth consumers in all key markets in Asia, from Japan, Singapore and China to Indonesia and India.

Some of the results were surprising. The data paints an interesting and complex story of shifting priorities and overall rethinking of lifestyle choices.

Here, per Agility managing director Amrita Banta, are three key insights that the firm picked to highlight some of these changing trends.

Short-term worries, long-term optimism

Unsurprisingly, consumer confidence has taken a hit in the last six months among affluent and HNW individuals in Asia.

While their wealth through high savings has shielded them from the worst consequences of the COVID-19 situation, the economic slowdown and health concerns have not left them untouched.

Concerns about the impact on the economy have made them more conscious when purchasing luxury goods.

Lingering concerns about travel safety have made them more likely to choose domestic destinations or countries closer to home when international travel does reopen.

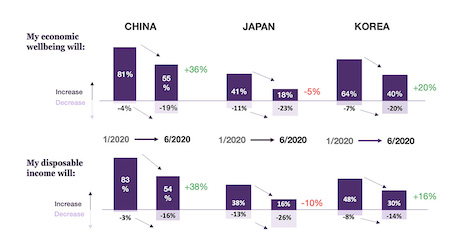

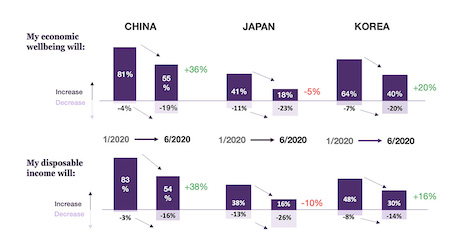

Yet analyzing Agility’s data, the firm sees how, despite concerns about the economy worsening, consumers remain relatively optimistic on their own financial prospects and economic situation – particularly affluent Chinese and Koreans.

Agility’s data show that more Chinese and Korean affluent consumers still expect their economic wellbeing and disposable income to increase rather than decrease in the next 12 months.

Chinese and South Korean affluent consumers still expect their economic wellbeing and disposable income to increase rather than decrease in the next 12 months. Source: Agility Research & Strategy

Chinese and South Korean affluent consumers still expect their economic wellbeing and disposable income to increase rather than decrease in the next 12 months. Source: Agility Research & Strategy

Less-is-more trend

Agility studied how Asian affluent spending behavior has changed. Months of travel lockdown have hampered affluent Asians’ ability to travel.

Considering that Asian affluent travelers represent one of the largest groups of international travelers, it is not a surprise that being unable to travel for half of a year has left them with a considerable disposable income surplus.

What are they doing with this additional disposable income?

Agility data shows that the unspent travel budget is moving to luxury purchases, particularly big-ticket items.

Many of the study respondents said that luxury purchases make them feel a sense of normalcy again – they want to treat themselves now that the worst seems behind and since they are unable to do some of the things they love like traveling the world.

Agility sees the simultaneous upgrading and less-is-more trend continuing to accelerate.

Many affluent Chinese consumers, for example, say they are now tending to buy fewer items, but are spending more on those that they do buy.

Agility attributes this new behavior in part to consumers’ realization of the impact of the COVID-19 crisis on their family and communities, and how so many lives have been upended by it.

In part it is also driven by practical concerns – as one high-net-worth woman in Beijing told Agility, “I don’t go out as often anymore – I can get more use out of a nice piece of jewelry or a watch than yet another handbag.”

Will the emphasis shift back to experiences when all is “back to normal”? It will be interesting to see if these are trends that will persist for the long term.

Bonds with brands that showed genuine care

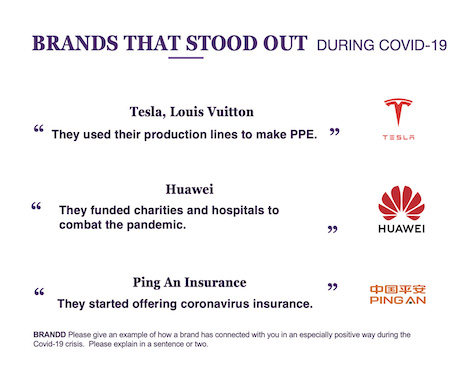

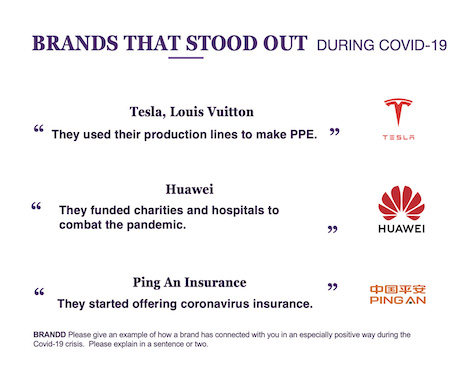

It is clear from our data that brands that engaged with their customers in an empathetic manner during the COVID-19 have strengthened their relationships with them.

In this time of need, affluent Asian consumers expected that the brands would step up and give back, not in term of discounts and special services, but rather help society recover.

Brands that already had social responsibility at their core before the pandemic were the ones that reacted fast and are now reaping the rewards in term of recognition with this critical segment.

Brands that stood out during COVID-19. Source: Agility Research & Strategy

Brands that stood out during COVID-19. Source: Agility Research & Strategy

Key takeaways

Agility’s data suggests a quick recovery in many markets and resiliently upbeat affluent consumer sentiment in the face of the pandemic.

This is the right time for brands to start investing in key markets and segments.

At the same time, brands need to be ready to adapt their strategy to the new landscape.

Since affluent Chinese consumers will not be able to travel internationally for the immediate future, brands will need to put in place strategies that expand their reach to these consumers where they are.

Huge opportunities are opening up for brands that are willing to deepen their reach in Tier 3 and 4 cities.

The affluent Asian consumer is more optimistic, more resilient and more loyal to brands that showed genuine concern. Image courtesy of Agility Research & Strategy

The affluent Asian consumer is more optimistic, more resilient and more loyal to brands that showed genuine concern. Image courtesy of Agility Research & Strategy

Chinese and South Korean affluent consumers still expect their economic wellbeing and disposable income to increase rather than decrease in the next 12 months. Source: Agility Research & Strategy

Chinese and South Korean affluent consumers still expect their economic wellbeing and disposable income to increase rather than decrease in the next 12 months. Source: Agility Research & Strategy Brands that stood out during COVID-19. Source: Agility Research & Strategy

Brands that stood out during COVID-19. Source: Agility Research & Strategy