- About

- Subscribe Now

- New York,

June 4, 2020

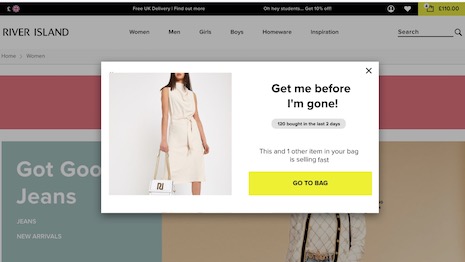

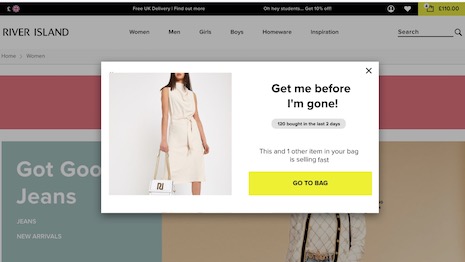

The COVID-19 lockdown has meant that digital has more say in conversion to in-store and ecommerce sales. Image courtesy of River Island, Qubit

The COVID-19 lockdown has meant that digital has more say in conversion to in-store and ecommerce sales. Image courtesy of River Island, Qubit

Comparing shopping trends mid-April through mid-May through the COVID-19 lockdowns has unearthed online behavior that will likely shape in-store retail strategy once bricks-and-mortar operations resume in most cities worldwide.

A study undertaken by marketing technology provider Qubit based on customer data across billions of customer events, transactions and visitor sessions in the United States and the United Kingdom concluded that digital marketing and ecommerce will have to do the heavy lifting to restore in-store sales.

“Luxury brands have been forced to pivot rapidly as their consumers have been completely shut-off from their preferred channel: in-store,” said Graham Cooke, founder/CEO of Qubit, London.

“However, with almost all offline journeys being significantly influenced by online research, it’s up to the digital, rather than in-store, channel to now ensure the conversion,” he said.

“Brands that are suffering are the ones that have failed to make the required investment in relevant and personalized experiences.”

Qubit works with brands and retailers such as Estée Lauder Cos., L’Occitane, River Island, Net-A-Porter, Emirates, Ladbrokes and LVMH labels, offering its personalization software for ecommerce transactions.

Graham Cooke is CEO of Qubit

Graham Cooke is CEO of Qubit

The latest data science effort to identify the new patterns of online shopping behavior emerging in the COVID-19 era found key changes in consumer behavior. Among the trends:

Revenue per customer is down across all verticals. There is risk that smaller average order value may become the new normal online once shops re-open.

Affordable luxury brands are losing out, including the high-propensity-to-convert segment after work with 20 percent fewer visitors shopping in the evening on weekdays. This means that brands can no longer depend on work-related events to drive offers and campaigns.

Overall, this sector has been most heavily impacted, while other sectors, such as higher-end luxury and fast fashion have increased their online demand due to store closures.

Affordable luxury online sales, on the other hand, have not increased during the quarantine period.

Higher-end luxury buyers are "scratching their rich itch" online. High-income consumers who do not generally shop online are trying it out.

Luxury brands should be devoting resources to making sure that the online shopping experience is optimized.

The number of visitors is up in 2020 versus 2019, and online revenues are up 115 percent year over year on weekends and 30 percent up year over year on weekdays.

Conversion rates are up during the day, but the same during the evenings.

The money spent usually in-store is impacting the amount now spent online.

That said, despite this increase, luxury brands cannot make up the difference, which is why overall performance is down.

Consumers are shopping later because they are waking up later due to working from home and their lack of commute, indicating that brands should pivot their digital strategy to match.

For example, peak fashion shopping has been 9 p.m. with computer trends not changing. However, there has an uptick in mobile until as late as 10 p.m., indicating that not only are consumers getting up and coming online later, but they are also going to sleep later.

Weekday shopping trends are looking more like weekend, particularly in fashion and affordable luxury. Time is fluid in a pandemic, so brands should adapt offers and campaigns to reflect this “new normal.”

Share your thoughts. Click here