Estée Lauder Cos.' Gennaisance de La Mer collection for this past Mother's Day. Image credit: La Mer

Estée Lauder Cos.' Gennaisance de La Mer collection for this past Mother's Day. Image credit: La Mer

Italy is home to the largest number of luxury brands in the world, while China is the industry’s biggest consumer – making up a third of global spend on luxury goods in 2018.

Together, these two countries were among the first to enter lockdown earlier this year. Soon after, the luxury business began to feel the weight of the pandemic’s profound effects.

While luxury, and commerce generally, are facing unprecedented challenges, COVID-19 has incidentally encouraged existing trends to evolve at a faster rate.

Here are four trends gathering significant momentum right now.

Asia’s contribution is now more important than ever

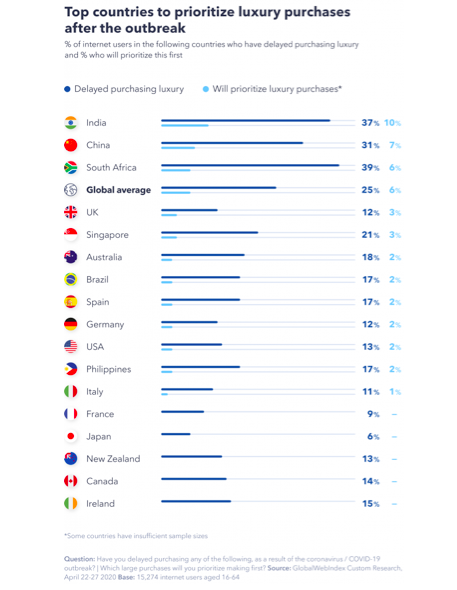

Globally, a quarter of consumers have delayed purchasing luxury items because of COVID-19.

The luxury market was able to ride out the 2008 crash because it could pivot to an emerging market: Asia, and in particular, China.

Over the last 15 years the Chinese market has developed into the leading consumer of luxury goods and services. Luxury stores began closing in Wuhan in late January 2020, and by March they had closed across China.

This domino effect continued across much of Asia Pacific and then throughout the rest of the world. This time, there wasn’t another market to pivot to.

Having experienced the crisis for the longest, it is no surprise that at 31 percent, Chinese consumers are the third most likely to have delayed purchasing luxury products.

Neighboring India – another high-growth luxury market – is slightly further ahead at 37 percent.

Demand for luxury in these nations was higher than their Western counterparts before the crisis, so it is not surprising to see them exhibiting a higher proportion of consumers presently delaying luxury purchases.

Demand in Asia has had the floor taken from underneath it, but there are still a lot of consumers keen to buy luxury when the time comes.

At 10 percent in India and 7 percent in China, these markets come up top for prioritizing luxury spending after the outbreak. It is these markets where luxury providers will look to recover from the crisis.

Top countries to prioritize luxury purchases after the outbreak. Source: GlobalWebIndex

Top countries to prioritize luxury purchases after the outbreak. Source: GlobalWebIndex

Interestingly, many consumers in South Africa are also delaying purchasing luxury and a comparatively high 6 percent will prioritize purchasing it once the pandemic is over.

However, due to South Africa’s small population in comparison to China and India, the luxury market will primarily look to the latter countries for recovery.

There is a sharp drop-off in terms of both delaying and prioritizing luxury after these three countries.

The rift between demand for luxury goods in China and the rest of the world has been widened considerably by the COVID-19 pandemic.

Western nations lag significantly behind for post-outbreak luxury prioritization, as does Japan. And due to COVID-19’s effect on travel, Chinese consumers will no longer be taking their luxury shopping abroad.

With sales normally bolstered by visitors from abroad, this is where luxury markets around the world are set to take the biggest hit.

Luxury’s growth depends on China’s emerging tiers and millennials

China is the world’s largest luxury market and, up until 2020, it was growing. In 2019 for example, Chinese citizens accounted for 90 percent of the luxury sector’s market growth.

While COVID-19 will impact this dramatically, it is not to say that the trends driving this growth will stop.

Demand for luxury will continue to develop in China’s lower-tier cities, and younger generations are still emerging as keen spenders.

Emerging Chinese cities in tiers 2 and 3 are becoming increasingly similar to tier 1 across a number of attitudes and interests. This is resulting in previously isolated and unconsidered Chinese consumers being embraced by the luxury industry as potential new customers.

Meanwhile, Gen Z and millennials make up 500 million of China’s 1.4 billion inhabitants, and in 2018, this group – flush with disposable income and optimistic about their futures – was responsible for about 60 percent of growth in total spending in China.

Our recent data suggests these trends have every opportunity to continue after COVID-19.

Gen Z and millennials are set to return to spending before their older counterparts.

Almost 60 percent of Gen Z and millennials who have delayed purchases plan to make these once the outbreak is over in China, compared to just 47 percent of Gen X and baby boomers who are more likely to wait until it is over globally.

Also in China, 40 percent of Gen Z and millennials say they will return to shops immediately or quickly following their reopening – compared to 35 percent of Gen X and baby boomers.

It should be noted, however, that China’s younger generations are more likely to say that the pandemic has negatively impacted their job and a higher proportion believe it will have a big or dramatic impact on their personal finances.

The extent of COVID-19’s effect on China’s economy is still not totally clear.

The luxury business should be aware of the younger generation’s comparatively optimistic attitudes to spending right now, but bear in mind that financial implications down the line may affect this.

In terms of China’s emerging-tier cities, demand for luxury continues to grow and brands should be considering these markets as opportunities to recoup profits after the outbreak.

Among consumers in tiers 2 and 3 who delayed purchasing luxury items because of the pandemic, 21 percent will prioritize purchasing these once the outbreak is over.

As stores begin to reopen across the country, retailers should remember how a growing youth and widening middle class contributed to luxury’s growth in China before the pandemic.

And while these groups may have taken a financial hit this year, that does not mean they will forgo luxury completely in the coming months.

Luxury is expanding its presence online

COVID-19 has been a driving force behind the traditional luxury market’s migration into the digital age.

Traditionally, luxury goods have been sold in bricks-and-mortar stores. This is primarily due to the fact that they are a high-touch category of products that require a very close relationship between the retailer and consumer.

Globally, 77 percent of luxury buyers agree that they would buy a product or service simply for the experience of being part of the community built around it. They are more than twice as likely as the average to say this.

Now, however, the closure of physical stores has forced luxury retailers to re-establish this unique experience and relationship online.

While this may be challenging, the sector’s digital channels will ultimately be developed and improved as a result.

Success will depend on how inventive luxury retailers can be in encouraging their customers to purchase a greater portion of goods online.

Methods could range from virtual shopping sessions, to personalized communication between managers and regular customers. It is up to brands to make their online offering equal or rival the experience in-store.

COVID-19’s effect on travel is having serious ramifications for the luxury industry and digital channels are pivotal for brands looking to recapture this lost business.

The bricks-and-mortar luxury store is now commonplace in airports.

Last year, Olivier Bottrie, Estée Lauder Cos.’ head of global travel retail business, said “When a department store goes away, it’s not a major catastrophe. But if a major airport went away, it would be a major catastrophe.”

As a result, the inevitable “coming online” of luxury is set to continue long after the pandemic ends. This does not signify the end of the traditional store, rather an embrace of an omnichannel future.

Globally, among consumers who have delayed buying luxury items because of the outbreak, more than half will buy more items online for home delivery once it is over.

This will also help retailers reach their emerging Chinese customers more effectively – most notably those in lower tiers who may not have a store nearby, and millennials who are already comfortable and appreciate the convenience of buying online.

What is so important to note here is that now is the time for brand building and audience engagement, particularly for the luxury business.

Tellingly, those who have delayed a luxury purchase are more than 60 percent likelier than average to say that they will reward brands who have kept in contact with them during the crisis with their spending once the outbreak is over (28 percent do).

As such, establishing a strong online relationship with luxury customers is not just a requisite for the post-outbreak buying experience, it is a requisite for post-outbreak loyalty, too.

Luxury and affordability is a balance

Last year, we reported that affordable luxury has been making a serious impact on the go-to-market strategies of many luxury brands. This trend has been accelerated by the financial implications of COVID-19.

Affordable luxury is often characterized by consumers looking for the status associated with luxury, without encountering the high price tag.

Among luxury buyers, 89 percent say it is important to feel respected by their peers – they are 1.28 times as likely as the average to say this.

As status-seeking consumers feel the financial effects of the outbreak, we can see they are beginning to turn to more affordable luxury alternatives and payment plans.

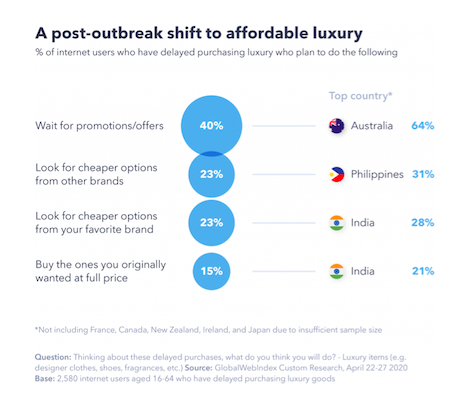

A post-outbreak shift to affordable luxury. Source: GlobalWebIndex

A post-outbreak shift to affordable luxury. Source: GlobalWebIndex

Globally, three in 10 consumers who have delayed buying luxury items because of COVID-19 say they will look for flexible payment options in the financial aftermath of the outbreak – being 54 percent more likely to say this than the average.

Additionally, just 15 percent say they will buy the items they originally wanted at full price, while 40 percent will wait for promotions, and 23 percent will look for cheaper options from other brands.

For many, a luxury good is an essential representation of status. However, COVID-19 is forcing more consumers to be pragmatic when making these transactions.

Consequently, brands need to look at how they bring more affordable luxury to consumers, while still remaining true to their values and purpose.

Evolution of the luxury sector

COVID-19 has undeniably had a significant negative effect on the luxury business. However, it has also encouraged emerging trends to evolve quicker.

Thanks to these accelerating trends, luxury is positioned to bounce back – especially in key regions such as Asia Pacific where demand is highest.

As well as staying front-of-mind during the outbreak, brands should look at new ways of reaching consumers, such as using online channels, while evaluating the best ways to bring more affordable luxury into the hands of consumers.

Affluent Consumer Report: Download Now

Isaac Hopkins is junior trends analyst at GlobalWebIndex

Isaac Hopkins is junior trends analyst at GlobalWebIndex

Isaac Hopkins is junior trends analyst at GlobalWebIndex, London. Reach him at ihopkins@globalwebindex.com.