- About

- Subscribe Now

- New York,

July 7, 2020

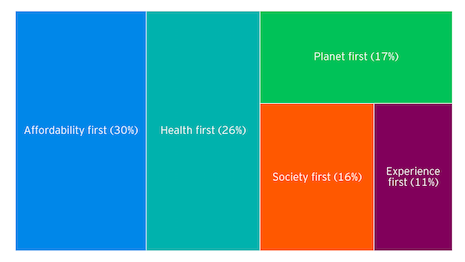

The COVID-19 coronavirus outbreak is reshaping consumer values and priorities, eventually forcing marketers to adapt their pitches and products. Source: EY

The COVID-19 coronavirus outbreak is reshaping consumer values and priorities, eventually forcing marketers to adapt their pitches and products. Source: EY

Five new consumer segments will emerge beyond the COVID-19 coronavirus pandemic, reflecting both a craving for return to normality, health safety concerns and changed values.

Consumers crave normality, but they have new priorities, according to the third edition of the EY Future Consumer Index that monthly tracks the sentiment and behavior of 14,074 individuals across 18 countries.

"Organizations will need to work out how to serve a more value-conscious, health-conscious consumer, but also a consumer who demands purposeful brands that reflect their environmental and social values,” said Kristina Rogers, EY global consumer leader, in a statement from London.

“Business leaders should focus on reshaping their portfolios so that they are relevant to the future consumer, providing digital customer journeys that reflect the way consumers will behave and creating the transparency needed to secure consumer trust," she said.

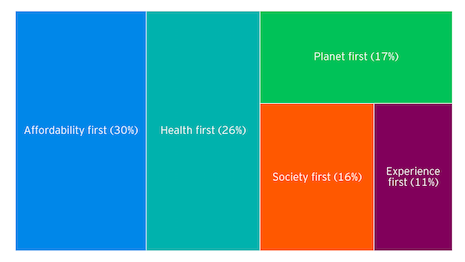

Consumers expect to make deep and lasting changes, but will they follow through? Source: EY

Consumers expect to make deep and lasting changes, but will they follow through? Source: EY

New normal

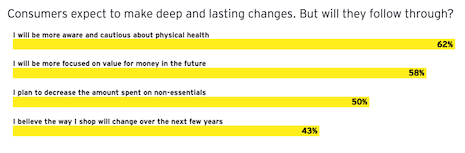

Per the survey, 40 percent of consumers are keen to “get to normal,” doubling over last month’s numbers of 20 percent.

That said, half (50 percent) of consumers still expect their lives to change significantly in the long term, while 53 percent said the pandemic has led to a re-evaluation of their values and how they look at life.

Five new consumer segments have emerged as a result of these changing sentiments, according to the EY Future Consumer Index:

How consumer segments could transition post-COVID-19. Source: EY

How consumer segments could transition post-COVID-19. Source: EY

Health is wealth

Given the ongoing COVID-19 crisis, health and affordability will continue to dominate beyond the pandemic.

The survey found that consumers expect to make deep and lasting changes, with 62 percent indicating that they will be more aware and cautious about their physical health and 58 percent increasingly focusing on value for money in the future.

These are not new drivers of behavior and preference, but the EY Future Consumer Index indicates that consumers will commit more to their values.

"Many businesses believe they already have the right portfolio, marketing and supply chain,” said EY global consumer knowledge leader Andrew Cosgrove in a statement. “However, few are resilient enough to deliver against these heightened consumer expectations.

“Efficiency is important but must be balanced against the need to keep developing the capabilities that will deliver growth,” he said. “Businesses now have the opportunity to not just protect what worked in the past, but to actively shape a successful future."

Share your thoughts. Click here