- About

- Subscribe Now

- New York,

July 1, 2020

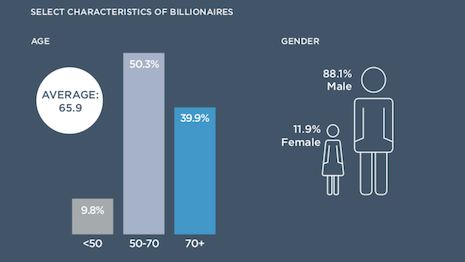

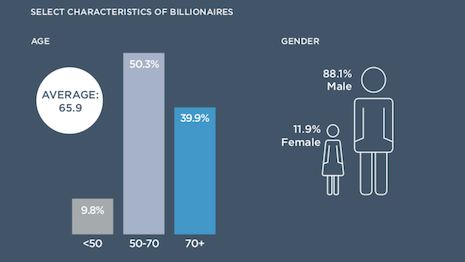

88.1 percent of billionaires were male and the average age is 65.9. Source: Wealth-X

88.1 percent of billionaires were male and the average age is 65.9. Source: Wealth-X

The number of global billionaires grew last year, and luxury marketers should be looking to understand this audience since these wealth leaders influence the consumption patterns of all affluent consumers.

In 2019, there were 2,143 billionaires in the top 15 countries, up 201 individuals as compared to 2018, with combined net worth up by an annual $796 billion to $7.6 trillion, according to Wealth-X's Billionaire Census 2020.

"While small in number, billionaires have a major influence over individuals in the lower tiers of wealth," said Michael Phillips, vice president of marketing and communications at Wealth-X, New York.

"We call this the billionaire halo effect, which means that the purchasing decisions that these individuals make will inspire the purchasing behavior among the lower tiers of the UHNW (ultra high net worth, +$30 million) population, as well as those in the VHNW (very high net worth, $5-$30 million)," Mr. Phillips said.

"Regardless of the wealth tier, it’s important to remember that as wealth increases among your target audience, your marketing and engagement efforts must become tailored to speak directly to the customer’s interests – addressing their bespoke needs and wants," he said.

The United States has the most billionaires. Europe is the largest region for billionaires. Asia is the fastest-growing region for billionaires. Source: Wealth-X

The United States has the most billionaires. Europe is the largest region for billionaires. Asia is the fastest-growing region for billionaires. Source: Wealth-X

Billionaires by country

Three quarters of the world’s billionaires live in 15 countries, according to the report from Wealth-X, which revealed that in 2019, 76 percent of the global billionaire population and 80 percent of global billionaire wealth lived in these nations.

The United States is the dominant country for billionaires, with 788 billionaires calling the nation home in 2019, up 12 percent from 2018, and accounting for 28 percent of the global billionaire population.

Cumulative billionaire wealth in the U.S. increased by 14 percent to $3.4 trillion, more than the combined net worth of the next eight highest-ranked countries last year. Equity markets and economic growth outperformed most other countries in 2019, driving strong portfolios in the region.

China is the second most popular place for billionaires to live, with China counting 342 billionaires as residents.

The nation had the fastest-growing billionaire population and combined wealth in 2019. The number of billionaires grew by 20 percent and cumulative net worth was up 16 percent to $1.2 trillion.

China’s big growth made its billionaire wealth worth 12 percent of the global share and more than twice the level in the third-ranked country Germany.

“Underlining the extensive wealth creation opportunities in China, the dynamic growth in billionaire net worth occurred against a relatively unfavorable backdrop of slowing emerging-market growth, disruption from the ongoing trade war with the U.S., and a downturn in global industrial and consumer demand,” read the report.

“As in most leading wealth markets, an influx of liquidity by policymakers supported robust equity market gains.”

Germany is the dominant billionaire country in Europe, but 2019 was not a great year for the nation. Strong returns in the domestic stock market helped balance the slowdown of the Eurozone economy and a depreciation of the euro. A downturn in global trade, ongoing Brexit concerns and regulations in the automotive sector made it a harder year for Germany.

Billionaires in Russia and Switzerland saw their wealth grow, with the Alpine nation overtaking the United Kingdom for the No. 5 spot on the list as a favorable stock market and currency movements drove 14 percent growth in net worth in the country.

In contrast, the U.K. recorded the weakest growth in billionaire numbers and combined wealth among the top 10 countries due to the economic challenges from Brexit.

The United Arab Emirates was the only nation in the top 15 to see a decline in billionaire population and wealth.

“The size of the global billionaire population increased strongly in 2019, rising by 8.5 percent to 2,825 individuals, more than reversing the previous year’s decline,” Wealth-X said in the report.

“Healthy returns were recorded across almost all major asset classes, despite a loss of momentum in the global economy and a still turbulent geopolitical environment.”

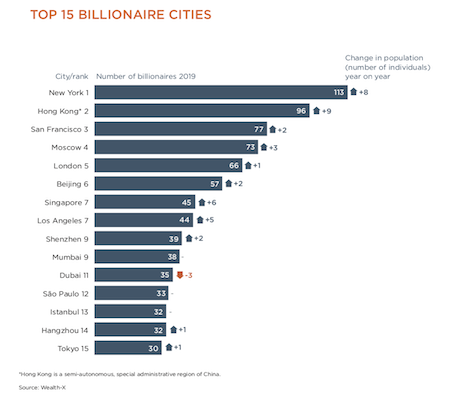

The Top 15 cities that are home to billionaires. Source: Wealth-X

The Top 15 cities that are home to billionaires. Source: Wealth-X

Billionaires by city

New York holds its post as the dominant city for billionaires as the city’s billionaire population continued to grow last year. The city’s billionaire population grew by eight individuals to 113 billionaires in 2019.

The Big Apple counted 17 more billionaires than in the second-ranked city of Hong Kong. Interestingly, there are more billionaires in New York than in almost every country in the world, except China or Germany.

The top 15 cities were home to 29 percent of the global billionaire population in 2019. The U.S. and China each accounted for three of the top 15 cities and were the only countries with more than one city in the rankings.

Hong Kong consolidated its second place in the rankings even as the city faced heightened political instability. The billionaire population grew by nine individuals, the largest growth of of any city globally.

There were 19 more billionaires in Hong Kong than in the third-ranked city of San Francisco.

San Francisco ranked at No. 3 after a decade of growth driven by the technology sector. The billionaire class has stabilized with only two new billionaires in 2019, bringing the total to 77.

Although China recorded the strongest growth in the billionaire population of any country last year, its highest-ranked cities saw modest growth – Beijing (two more individuals), Shenzhen (two) and Hangzhou (one), per the report.

“This reflects the broad distribution of the expanding stock of billionaire wealth across a large number of highly populated and economically dynamic cities in China, which contrasts with more highly concentrated pockets of city wealth in most other leading billionaire countries,” read the report.

COVID-19 effect

Billionaires’ net worth shrunk due to the economic fallout from the COVID-19 crisis, as volatile shifts in financial markets rippled through the economy, affecting even this insulated group.

With about 90 percent of billionaires creating their wealth through their own efforts or along with their inheritance, many own or operate a business that they are now adapting to the current situation, according to Wealth-X’s Billionaire Census 2020.

Depending on their sector, some have seen declines in business.

“Not all billionaires are created equal," the report said.

"The number of billionaires in technology, insurance, business services and healthcare grew by between 6 percent and 9 percent during the first five months of 2020 compared with 2019. Billionaires in shipping, apparel, including luxury, and aerospace experienced the worst performances."

Share your thoughts. Click here