- About

- Subscribe Now

- New York,

April 30, 2020

Influential musician Billie Eilish in Chanel at the Oscars. Image credit: Billie Eilish

Influential musician Billie Eilish in Chanel at the Oscars. Image credit: Billie Eilish

Investments in influencer marketing programs have grown 10-30 percent in early 2020, and these numbers may continue to rise as stores are closed and brands look for new ways to maintain sales during the global lockdown.

Even as brands scale back on marketing budgets, they continue to invest in channels that drive sales. Ninety-four percent of professionals believe influencer activations drive sales, up 18 percent from last year, according to Launchmetrics’ sixth annual State of Influencer Marketing Report 2020.

“Relatability is key,” said Alison Bringé, London-based chief marketing officer of Launchmetrics.

“Consumers want to engage with people they have a connection with and those who will win out during and after COVID-19 are those who will be able to share a more 360-degree lifestyle with their audience, and allow their followers to feel a part of their community," she said. “This goes for both influencers and brands.”

Launchmetrics is the leading brand performance cloud used by fashion, luxury and beauty executives.

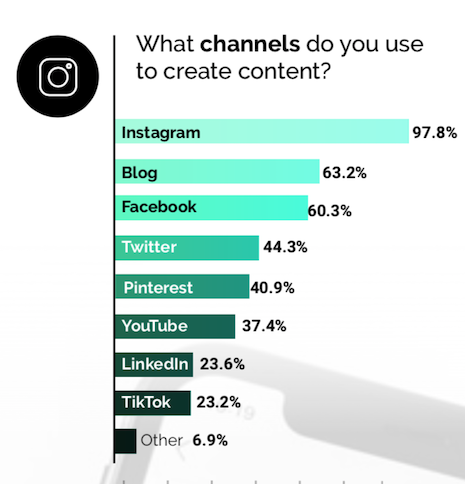

Instagram is the most important influencer channel, but TikTok is gaining momentum. Image courtesy of Launch Metrics

Instagram is the most important influencer channel, but TikTok is gaining momentum. Image courtesy of Launch Metrics

UGC

Fifty-six percent of the brands surveyed for the Launchmetrics report said they use user-generated content to turn their customers into influencers.

Similar to last year’s findings, micro-influencers with a niche following are the most effective for brands whose main objective is to get closer to their audiences.

Millennials are the No. 1 target group (67 percent) for brands. Generation Z has grown by 9 percent as a target for brands in their aspiration to reach the consumer of tomorrow, per the report.

“Digitally speaking, millennials and Gen Z are the most active, and it speaks volumes about how they like to discover products and services,” Ms. Bringé said.

“In contrast, Generation X has leaned more towards traditional media as their voice of authority, whereas the younger consumers believe that the best way to find brands or products that best fit them is through their peers and influencers,” she said.

Gucci's TikTok channel. Image credit: Gucci

Gucci's TikTok channel. Image credit: Gucci

Instagram and TikTok

Although Instagram is still the No. 1 platform for influencer marketing, TikTok is making a big play when it comes to capturing millennial and Gen Z consumers.

Forty-six percent of TikTok users are 16-24 years old and brands looking to connect with this target have a presence on the network.

Some 42 percent of brands interviewed for the report said they are using the platform to reach these audiences.

Of the brands investing in new channels, specifically TikTok, 55 percent say it is because they want to engage with a new consumer.

“The channel is designed for users to create fun, viral moments and take part in challenges that everyone can get involved in, making it increasingly popular, especially in today’s current climate,” Ms. Bringé said.

“Brands have started to notice this growth, with the likes of Tommy Hilfiger, Burberry and Calvin Klein paving the way,” she said.

“In the end, the most important part of any marketing strategy is to activate the right voice, through the right channel with the right message that is tailored to your target audience, whether it's TikTok, YouTube, Instagram or any other.”

COVID-19 could make influencer marketing more important. Image courtesy of Launch Metrics

COVID-19 could make influencer marketing more important. Image courtesy of Launch Metrics

COVID-19 impact

The report includes feedback from before the COVID-19 pandemic kicked in. The report indicates that, as of early 2020, influencer marketing has stabilized after continuous evolution.

Going forward, the marketing channel has a potentially larger opportunity as department stores struggle and luxury brands look for new ways to showcase their products and reach new audiences.

“We foresee that not only will customer connections strengthen, but brands will learn to diversify their strategies, approaches and channels while becoming stronger content creators to bridge the physical divide, as the world transitions into the new normal,” Ms. Bringé said.

“At the moment, brands are evolving from a product-focused communication line to reinforcing the intangible values of their brand, with a decline in sponsored content being a strong indicator of this shift,” she said.

As consumers look to influencers to entertain them and ease their anxiety during these difficult times, messaging must be tailored with the right tone. Calming connections, fashion tips for Zoom calls and makeup tutorials for Skype dates are the types of content to which consumers are responding.

As brands look to ecommerce and online sales to stay in business, digital will continue to play an even more important role in the future of luxury.

“COVID-19 has forced the industry to embrace digital with arms wide open in order to reach their global communities and mitigate the impacts,” Ms. Bringé said.

“With less opportunity for in-person events, brands will need to become their own content creators,” she said.

“With no option for live events, brands have to fuel their own content engine with the right voices to amplify their message and continue to build brand momentum through unique, digital strategies whilst increasing brand performance.”

Share your thoughts. Click here