- About

- Subscribe Now

- New York,

May 5, 2020

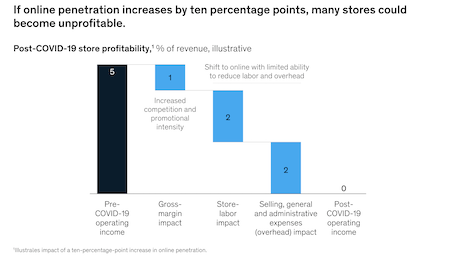

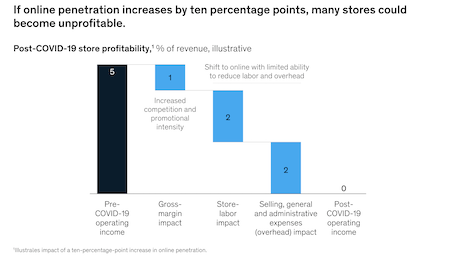

If online penetration increases by ten percentage points, many stores could become unprofitable. Image credit: McKinsey

If online penetration increases by ten percentage points, many stores could become unprofitable. Image credit: McKinsey

When retail returns after the COVID-19 pandemic shutdowns, retailers should be prepared to completely transform the way they imagine a store.

Omnichannel integration, employee flexibility and new price structures will be the basis for the new world order, according to a new report from McKinsey.

“The timing is uncertain and will differ across U.S. markets, but what’s certain is that stores can’t simply pick up where they left off,” the report said. “COVID-19 has changed consumer behavior, perhaps permanently, and retail stores will need to take these new behaviors into account.

“To maximize their potential when they emerge from the crisis, retailers must factor in the realities of the post-coronavirus world.”

New McKinsey report explores the future of shopping. Image credit: McKinsey

New McKinsey report explores the future of shopping. Image credit: McKinsey

Changing behavior

Coronavirus shutdowns and ensuing layoffs and furloughs have left consumers across the board with less discretionary spending.

Sixty-seven percent of consumers surveyed by McKinsey said they plan to spend less than usual on apparel in the near future.

Those consumers who are purchasing are doing so online, and the pandemic is escalating the importance of ecommerce, which has been challenging bricks-and-mortar stores even before the crisis.

“In the recovery period, retailers could see spikes in online shopping, even in categories that in the past were primarily store-based, such as makeup,” per the report.

During the pandemic, baby boomers and Gen Z consumers, who traditionally preferred to shop in stores, have moved online. This could last after stores reopen.

Apparel executives said they expect a 13 percent increase in online penetration, according to the McKinsey report.

Ecommerce channels are typically lower margin that offline sales, and this shift could hurt overall profitability for already struggling retailers.

“If online penetration increases by 10 percentage points and gross margin falls by one percentage point, driven by increased pricing pressure, retailers could expect store profitability to decline by up to five percentage points,” read the report.

“A hit to profitability of this magnitude could push a significant number of brick-and-mortar stores into loss-making territory.”

New McKinsey report reimagines retail's new normal. Image credit: McKinsey

New McKinsey report reimagines retail's new normal. Image credit: McKinsey

Surviving and thriving

For retailers to survive the in the post-coronavirus world, apparel and specialty stores must transform operations, according to McKinsey.

The first step would be to quickly integrate the online and offline shopping experience.

Seventy-six percent of apparel executives said they plan to improve omnichannel integration in stores.

As consumers slowly feel more comfortable going out again, they still might hesitate to spend hours inside of a retail store. Retailers can help ease this transition by offering easy in-store returns to online orders, as well as curbside pickups. These incentives will help drive traffic back in-store, already a challenge pre-COVID-19.

“Consumers are now accustomed to staying home for weeks at a time and buying a wide range of products online,” McKinsey said in the report. “In the future, they won’t visit stores unless retailers give them good reason to.

“Retailers must therefore gain a deep and up-to-date understanding of customer preferences, envision a new role for their stores in light of these preferences, and execute surgical changes to store formats and in-store customer experience.”

Retailers must rethink the future of shopping, according to a new McKinsey report. Image credit: McKinsey

Retailers must rethink the future of shopping, according to a new McKinsey report. Image credit: McKinsey

Recommended practices

Retailers will have to be creative to reimagine store operations in this new post-coronavirus world. This will include resetting cost structures, retraining the workforce and overall shift in perspective about what purpose the stores service.

Seventy-five percent of retail executives surveyed said they have either furloughed or laid off store employees since the shutdowns began.

When employees return, the composition may need to change and they will have to be trained on how to operate in the new era. It might mean doing more with less.

“Retailers may find that they need to deliver 20 to 30 percent improvement in store productivity to compensate for the channel shift away from physical stores,” read the report.

“To achieve this, they will need to relentlessly simplify store operations and rebalance the allocation of store costs to support the increasing volume of in-store omnichannel activities.”

From the big picture perspective, retailers may have to develop a new vision for its store network. This might include cutting staff, store-closures, negotiating rents and footprint rationalization for essential stores that are underperforming. They may also need to enhance distribution centers and ecommerce fulfillment.

“The traditional way of looking only at four-wall economics is outdated because it doesn’t account for the role that a store might play in generating ecommerce sales,” per McKinsey.

“To better understand a store’s true economic value, a retailer should modify the store P&L to include its ecommerce halo—for example, by ensuring that the store ‘gets credit’ for ecommerce sales in the local ZIP code.”

Share your thoughts. Click here