- About

- Subscribe Now

- New York,

June 15, 2020

Brandwatch's latest report, "Brand Loyalty in Times of Crisis" explores how brands can navigate the uncertainty of 2020. Image credit: Brandwatch

Brandwatch's latest report, "Brand Loyalty in Times of Crisis" explores how brands can navigate the uncertainty of 2020. Image credit: Brandwatch

As the COVID-19 coronavirus regulations begin to lighten and stores reopen, brands are looking to their loyal customers to help stimulate business and bring back the economy.

Cultivating brand loyalty is a core foundation for marketers across sectors, but this year will be tricky even among a brand’s biggest advocates. With consumers feeling the recession in their wallets, brands will have to fight harder than ever to cultivate those relationships and convert those connections into sales, according to a new report from Brandwatch Qriously.

"With the current state of the world, luxury brands need to realize that they are just that: a luxury," said Kellan Terry, senior manager of communications at Brandwatch, New York. "Millions of people are unemployed, and many are more focused on their bills and rent before going on shopping sprees.

"Luxury brands could offer sales and discounts in an attempt to lure buyers, but times are hard for many, and luxury brands will feel that," he said.

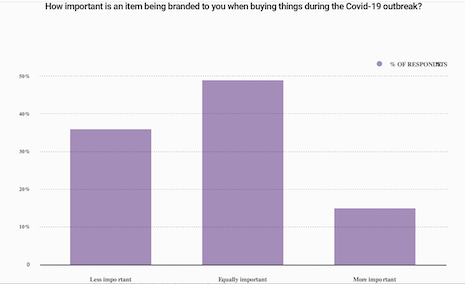

How important is an item being branded to you when buying things during the COVID-19 outbreak? Image credit: Brandwatch

How important is an item being branded to you when buying things during the COVID-19 outbreak? Image credit: Brandwatch

Brand loyalty landscape

The post-pandemic world is not the same as the world pre-virus, according to Brandwatch Qriously’s report, “Brand Loyalty in Times of Crisis 2020.”

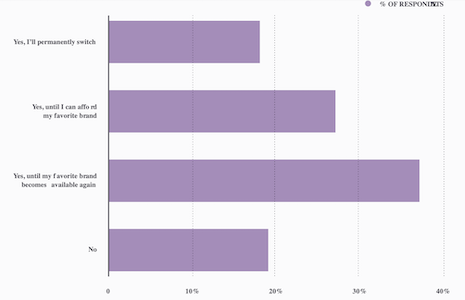

The report found that 18 percent of consumers that bought alternatives to their favorite brands during the pandemic, either because they could not afford to label or because it was not available, will switch to the non-branded version.

Additionally, 36 percent of consumers said they think that buying branded products is less important now than it was before the pandemic.

With these new consumer attitudes, brands will have to turn their marketing focus to customer relationship marketing to win-back these previously established customers.

“These are pretty big danger signs,” read the report. “A strong customer base pre-pandemic will not necessarily translate to one once the outbreak is contained.”

With this in mind, consumers are also concerned about returning to physical stores, which could just extend the retail recession that hit in March when stores closed.

The report found that 14 percent of consumers said they would not feel safe at all returning to shops or stores.

Only 20 percent said they would feel very safe.

“It’s a polarizing picture, and one that bricks-and-mortar stores are going to have to address to get their in-person customers back,” read the report. “And there will be some customers who simply don’t want to come back in person.”

Brandwatch asked consumers if they will continue to buy alternatives to name brands post-pandemic. Image credit: Brandwatch

Brandwatch asked consumers if they will continue to buy alternatives to name brands post-pandemic. Image credit: Brandwatch

Building connections online

On the bright side, the pandemic brought many shoppers online for the first time, a behavior they intend to maintain, per the report.

More than 20 percent of those consumers surveyed said that they bought clothes, groceries or toiletries and beauty products online, items they would normally buy in-store that they would not have normally bought online.

More than 50 percent of those new online consumers said they would continue to buy products across all categories online now that they have done so.

Online retailers, in particular, will benefit from this pandemic-induced behavioral shift. Some 73 percent of new online shoppers said that they plan to buy clothing online even after the outbreak.

Additionally, 33 percent of consumers said it is important to purchase locally sourced goods since the pandemic started.

Brands should take this as a call-to-action to improve their online shopping experiences now, because new loyalties will be borne during these times.

Giving consumers a good online experience now will likely drive them to return again to the online stores, even as physical stores reopen.

"With consumers feeling more comfortable making their purchases online, brands need to make sure that their online infrastructure is capable of handling increased traffic and transactions," Mr. Terry said.

"They need to ensure that the consumer experience is smooth and seamless," he said. "Brands should also completely optimize and integrate their social media strategy so that consumers can buy their products as easily as possible from social posts."

Even as online sales are accelerating, brands should still set realistic expectations for the coming year. Consumers still feel uncertainty and are holding off on big spending this year.

The report found that 44 percent of consumers think they will be spending less on holiday gifts and celebrations this year compared to last year.

Brands that are able to win back loyalty and build trust will be better poised to attract some of that spend, even if it is smaller this year.

“You can’t have loyalty without trust, and there are plenty of reasons for consumers to be wary right now,” the report said.

“Concerns around supply chains, safety of key workers, sanitization protocol in stores, and delivery issues are just a few of the reasons that trust in brands is lacking,” she said.

Share your thoughts. Click here