- About

- Subscribe Now

- New York,

June 30, 2020

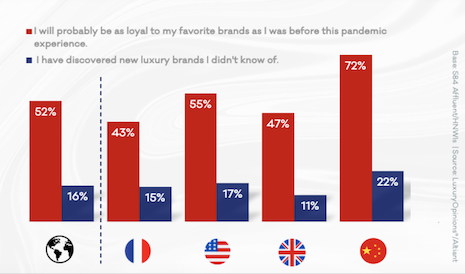

More than 50 percent of affluent consumers will remain loyal to brands they know post-pandemic, according to Altiant's latest report. Image courtesy of Altiant

More than 50 percent of affluent consumers will remain loyal to brands they know post-pandemic, according to Altiant's latest report. Image courtesy of Altiant

More than one-third of the wealthy consumers have questioned their level of luxury consumption as a result of the COVID-19 pandemic, suggesting that this highly attractive demographic is doing some soul-searching about how to live their lives after the health crisis.

The new report from market researcher Altiant measured consumer sentiment by interviewing more than 580 affluent consumers and high-net-worth individuals in China, United States, United Kingdom and France. The report found that consumers are more focused on supporting their communities and the environment, with 40 percent of the global wealthy contributing to a COVID-19-related charitable cause and 35 percent planning to put more stress on sustainability.

“What this new pulse is showing is a real shift in intention to purchase more sustainable luxury, 35 percent of which countries’ consumers tell us that they will consume more sustainably and this number goes up to 57 percent for the Chinese," said Meryam Schneider, vice president of marketing and partnerships at Altiant, Paris.

"In the U.S., U.K. and France, the consumer’s desire to be more sustainable comes hand in hand with the desire to consume more locally," she said.

Altiant is a leading market researcher and also a partner to Luxury Daily in select consumer-focused luxury research.

72% of Chinese consumers will remain loyal to brands they knew before the pandemic, according to Altiant's latest report. Image courtesy of Altiant

72% of Chinese consumers will remain loyal to brands they knew before the pandemic, according to Altiant's latest report. Image courtesy of Altiant

Brand loyalty remains

Still, while consumers are interested in living more sustainable lives, this does not always mean that they will be shopping secondhand.

The study found that alternative models are gaining more users, but intentions for secondhand show a net drop of 14 points, according to the report.

Post-COVID-19, 50 percent of global consumers are feeling more loyal to the brands they know and only 16 percent are looking to discover new luxury brands, and more than 50 percent will remain loyal with disparity between markets.

Interestingly, only 25 percent of global affluents are willing to download an app to help scientists monitor the spread of COVID-19. Chinese consumers were much more likely to do so (44 percent). French consumers, on the other hand, are almost unwilling, with a mere 8 percent willing to download such an app.

"Affluent and high-net-worth individuals are often very attached to their privacy and in the era of GDPR in Europe, there might be some concerns over these types of apps," Ms. Schneider said.

"In England, for example, 33 percent of the affluent population said they will download it, which is still far from the general population number of 50 percent reported by The Guardian [newspaper] recently," she said.

"The app developed by the French government show the lowest endorsement. Some could explain that as deeper cultural difference or the current political climate."

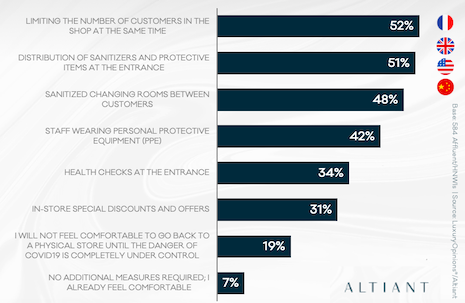

Measures that will make consumers feel comfortable returning to stores. Image courtesy of Altiant

Measures that will make consumers feel comfortable returning to stores. Image courtesy of Altiant

Going shopping

As stores begin to reopen, not everyone is willing to go out to shop as consumers still have concerns about catching the disease.

"The luxury consumers across all countries tell us that the most important measures are these related to health and safety protocols, in order of importance, limiting the number of customers present at the same time for more than half of them, offering sanitizers/protective items at the entrance and sanitizing the changing rooms, then seeing the sales representatives wearing appropriate protective gears," Ms. Schneider said.

"The discounts are not a strong driver to the store and only come in sixth position and will risk affecting the real value of the service," she said.

"It is important to note that 19 percent of the interviewed affluent individuals are not willing to go back to a store until the virus is completely under control.

"Among the studied population, the Chinese were the more ready to resume their shopping habits in-store despite the uncertainty around vaccines and cures. However, they are more demanding regarding strict hygiene and security protocols."

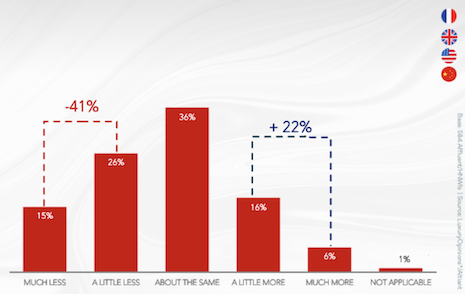

Overall, 40 percent plan to spend the same amount as before the crisis in duty free and 15 percent would spend more than before.

The wealthy Chinese are showing much greater intention with an intended increase of 44 percent when they are available.

If and when consumers do return to stores, most feel that limiting the number of shoppers inside will help draw them back to in-person shopping.

Consumers are coming out of lockdown less willing to spend on watches and jewelry, and more willing to spend on electronics and fashion.

Forty-five percent of those interviewed for the survey said they had shifted more budget online during the confinement and brand sites saw a net increase of 18 points and multi-brand sites increased 5 points during lockdown.

Chinese and U.S. consumers were shopping these brand sites and this shift could continue even beyond the re-openings.

Generous return policies and good pricing were attributes that drew customers to sites.

Louis Vuitton, Chanel and Net-A-Porter saw spikes in traffic during the lockdown.

"The continuous shift to digital has accelerated significantly during the pandemic and is likely to stay that way until the world truly returns to normal," Ms. Schneider said.

"Even then, the data we’re seeing indicates that (42.5 percent) of consumers will likely remain more online shopping-focused than they were previously, so elements of this shift will likely be permanent," she said.

"The brands that innovate during this shift with interesting consumer-centric events and communications strategies will continue to be noticed and excel."

Forty-one percent of affluent consumers expect to spend less in luxury retail stores than they did before the pandemic, according to Altiant's latest report. Image courtesy of Altiant

Forty-one percent of affluent consumers expect to spend less in luxury retail stores than they did before the pandemic, according to Altiant's latest report. Image courtesy of Altiant

Share your thoughts. Click here