- About

- Subscribe Now

- New York,

May 19, 2020

Wealth-X's new report "A Decade of Wealth" explores the trends in global wealth from 2010-2019. Image courtesy of Wealth-X

Wealth-X's new report "A Decade of Wealth" explores the trends in global wealth from 2010-2019. Image courtesy of Wealth-X

Worldwide wealth and the wealthy population increased by more than 50 percent over the last decade and the number of global millionaires doubled between 2005 and 2019 to more than 25 million individuals. But the current crisis leaves the future uncertain.

Wealthy individuals controlled almost one-third of global private wealth in 2019, a massive $104 trillion, up from $50 trillion in 2005. However, the COVID-19 coronavirus pandemic could upend the trends of the last decade, as volatile markets drop and economies stay closed.

“Not only has it brought to an immediate halt the unbroken upward trend in global growth over the past decade, it has also threatened a sharp correction in world asset markets and increased the risk of intensifying global rivalries, particularly between the U.S. and China,” Wealth-X said in the report.

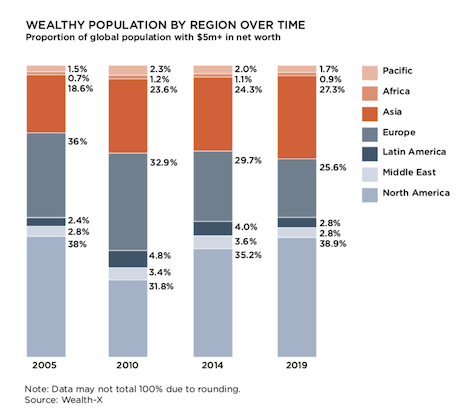

Wealthy population by region over time. Image courtesy of Wealth-X

Wealthy population by region over time. Image courtesy of Wealth-X

A decade of growth

The rise in wealth over the last decade was driven by strong economic growth in Asia and other emerging economies, urbanization and advances in digital technology, largely led by the U.S. tech giants.

North America continues to dominate as the world’s leading wealth region, with almost 39 percent of all wealthy individuals.

The U.S. is the world’s largest wealth market driven by the dollar’s global reserve currency status, the financial services and technology sectors, as well as a business environment that supports private enterprise and competition.

Europe has seen a steady decline in its status driven by slow-growing economies, restrained financial markets and the maturity of its main wealth markets.

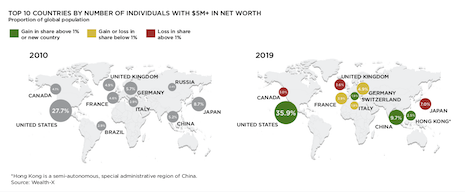

One of the biggest trends is the rise of emerging markets across Asia — six countries are in the top ten. Vietnam and Bangladesh topped the rankings, as a young and expanding workforce and integration in regional manufacturing supply chains helped their economies boom.

Wealth in Asia, and China in particular, has grown significantly since 2005. The number of individuals with net worth of $5 million-plus in the region has tripled over this period.

“One of the clearest trends over the past decade has been a shift in the global balance of power from West to East, and this has been mirrored in the changing distribution of wealth among regions,” the report said.

Top 10 countries by number of individuals with $5M+ in net worth. Image courtesy of Wealth-X

Top 10 countries by number of individuals with $5M+ in net worth. Image courtesy of Wealth-X

Urban growth

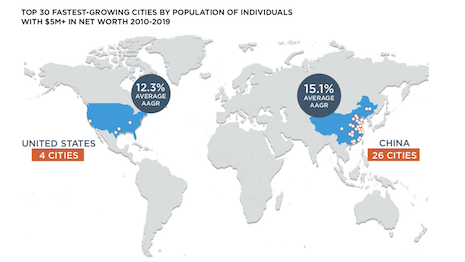

China accounts for all but four of the world’s 30 fastest-growing cities among wealthy individuals. Most are located on or near China’s east coast.

The four non-Chinese cities in the top 30 list are all in the United States, showing new wealth hotspots, including Austin, TX and Nashville, TN.

“As the global urbanization trend has continued, the wealthy have congregated increasingly in cities — attracted by commercial opportunities and talent but also an array of cultural, educational and lifestyle opportunities,” the report said.

Leading global cities for wealthy citizens include Hong Kong, London, Paris and Los Angeles. New York is the leading city, with Tokyo in second.

During the first decade of the 2000s, Tokyo and New York alternated as the world’s leading city for wealthy individuals. But since 2012, New York has solidly been the leading global city of the wealthy.

“While the U.S. recovered strongly from the global financial crisis, wealth creation in Japan has been hampered by sluggish economic growth, exchange-rate effects and aging demographics,” the report said. “Underlining the robust wealth gains in the U.S. over 2010-19 and the overall size of its wealth market, five other U.S. cities also rank among the global top 10.”

Top 30 fastest growing cities by population of individuals with $5M in net worth. Image courtesy of Wealth-X

Top 30 fastest growing cities by population of individuals with $5M in net worth. Image courtesy of Wealth-X

Outlook

The luxury goods sector has expanded remarkably in China over the past decade, illustrating the relationship between demand and the trajectory of wealth.

Still, Europe and the U.S. remain the dominant global markets for luxury consumption.

As luxury brands market to wealthy consumers in the current landscape, the experience of products and services will continue to grow in importance.

And while technology will continue to play an important factor in the post-pandemic world, it will not replace the role of relationships in luxury marketing.

Relationships continue to make a difference to customer acquisition and long-term business.

Additionally, passions will increasingly inform spending of the wealthy.

But while global wealth has grown significantly since the last recession in 2008, the current situation has brought uncertainty to the world.

No one knows how long the downturn will last and how much economic damage it will bring, leaving a volatile situation for the stock market and property assets.

As wealthy people await the outcomes and information on how effectively governments and central banks can assist, many are trying to help their staff and employees survive in the meantime.

Some wealthy individuals may need to free up liquid assets to get through the crisis.

“The vast majority of wealthy individuals own and/or operate a business, so the speed and scale of the downturn mean that quite a few companies will be struggling, be it from a solvency, liquidity and/or operational perspective,” Wealth-X said in the report.

“However, as in all crises, there will be some organizations - most likely in the technology, healthcare and distribution sectors - for which demand is likely to have strengthened.”

Share your thoughts. Click here