- About

- Subscribe Now

- New York,

May 14, 2020

Wellbeing may become the new coin of the realm. Image credit: Unity Marketing

Wellbeing may become the new coin of the realm. Image credit: Unity Marketing

The COVID-19 coronavirus shutdown has forced a reset to consumers’ purchasing behavior across the globe and at every income level.

In a blink of the eye, consumer spending shifted from discretionary to necessity purchases and has remained that way throughout the months of the shutdowns.

With luxury being the most discretionary of all consumer purchases, it was the first consumer segment to suffer cutbacks due to the coronavirus and is shaping up to be the last one that will recover.

While luxury brands have been able to limp along throughout the duration thanks to their online presence, the virtual global shutdown in affluent consumers’ lifestyles has given them idle time to reassess the priorities in their lives.

Luxury brands and the conspicuous consumption that sustains them are coming up on the short end of the stick.

For example, while the headlines proclaim that the China luxury consumers have emerged from their lockdown ready to spend, like this one from WWD, a McKinsey survey among some 60 luxury store managers in China shows that about 50 percent report store sales are still lagging way behind last year’s levels.

The luxury market drives on the psychology of affluent consumers. When they feel good about themselves and are on solid ground financially, they give themselves permission to indulge. When they do not, they will not. It is that simple.

Right now, nobody feels confident or assured that they or their loved ones will get through this unscathed and depending on where they fall on the income/wealth spectrum, their financial status may be in question, too. How long these feelings of uncertainty will last is the $64,000 question.

As I look across the luxury consumer market, luxury brands can count on their rich customers to come back, maybe not with the same enthusiasm short term, but return they will.

That will not be the case for the mass-affluent, however, who I call the HENRYs (high-earners-not-rich-yet).

HENRYs occupy the space between the middle-income consumers ($50,000-$99,000) and the ultra-affluent elites ($250,000+).

While individually HENRYs do not have the spending power of the ultra-affluents, they way outnumber them as a group. There are 32.7 million U.S. HENRY households compared with 6.2 million ultra-affluent.

More than 80 percent of the nation’s nearly 40 million affluent households are HENRYs, which is why luxury brands depend upon HENRYs to keep their sales strong and growing.

In the new-normal, post-coronavirus world, the luxury market is going to be profoundly changed by profound changes to the HENRYs mindset, priorities and values.

“Consumption is driven by very strong motivations, like emotion, identity, and social connection,” said Erica Carranza, vice president of consumer psychology at research firm Chadwick Martin Bailey.

“Those motivations aren’t going anywhere,” she said. “But the values, habits and norms that shape what we consume and how we consume could shift dramatically.”

The changes coming to the white-collar professional, creative class of HENRYs, who make up the bulk of the nation’s luxury consumers, is a dramatic shift toward wellbeing, across the dimensions of physical, emotional, and financial health and security.

While the luxury industry has been leaning into wellness and environmental sustainability as macro-trends shaping the future of the luxury market, wellbeing is going to be the emerging macro-trend that will subsume wellness and sustainability as micro-trends within it.

Here is how the future of luxury will shape up under the macro-trend of wellbeing. Note, wellbeing will emerge as a priority for the elite ultra-affluent consumers too, though their concerns about financial wellbeing is going to be much less.

Maslow's Hierarchy of Needs. Image credit: Unity Marketing

Maslow's Hierarchy of Needs. Image credit: Unity Marketing

New luxury of health

Luxury brands are well versed in applying Maslow’s Hierarchy of Needs in their marketing and positioning.

They have always played to promising satisfaction of the higher-level needs of social belonging, esteem and self-actualization, taking for granted that their affluent target customers has the lower-level physiological and safety needs covered.

After the coronavirus pandemic, they cannot take those lower-level needs for granted, which Maslow theorizes must be satisfied for people to focus on their higher-level needs.

In effect, the coronavirus pandemic has turned Maslow’s Hierarchy of Needs upside down. Shopping, even for the affluent, has shifted toward the basics with many affluents for the first time experiencing online grocery shopping.

Free time that they once spent shopping to meet social belonging, esteem and self-actualization needs is now being spent doing other things, such as connecting with friends and family via their devices (57 percent doing more), de-cluttering their homes (45 percent), crafting or hobbies (35 percent), spending time outdoors (26 percent) and exercising (23 percent), according to YouGov Affluent Perspective survey conducted in early April.

Affluent consumers’ shift toward de-cluttering is particularly noteworthy, since I do not know any luxury consumer who has not got more stuff than they know what to do with. The same rigorous judgments they are using to clean out their closets now is likely to be applied once they can get back into the stores later.

With affluents physical health and safety threatened, time spent in isolation has forced a reset to consumers’ priorities.

“The silver lining in all of this is it brings a lot more focus on health and wellness,” said Beth McGroarty, director of research and public relations at the Global Wellness Institute.

“Post-pandemic behaviors will change just because people will have adopted new ways to survive, even thrive,” she said. “It will be a radical check on our blatant consumerism. People have been forced to stop it, and they realize that it doesn’t matter. It doesn’t make them happier.”

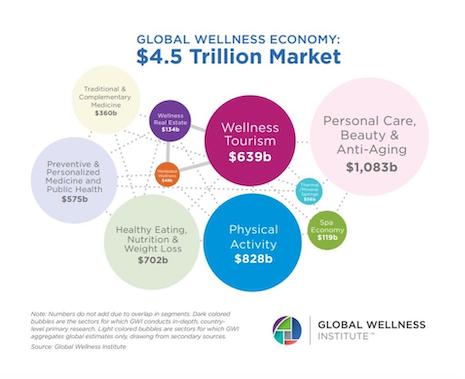

The luxury sector that will benefit most from the pandemic reset is the $4.5 trillion global wellness economy. Products and services will gain that offer real wellness benefits, that is, things and experiences that actually do a body or our collective bodies good, rather than just do less damage to the person or environment.

“It’s not like people will just buy really expensive organic soaps or organic food or sustainable fashion,” Ms. McGroarty said. “Over-consumption in the sustainability movement can ultimately do more harm than good.”

Global wellness is a $4.5 trillion business. Source: Global Wellness Institute

Global wellness is a $4.5 trillion business. Source: Global Wellness Institute

The new luxury of emotional wellbeing

Happiness is an emotional state and while being healthy is a first critical step toward happiness, it is only part of the journey.

“Mental and emotional wellness has been the biggest trend in the wellness space before coronavirus and it will become even more important after,” Ms. McGroarty said, as she expects more people to suffer post-traumatic-stress levels of anxiety and fear caused by the threat to health and extended social isolation.

“The crisis of social isolation and loneliness is one of the biggest health threats to the world,” she said. “And it is getting worse since the digital age, especially among young people with growing rates of suicide and anxiety.”

The latest World Happiness Report found a distressing and growing happiness gap in countries across the world. And the gap is not explained by physical health or the GDP of the nations.

“Social connections are the number one determinant of happiness because of a strong sense of community and connections with real people and trust in a society’s institutions,” Ms. McGroarty said, pointing to some poorer countries that are happier than richer ones, such as No. 15 Costa Rica which ranks higher than No. 18 United States.

Further, the research indicates that countries with rising incomes do not necessarily gain in happiness. And for the happiest countries, such as No. 1 Finland and Nordic countries overall, consumers’ strong sense of social cohesion that is fostered by trust in their governments is a major contributor to happiness.

Luxury brands have been trying to mimic that sense of community and belonging for their customers, but it is a poor substitute for real personal connections.

After all, people have to pay a high price to be connected to any of these brands. And the very act of displaying one’s connection can cause problems all their own.

“You see the media reports of the rich people renting $6,000 a night beach houses in the Hamptons, hoarding all the food, and flying in their private jets to escape,” Ms. McGroarty said. “It seems like all the pain and misery is falling on the lower classes. It just highlights income inequality.”

Prominent luxury logos that display one’s wealth and extravagance will appear distasteful in a post-coronavirus world.

The new luxury of financial wellbeing

Securing a financially-healthy future is going to be a priority for luxury consumers, with the experience from the 2008-09 recession still fresh in their memories.

While the ultra-affluent elites may feel their financial status is immune from the aftermath of the coronavirus, the professional class HENRYs certainly do not.

With 30 million Americans now unemployed, the AP reports that layoffs and pay cuts are starting to impact white-collar professionals at law, accounting and consulting firms, in healthcare, marketing and administration, even professionals working in technology and scientific fields, such as architecture and engineering.

And then there are the 16 million self-employed Americans and the 31 million small-business owners who have seen their revenues and incomes cut dramatically. These people overwhelmingly make up the HENRY demographic.

For luxury brands, their future growth is going to come down to the 80/20 rule. About 80 percent of their target customers are HENRYs and while HENRYs may not contribute 80 percent of their revenues, it is reasonable to assume that the HENRY’s share is way too important to lose.

But lose them they will, if the last recession is any indicator of the impact of coronavirus on the personal luxury goods market, which declined from €170 billion in 2007 to €153 billion in 2009, according to Bain and Altagamma.

That 10 percent decline may be a drop in the bucket compared to the aftermath of the coronavirus pandemic, which threatens luxury consumers’ health and emotional wellbeing, not just their financial status.

People do not reach a state of financial wellbeing and security by spending all their money – the Millionaire Next Door proves it.

As the HENRYs emerge from their cocoons where they have had ample time to reflect on what is most important to them now and in the future, their spending habits are likely to take a radical shift from indulging in luxury goods as much as their income allows to saving and more modest, discreet luxury indulgences where high-quality and long-lasting utility take precedence.

Luxury is the journey, not the goal

The Global Wellness Institute defines wellness as: the active pursuit of activities, choices, and lifestyles that lead to a state of holistic health.

The organiztion distinguishes wellness not as a “static state of being – i.e. being happy, in good health, or a state of wellbeing – but rather the “active process of being aware and making choices that lead toward an outcome of optimal holistic health and wellbeing.”

The institute further stresses that individuals have self-responsibility for their choices, behavior and lifestyles which are significantly influenced by “the physical, social, and cultural environments in which we live.”

Those environments have been radically altered by the coronavirus pandemic and the government’s response to it.

Luxury brands, which represent the pinnacle of social status and cultural aspirations, need to ponder how their consumers’ luxury values and lifestyles will change as a result of the reset they have experienced.

Achieving the true luxury of wellbeing will be their customers’ new goal. Where does a new piece of jewelry, handbag or pair of expensive shoes fit into that pursuit, even if said items are produced responsibly?

FOR LUXURY BRANDS, the goal all along has been more consumption (i.e. the thing), but in the post-coronavirus world where consumers have been forced to get off their habitual buying-and-spending treadmill, I foresee luxury consumers, most especially the HENRYs, emerging with a new set of priorities (i.e. the experience of life’s journey).

The HENRYs’ passion for wellness for the planet will take a back seat to their drive for personal wellbeing that has multi-dimensional physical health, emotional and financial components.

Luxury brands will have to reset to these new dimensions as they pursue their own post-coronavirus journey.

Pam Danziger is president of Unity Marketing

Pam Danziger is president of Unity Marketing

Pamela N. Danziger is Stevens, PA-based president of Unity Marketing and Retail Rescue, cofounder of the American Marketing Group, and a luxury marketing expert. Reach her at pam@unitymarketingonline.com.

Share your thoughts. Click here