- About

- Subscribe Now

- New York,

June 25, 2020

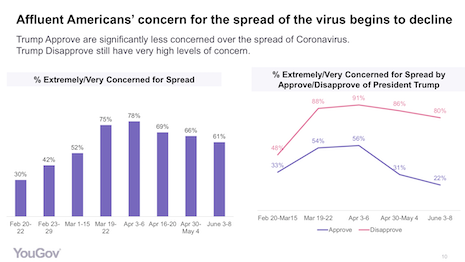

Affluent American's concern for the spread of the virus begins to decline. Image courtesy of YouGov

Affluent American's concern for the spread of the virus begins to decline. Image courtesy of YouGov

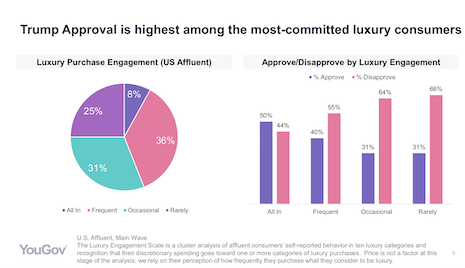

Affluent consumers are feeling more relaxed now that stores have reopened, but concerns over COVID-19 are not going away anytime soon as the coronavirus persists and confidence in the economy is low.

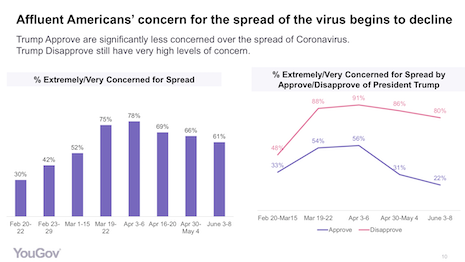

The top 10 percent of affluent luxury buyers experienced the greatest decline in personal economy among all affluent groups, according to a new report by YouGov.

“Affluent consumers purchase luxury when they feel confident in their personal economy, job stability, cash flow and asset values,” said Chandler Mount, vice president of business development and affluent perspective team at YouGov, Cheshire, CT. “The core luxury buyer will hesitate to return until restrictions loosen, and their confidence is restored.”

Confidence in personal economy remains lower than pre-recession levels. Image courtesy of YouGov

Confidence in personal economy remains lower than pre-recession levels. Image courtesy of YouGov

Lack of confidence

Affluent consumers are not feeling confident in the current market, per the YouGov report. However, they are confident that they will survive.

Fully 90 percent of U.S. affluent consumers agree with the statement: “I am in good shape to endure a recession,” a sentiment that started high and has remained strong.

In the first quarter of 2020, cash deposit balances in the U.S. grew by 7 percent or $940 billion dollars, as reported by the Federal Reserve, to a record high of $14.5 trillion.

“Stimulus checks from the CARES Act and IRS refunds certainly contributed to this figure, but keep in mind the top 10 percent control the majority of these assets were most likely not eligible for stimulus checks,” Mr. Mount said.

“I expect that buyers will be in a worth-mindset, buying high-quality, artistically crafted products and experiences that come wrapped in service that meets their individual expectations,” he said. “The only way to know an individual’s service or COVID-19 expectations are to ask.

“For now it appears there are two worlds: a pocket of the affluent who are ready to get back out there and those who are expecting still more months of lying-low.”

During this time, brands should focus on nurturing loyal customers and play up their heritage and values to maintain their brands throughout the uncertainty of 2020.

“A brand’s external message to consumers should remain consistent with its values,” Mr. Mount said. “Internally, however, there is work to do with preparing front-line staff that there will be an irregular response to opening up. Some will want all measures taken to protect health, and others will prioritize the experience they came to have at the store, at the resort, at the dealership, etc.

“If not already the case, now is the time to empower regional teams to respond to the local market’s needs and to equip staff with the language and action steps for engaging with a range of consumer preferences,” he said.

“The advised goal for the near-term is to build customer confidence that the face-to-face interactions are being handled appropriately."

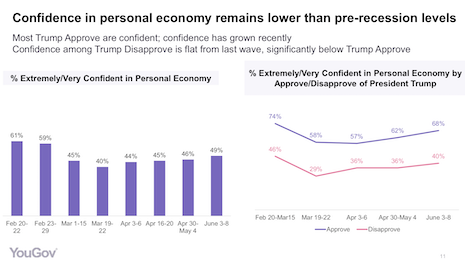

The majority of affluent consumers disapprove of president Trump, but the half of those consumers in the top 10% of affluent consumers support the president. Image courtesy of YouGov

The majority of affluent consumers disapprove of president Trump, but the half of those consumers in the top 10% of affluent consumers support the president. Image courtesy of YouGov

Rich do not like the top man

Fifty-six percent of affluent consumers "strongly" disapprove of U.S. President Donald Trump and only 26 percent of these consumers strongly approve of President Trump.

However, brands should be aware that Trump approval is highest among the biggest spenders and most committed luxury buyers.

“It’s true the majority disapprove of how Trump is handling his job as president, but within luxury it’s a nuanced conversation,” Mr. Mount said. “At the highest end — the top 10 percent of highly committed luxury consumers — approval of Trump increases to 50 percent.

“This means brands catering to high-luxury customers are particularly impacted by this trend,” he said. “While it’s only about 5 percent of the affluent, they over-index in luxury spending and purchasing of iconic luxury brands.”

Concerns about the coronavirus spiked in early April, when ninety-one percent of U.S. affluent consumers who disapprove of the president were extremely/very concerned about the spread of coronavirus, compared to 56% of those who approve.

As consumer trust erodes in government agencies, consumers are not looking to brands to fill in the gaps. Instead, they look to brands to make them feel better.

Sixty-eight percent of affluent consumers do not expect companies to be an authority on coronavirus, but they do think favorably about brands that have a positive response to the pandemic.

“Build confidence with customers by letting them see what is being done to protect them,” Mr. Mount said.

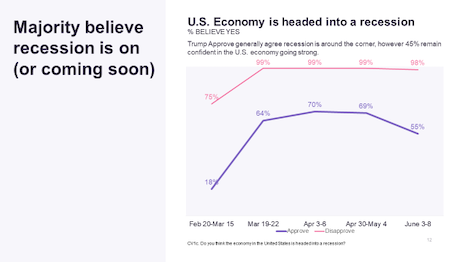

Affluent consumers expect the US Economy is headed into a recession. Image courtesy of YouGov

Affluent consumers expect the US Economy is headed into a recession. Image courtesy of YouGov

Online outlook

As states begin to reopen and shops open their doors with hand sanitizer, face masks and social distancing guidelines, many affluent consumers will still likely stay home.

Forty-three percent of U.S. affluent consumers say that they are shopping online more now than before the pandemic and 50 percent agree with the statement: “I plan on shopping more online even after the pandemic ends.”

Luxury brands need to be ready for this shift to continue by focusing on digital strategies.

“Having digital assets in place will be important marketing outlets for luxury brands as we see a significant uptick in digital media consumption,” Mr. Mount said.

“Ecommerce, where applicable, will also be an important outlet — the top concern being lack of availability of the product they want," he said. "If a brand is looking for a reason to jump into ecommerce, then the pandemic might be the perfect excuse to make the leap.”

Share your thoughts. Click here