JLL's latest report explores retail real estate expectations this year. Image courtesy of JLL

By Dianna Dilworth

As the retail world begins to slowly reopen in the United States, the commercial real estate business could feel the after-effects of the COVID-19 lockdown for the rest of the year.

As stores closures slammed retailers, shopping malls and property management companies suffered lost rents and defaults, according to a new report from JLL.

"As expected, most landlords were not willing to offer total rent forgiveness, leading many retailers to take a negotiation stance by working towards a deferred rent program," said Naveen Jaggi, president of retail advisory services at JLL, Chicago.

"Many retailers entered these landlord discussions with a willingness to find a mutually beneficial solution and, as a result, found an amenable landlord open to deferral conversations," he said.

40% of apparel & accessories stores asked for rent relief in April. Image courtesy of JLL

40% of apparel & accessories stores asked for rent relief in April. Image courtesy of JLL

Retail rentals

Even as stores begin to reopen and consumers start to return, shopping districts and shopping malls will not be what they were as the retail industry deals with many hurdles to returning to some form of normalcy.

As stores closed down, many brands renegotiated their rental agreements with malls and property owners to save money.

Some 41.5 percent of apparel and accessories retailers and 21.5 percent asked for rent relief.

For

the report, JLL looked at 100 letters from national retailers to their landlords regarding April rent.

The research found that about 60 percent of retailers said they could not pay rent in April. Many of these retailers asked for three months of rent abatement. Other brands stated they could not pay rent until stores reopened.

More than 75 percent of those businesses asking for rent abatement for the month came from apparel and specialty tenants and dining retailers.

And interestingly, there is still a lot to understand around how these scenarios will impact the mall real estate business.

The closures only began around mid- March, near the end of the quarter. Second-quarter data could give a better picture at what things will look like moving forward.

The report found that total net absorption was negative for the first quarter at -6.4 million square feet, a 213.5 percent decline year-over-year.

Vacancy increased 20 basis points to 4.7 percent. Rents were still unaffected in the first quarter, rising 0.5 percent from the previous quarter and 2.7 percent year-over-year. This will likely adjust by the second quarter.

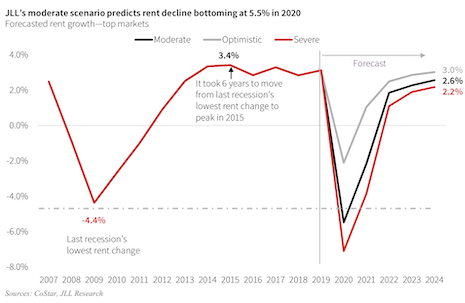

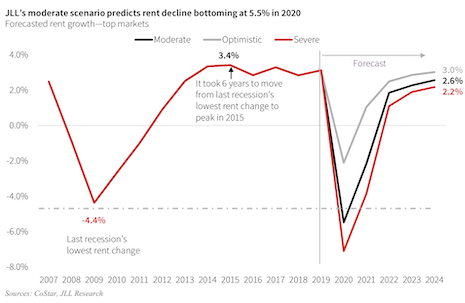

JLL’s forecast expects rents to decline approximately 5.5 percent this year.

Rents will fall by 1.2 percent if consumer confidence and retailer sales rebound faster. If things get worse, retail rents will likely drop by 7.1 percent.

Still, retail rent is expected to rebound and become positive in 2022.

The report predicts that retail vacancy will reach 5.7 percent in 2021 and return to pre-pandemic levels in 2024.

"Luxury retail is posed for a quicker rebound than aspirational retail," Mr. Jaggi said.

"Because many luxury retailers tend to operate in high-income areas with consumers who predominantly haven’t faced high levels of economic pain from the pandemic, the sector is well-positioned for recovery," he said.

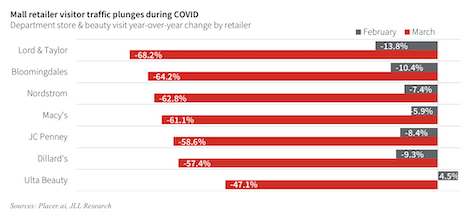

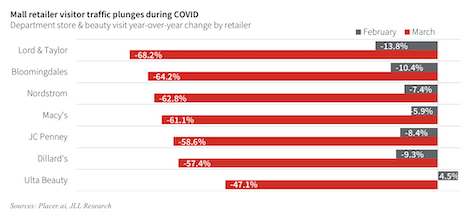

JLL Research found foot traffic to Nordstrom decreased 62.8 percent in March. Image courtesy of JLL Research

JLL Research found foot traffic to Nordstrom decreased 62.8 percent in March. Image courtesy of JLL Research

Malls hit hard

As non-essential stores began closing down in March, malls were hit especially hard, as they mainly include discretionary retailers, or those most severely affected by the closures.

Fifty-seven percent of mall gross leasable area (GLA) is normally taken by apparel and accessories retailers. This is the same sector that has seen the most significant drop in sales.

From the beginning of March, consumers started avoiding the malls. Department store sales fell 63.1 percent in March and 95.2 percent as of mid-April.

Online sales were up 4.3 percent in March and 18.1 percent in April, but these increases did not make up for the massive drop off in stores.

Case in point: in-store apparel sales fell 59.8 percent in March and 91.7 percent in April. Online apparel sales fell 9.8 percent in March year-over-year and rose 22.6 percent in April.

Net absorption for all malls in the U.S. dropped to -3.7 million square feet during the first quarter. The amount of mall space vacated increased by 83.1 percent as compared to fourth-quarter 2019.

"Lifestyle centers were the only mall type without negative absorption," read the report. "Class A malls continue to perform above average, with positive absorption of 382,000 square feet in the quarter, while Class B and C malls struggle with negative net absorption."

"Most shopping centers are an aggregation of small stores," Mr. Jaggi said. "When a shopping center is forced to close, the aggregated stores combined take up a significant amount of underutilized real estate.

"One small store closure won’t pull down an entire shopping center, but 15-20 small store closures in one center can have a colossal impact on overall performance," he said.

JLL predicts that rent declines will bottom out at 5.5% in 2020. Image courtesy of JLL Research

JLL predicts that rent declines will bottom out at 5.5% in 2020. Image courtesy of JLL Research

JLL's latest report explores retail real estate expectations this year. Image courtesy of JLL

JLL's latest report explores retail real estate expectations this year. Image courtesy of JLL

40% of apparel & accessories stores asked for rent relief in April. Image courtesy of JLL

40% of apparel & accessories stores asked for rent relief in April. Image courtesy of JLL JLL Research found foot traffic to Nordstrom decreased 62.8 percent in March. Image courtesy of JLL Research

JLL Research found foot traffic to Nordstrom decreased 62.8 percent in March. Image courtesy of JLL Research JLL predicts that rent declines will bottom out at 5.5% in 2020. Image courtesy of JLL Research

JLL predicts that rent declines will bottom out at 5.5% in 2020. Image courtesy of JLL Research