- About

- Subscribe Now

- New York,

June 23, 2020

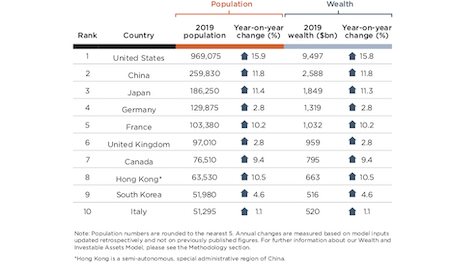

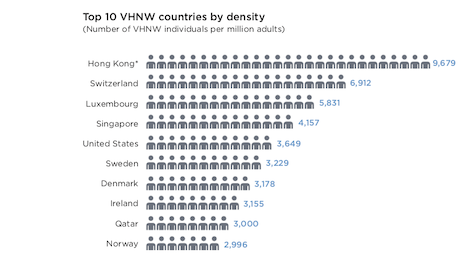

Top 10 very-high-net-worth countries. Image courtesy of Wealth-X

Top 10 very-high-net-worth countries. Image courtesy of Wealth-X

The population of very-high-net-worth (VHNW) individuals – those with a net worth of $5 million to $30 million – rose 10 percent in 2019 to 2.7 million to a combined net worth of $26.6 trillion, suggesting that affluent consumers are gaining income at a faster rate than in previous years.

VHNW individuals grew by only 1 percent in 2018, according to a new report from Wealth-X.

"This growth reflects a strong bounce-back across most asset classes, despite the turbulent geopolitical environment, ongoing trade disputes and a slowing global economy,” said Maya Imberg, director of thought leadership and analytics at Wealth-X.

“An important driver of this recovery was the reorientation of policy by major central banks towards monetary stimulus, which delivered a boost to investor sentiment and world equity markets, as did an easing of trade tensions towards the end of the year,” she said.

The majority, 85 percent, of VHNW people are self-made individuals.

“Wealthy individuals often create a halo effect for those in lower tiers of wealth as their consumer behavior creates aspirational influence,” Ms. Imberg said.

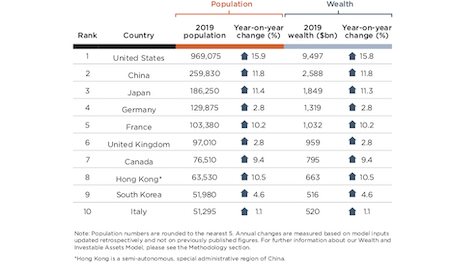

Global map of very-high-net-worth individuals. Image courtesy of Wealth-X

Global map of very-high-net-worth individuals. Image courtesy of Wealth-X

Global wealth

North America, the most concentrated area for the VHNW, saw their collective net worth increase about 15 percent.

The VHNW population in the United States accounted for approximately 36 percent of the global total in 2019.

Six U.S. cities feature in the top 10, while Asia and Europe had two cities each.

New York was the city with the largest number, with 110,170 VHNW people there in 2019.

Very high net worth went up 20 percent in Asia and Africa. China and Japan ranked high on the list. Combined the two countries account for 60 percent of VHNW wealth in Asia. The number of VHNW people in China make up 10 percent of their global population, almost double that of 2010.

Some 73,845 VHNW people live in Tokyo. Hong Kong counts 9,000.

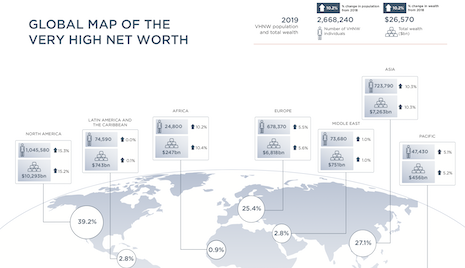

"When it comes to density, all three of the top countries are well-established financial services hubs, attracting capital from, and trading with, their close neighbors,” said Maeen Shaban, director of research and analytics at Wealth-X.

“At 9,679 VHNW individuals per million adults, Hong Kong leads by a significant margin, reflecting – notwithstanding the current political crisis – the economic benefits of a stronger relationship with China over the past two decades,” she said.

Interestingly, no mainland Chinese or German cities made the Top 10 list, despite having the second- and fourth-largest VHNW populations on a national level.

Top 10 very-high-net-worth countries by density. Image courtesy of Wealth-X

Top 10 very-high-net-worth countries by density. Image courtesy of Wealth-X

Hong Kong, Switzerland and Luxembourg have the highest density of VHNW individuals.

Europe and the Pacific did not see their numbers of VHNW people grow by as much as other regions.

However, the VHNW population in France grew by 11 percent, while the rest of European wealth markets only grew modestly at 1 percent to 3 percent. Investor confidence in France was supported by signs of structural resilience in the economy. Political instability led to a slow growing economy in the United Kingdom and Italy. Germany had issues in the automotive sector.

Unexpectedly, Sweden, Denmark and Norway feature among the top 10 likely due to a very high level of GDP per capita.

The Middle East saw negligible increases, and wealth in Latin America and the Caribbean stagnated.

Outside of China and the U.S., Istanbul and Ankara in Turkey are expected to be the fastest-growing VHNW cities over the next five years, with annual growth estimated to reach 17 percent annually.

"This will be driven by the country’s dynamic and diversified private sector, rising investment and tourism, and government policy that strongly prioritizes economic growth," Ms. Shaban said.

Share your thoughts. Click here