- About

- Subscribe Now

- New York,

May 15, 2020

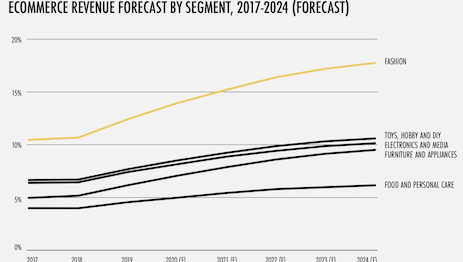

Ecommerce revenue forecast by segment. Image courtesy of RetailX

Ecommerce revenue forecast by segment. Image courtesy of RetailX

Ecommerce and mobile sales were up in France last year, as more French consumers are accessing the Internet and using the medium to order everything from apparel and footwear to bags and food.

In 2019, ecommerce in France generated $111 billion in sales, up 11 percent over 2018, making the country the second-biggest online market in Europe after the United Kingdom and just ahead of Germany.

“The growth is mainly driven by marketplaces," said Elodie Vauthier, ecommerce product manager at Asendia, a joint venture of French La Poste and Swiss Post, Paris, in the report. "In the current health crisis, new behaviors have emerged.

“For instance, we notice the rise of new eshoppers’ profile, with baby boomers clearly increasing their online usage,” she said.

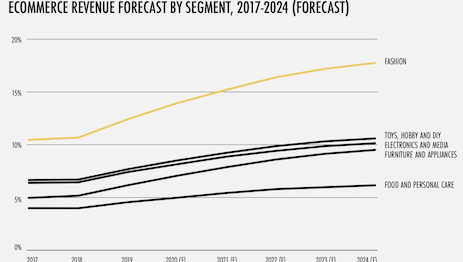

Hermès is known for its savvy social media strategy. Image courtesy of RetailX

Hermès is known for its savvy social media strategy. Image courtesy of RetailX

Internet penetration in France

Even as the French GDP dropped by 5.8 percent in the first quarter of 2020, the biggest-ever decline since 1949, ecommerce held steady, remaining a lifeline as stores were closed, according to a new report from RetailX.

When the pandemic broke out, 51 percent of consumers said there was no change in their ecommerce activity, 16 percent said they shopped online more frequently. Only 6 percent of shoppers said they cut back on online shopping behavior and 28 percent admitted that they rarely shop online.

In 2019, 90 percent of adults were able to go online and that figure is expected to continue to grow.

Marketplaces including Rakuten and Amazon are a significant part of the French ecommerce landscape, accounting for half of Web traffic, according to RetailX, but do not dominate as they do in other markets.

Retailers generate 42 percent of ecommerce traffic and brands get 7.4 percent.

Direct-to-consumer selling is on the rise, and most Web sites that sell in this market are in the French language and operate from .fr domains.

Luxury fashion house Hermès, which is cited in the report as being worth $25 billion in 2018, is one of the most valuable French brands and uses a .fr Web address.

In highly urban France, 86 percent of online shoppers use home delivery, 83 percent use third-party click-and-collect points, and 38 percent pick up orders in a retailer or brand’s physical store.

Ecommerce spending per shopper is projected to grow this year. Image courtesy of RetailX

Ecommerce spending per shopper is projected to grow this year. Image courtesy of RetailX

Mobile commerce is growing

Increasingly, French consumers are using mobile devices to shop online.

In fact, mobile commerce is growing 4x faster than ecommerce as a whole.

While earlier in 2019, laptops were just ahead of smartphones for preferred digital shopping devices, by November a study from Fevad showed that mobile had overtaken desktop for the first time.

Additionally, some retailers are seeing more traffic to their mobile Web sites, as compared to their desktop traffic.

Additionally, app use is also increasing as a shopping tool.

When consumers were asked in what circumstances they would like to use a smartphone to pay, 15 percent said they would like to use one to pay all the time.

“Most people are buying on their smartphones at home – it’s more convenient than opening a computer,” said Marc Lolivier, director general at the Fédération ecommerce et vente à distance (Fevad), in the report.

“Also, retailers are now realizing how important it is to have an app for mcommerce as consumers can store their payment details, address, etc.," he said. "This creates more convenience for consumers.

“People were spending a lot of time during the gilets jaunes strikes on transportation and could order online on mobile. Mcommerce is definitely a driver and will keep on for this year, particularly because of apps. All the main Webshops now have apps.”

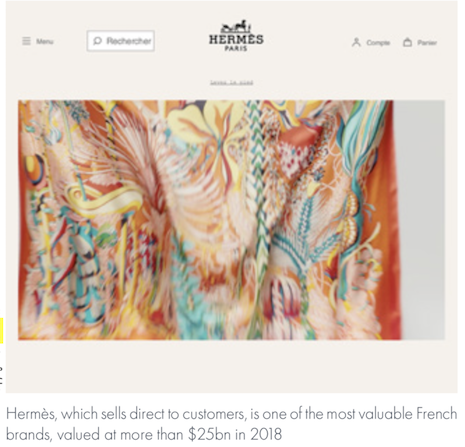

Facebook is the most popular social network in France. Image courtesy of RetailX

Facebook is the most popular social network in France. Image courtesy of RetailX

Digital strategies

Brands are increasingly creating a presence online to sell direct to consumers in France.

In doing so, many are creating digital campaigns to engage consumers online through email and social media. Brands are developing deeper digital strategies through customers data.

Social media plays a key role in brand strategy.

Facebook is the strongest social media site in France, with 60 percent of consumers on the network.

Pinterest makes up 16.5 percent of social media usage in France, Twitter 9 percent and Instagram 7 percent.

Instagram users, for example, tend to visit predominantly from mobile devices.

Still, brands are advised to be on the platform where their particular audience spends time.

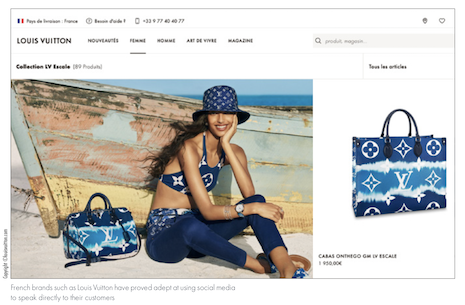

LVMH brand Louis Vuitton was cited in the report for its savvy use of social media to speak directly to its customers.

“Brands are very strong on Instagram, so they are using these tools and bringing them to ecommerce,” Mr. Lolivier said.

“Smaller Webshops also love social media because they’re cheaper than using Google marketing tools,” he said.

Louis Vuitton joins other French brands building direct-to-consumer businesses. Image courtesy of RetailX

Louis Vuitton joins other French brands building direct-to-consumer businesses. Image courtesy of RetailX

Share your thoughts. Click here