- About

- Subscribe Now

- New York,

May 14, 2020

Agility Research & Strategy explores recovery outlook from luxury leaders in China. Image courtesy of Agility Research & Strategy

Agility Research & Strategy explores recovery outlook from luxury leaders in China. Image courtesy of Agility Research & Strategy

Luxury marketers can learn two key post-COVID-19 lessons from China: brands should maintain connections with their loyal VIP shoppers and embrace the new digital and virtual lives that consumers have built even when stores reopen.

China has shown the way to bounce back, according to the webinar, “China Luxury Rebound: Lessons for Other Markets,” featuring Amrita Banta, Singapore-based managing director of Agility Research & Strategy and Luxury Daily editor in chief Mickey Alam Khan. The webinar is part of Luxury Daily's Luxury Roundtable series.

“The turnaround was pretty quick because the crisis was controlled quickly,” Ms. Banta said on the webinar. “A slower turnaround and a slightly longer crisis that China avoided.”

China shows early signs of recovery. Image courtesy of Agility Research & Strategy

China shows early signs of recovery. Image courtesy of Agility Research & Strategy

Reopenings

January and February were not business as usual in China, as cities shut down under pandemic-related lockdowns.

Things slowly started to reopen in March and when the Wuhan ban lifted on April 7, the market began to rebound.

Many luxury brands reached 60-70 percent of 2019 levels in March, and saw continued weekly increases in April.

Some brands have already reached 2019 levels. Others are cautiously optimistic about recovering to 2019 levels in May or June.

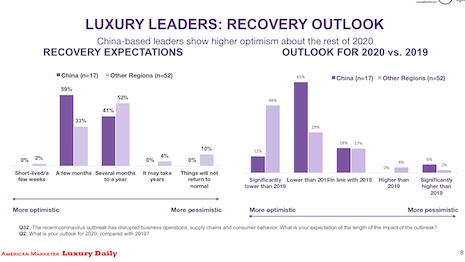

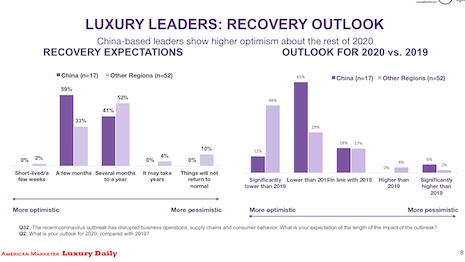

“Luxury leaders have a very positive outlook on recovery expectations,” Ms. Banta said. “Some executives expect things to return to 2019 levels in a few months, others expect several months to a year.”

One of the early signs of recovery was the element of "revenge spending," when stores first opened and consumers made up for lost time.

“There was a pent-up demand while people were locked down at home and this could really happen in the other markets,” Ms. Banta said. “It was like people needed some retail shopping, to reclaim a sense of normalcy by going back to what they were doing before the lockdown.”

Much of this shopping was encouraged by stimulus programs created by the Chinese government. India has recently announced a similar stimulus program.

“There was a definite rebound of people coming back and going a little bit overboard during the first week or two,” she said.

China's domestic travel begins to return. Image courtesy of Agility Research & Strategy

China's domestic travel begins to return. Image courtesy of Agility Research & Strategy

By category

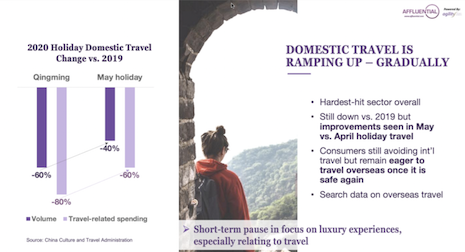

The travel business has been the hardest-hit sector.

However, the outlook is positive with domestic travel returning in China during April and increasingly in May. This signals hope for tourism in the future.

However, even though people are willing to travel again, it is still very short of 2019 numbers and international travel is still a long way from returning.

“The good news is that domestic travel is increasing,” Ms. Banta said. “But markets that depended so much on the Chinese traveler, we don't know when this is going to reopen.”

Chinese consumers make half of their luxury purchases on travels abroad, so brands should now try to adapt marketing to reach these consumers in their home markets.

For instance, luxury brands should consider hosting virtual fashion shows in China.

“The Chinese did like traveling abroad,” Ms. Banta said. "This year a lot of Chinese will be shopping at home.”

Categories that have been more resilient include beauty, health and wellness, banking, insurance, gold and alcohol sales.

“Shiseido, L'Oreal and Estée Lauder have already reported positive sales news coming out of China,” Ms. Banta said.

Sephora China April 23 took the annual Sephora Day online and earned more than 1 million views, illustrating the opportunity to transition bricks to clicks.

The lack of overseas travel is creating a captive market and many brands are joining Tmall to tap this base.

A brand’s Web site is still important, no matter where the brand sells. It is very important to have that Web site with a lot of details about products and pricing.

“There is a real captive market in China, and you can see by the new brands joining Tmall, through Valentine’s Day,” Ms.Banta said. “Kenzo, Cartier and Prada still did good sales.

“Brands have been flocking to these platforms,” she said. “It is going to be important to see how these online markets develop. It is a big area of growth.”

Commerce-driven content

As online sales have been taking on a more important role during lockdown, so too is online marketing.

During lockdowns luxury brands looked to connect with loyal customers in more narrative storytelling to entertain anxious consumers rather than sell to them.

“The tone of voice in the narrative is how brands stay connected with consumers,” Ms. Banta said. “Relationships have to go beyond transactions and beyond products being at the center of it.”

For instance, L’Oreal created a film in collaboration with GQ called “Wrinkle, Women, Wonderful?” to promote L’Oréal’s Revitalift line on Tmall that was well-received by consumers.

Other brands and organizations hosted cloud luxury events. For instance, Watches & Wonders livestreamed an event on Tmall. Shanghai Fashion Week was live streamed.

Burberry created the Craft Series that told the story of the work that goes into creating a Burberry trench coat, focusing on its craftsmanship and then engaged with users through WeChat quiz testing games.

“During the crisis, it is very important about how brands are telling their story,” Ms. Banta said.

“It is more about engaging the consumer in very interesting ways, rather than directly selling to them," she said. "Loyal and VIP consumers are coming back very bonded to the brands that have connected to them during lockdown.”

Brand strategies that have worked. Image courtesy of Agility Research & Strategy

Brand strategies that have worked. Image courtesy of Agility Research & Strategy

Trends to watch

As China opened up, affluent and high-net-worth consumers returned to stores, but they have also kept shopping online.

On the one hand, luxury is about in-person experiences. On the other, the lockdown increased ecommerce sales that are likely to continue, especially among those consumers in smaller Chinese cities who do not have stores of the brands they love nearby.

“That is where the engagement will now translate more into ecommerce opportunities, who can sell to them,” Ms. Banta said.

Selling can even happen online without ecommerce. An exclusive jewelry brand that does not have an ecommerce presence in China livestreamed its VIP events that were a big success.

“Even during this time, as a lot of us are locked down, we are still enjoying a beautiful experience,” Ms. Banta said.

“It is interesting to see people with the money in China, and maybe across the world, are interested in engaging in these events even if they are not face-to-face,” she said. “We expect them to continue. Don’t cancel your events, keep them going online even if you are in a market where you can’t do a face-to-face event.”

One trend people really latched onto was the desire to learn new things such as a new language, cooking, video editing or simply dancing on TikTok.

“It is a great opportunity for brands to engage consumers,” Ms. Banta said.

Livestreaming will also likely continue. Beauty is well-positioned for this trend, but expect to see it across sectors including fashion and real estate.

Another trend to watch is the importance of a minimalist life, which was trending even before the crisis.

As consumers look to live this less-is-more life, it does not mean they will not spend money. In fact, they may simply cut back on impulse spending and spend more money on a few, well-crafted things, which could benefit luxury.

Additionally, cloud life will likely continue well into the future as consumers have discovered how to work, socialize, study and be entertained online. Brands have an opportunity to connect to this consumer behavior.

“The trend [is] about being able to do so much more online than you ever really did,” Ms. Banta said.

Another trend is the rise of localization in which brands design and produce products in their local markets to avoid some of the supply chain disruptions that were experienced during the crisis.

“Some of the local brands in Japan, India or Korea don't rely on foreign factories and have been doing well in a crisis like this because it is much easier to have control,” Ms. Banta said.

High-net-worth individuals remain more optimistic than the general population and global luxury brands can expect more sheltered consumers with money to continue to spend this year.

Brands should nurture relationships with these VIPs in very personal ways such as sending handwritten notes.

“Loyal customers are really important for every brand," Ms. Banta said. "It is critical at this time of crisis to invest in your loyal customers because those are the ones that come back quickly.”

Share your thoughts. Click here