Kering's Girard-Perregaux, was among the most resilient brands when it comes to online search interest during COVID-19. Image credit: Girard-Perregaux

Kering's Girard-Perregaux, was among the most resilient brands when it comes to online search interest during COVID-19. Image credit: Girard-Perregaux

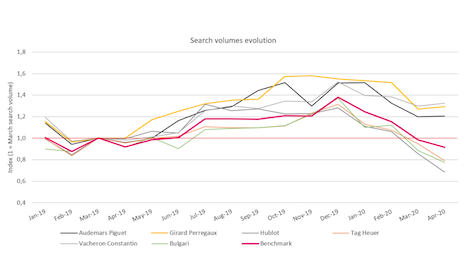

By Pauline Monnin After enjoying continuous growth search interest and demand over the past years, the luxury watchmaking industry experienced its first substantial decrease in interest since March 2020. In fact, the level of interest has recently reached a low similar to the rate of 2011. The COVID-19 pandemic stands as the first answer as to why, with consumers shifting more toward psychological and safety needs during the first weeks of the crisis and lockdown. Some brands, however, did manage to stand out from the crowd and succeeded in generating a high search interest in March and April 2020. Most watchmaking brand interest was in decline, subsequently decreasing search traffic to the site. The overall search volume for the 24 brands analyzed decreased by 1 percent in March and April 2020, compared to 2019, according to the latest research from international-based digital marketing agency DLG (Digital Luxury Group). Brands that were underperforming, compared to the benchmark prior to the crisis, were affected more on average compared to other brands. Vacheron Constantin, Girard Perregaux, Audemars Piguet and Parmigiani are the brands that resisted the most. Luxury brand watches search interest The table here displays search volume evolution, compared to March 2019 as a point of reference. A value of 1, close to the red line, indicates a decreasing volume compared to March 2019. The graph only showcases brands experiencing the highest increase or decrease when looking at March to April 2020 compared to 2019, while all 24 brands analyzed are available upon request.

Luxury brand watches search interest. Source: Digital Luxury Group

Luxury brand watches search interest. Source: Digital Luxury Group

- Vacheron Constantin +32 percent (from 417K to 553K), mostly helped by new product launch, a strong focus on customer experience, along with an effective PR and social media strategy. Most of the increase in April 2020, compared to 2019, is linked to pure brand search (+30K searches for “vacheron constantin”) and driven by the Overseas collection (+14K searches)

- Girard-Perregaux + 28 percent (from 126K to 162K), again mainly linked to pure brand search (+7.5K searches in April 2020 versus 2019 for “girard perregaux”) and driven by the Laureato collection (+5K searches April 2020 vs. 2019). Girard-Perregaux was also highly active on Instagram during the lockdown with regular live content.

- Audemars Piguet +23 percent (from 2.7M to 3.3M), recording +123K searches in April 2020 vs. 2019 for branded searches “audemars piguet”, +30K for “ap watch” and +45K for the Royal Oak collection. “Born in Le Brassus” Social Media & Display campaigns were running during the COVID-19 lockdown to take advantage of the low CPM and the rare communication from watchmakers.

- Parmigiani Fleurier +22 percent (from 17K to 21K). While the volumes are much smaller than the brands previously mentioned leading to much more volatility, its search interest stands out, driven by an influencer campaign in the Middle East with @Therealfouz and the Parmigiani Heroes initiative to support the COVID-19 crisis (20 percent donation to associations when buying a watch).

- Hublot -23 percent (from 2.4M to 1.8M). Both Hublot and TAG Heuer are heavily invested in sponsorship of sporting events that have all been canceled due to the pandemic, which has reduced their visibility.

- TAG Heuer -11 percent (from 4.1M to 3.7M), despite an increase since March for a specific collection, linked to the launch of the new Connected Modular smartwatch (+48K in April 2020 vs. 2019 for “tag connected”, “tag heuer connected” and “tag heuer connected 2020”)

- Ulysse Nardin -11 percent (from 259K to 231K)

- Create brand desirability: To attract customers, luxury brands need to generate interest by creating scarce and appealing products. Creating content is also key to crafting a brand story that resonates with its customers, along with making partnerships with famous designers.

- Build impactful corporate social responsibility initiatives with ethical motives: Brands should not pursue CSR for benefits such as greater productivity or increased awareness. They should do it if they believe their initiatives will benefit society. From sustainability initiatives to corporate foundations, employee volunteer programs, or donations to charity, luxury brands could be giving the right push toward making this world a better place to live in.

- Pursue a common objective internally: Teams need to work together with the same objective in mind, within the same ecosystem. Building cross-discipline teams mixing marketers, engineers, designers, and IT is a good way for brands to create innovative experiences.

- Build unique data-driven ecosystems: This is to identify your customers by investing in a CRM and a DMP to have an integrated view of what they are interested in. Use this database to build strong relationships with them, to anticipate their needs, and support your product strategy.

- Think long-term and customer lifetime value: Listen to customers and work on anticipating their future needs to create successful brand experiences.

- Invest in content and experience and stop spending most of your budget in advertising if you have not worked on the experience first. Flip the funnel and your investment to deliver impactful digital experiences such as Web site, content and customer service.

- Build the right partnerships that fit your brand culture and that can become allies to compete in the industry you are in.