- About

- Subscribe Now

- New York,

April 29, 2020

United Kingdom 2020 Ecommerce Report by RetailX and Internet Retailing. Image courtesy of RetailX

United Kingdom 2020 Ecommerce Report by RetailX and Internet Retailing. Image courtesy of RetailX

Consumers in the United Kingdom are some of the most savvy online shoppers in the world, and retailers that want to survive in the market should offer smooth ecommerce experiences with good delivery and return options.

As brands look to the post-COVID-19 future, an agile customer-centric, digital-friendly focus is the way forward, according to the United Kingdom 2020 Ecommerce Country report from RetailX and Internet Retailing.

“While the majority of consumer spending is still taking place in physical stores, the move to online shopping is happening to the detriment of high street retailing,” read the report.

“Uncertainty over Brexit and the economic climate have also impacted recent consumer spending. Many retailers that were slower to seize the opportunities of online, or were not able to invest to the required levels, have ceased trading.”

Impact of COVID-19 on online shopping in the U.K., according to United Kingdom 2020 Ecommerce Report by RetailX and Internet Retailing. Image courtesy of RetailX

Impact of COVID-19 on online shopping in the U.K., according to United Kingdom 2020 Ecommerce Report by RetailX and Internet Retailing. Image courtesy of RetailX

Mobile experience key

The U.K. is the largest ecommerce market in Europe, with 96 percent of the population accessing the Internet in 2019, higher than Europe’s 88 percent average.

Most of the 67 million people in the country are comfortable with accessing services online, with 87 percent of these consumers shopping online, per the report.

Online accounts for around a fifth of all retail sales in the U.K., ranging from 18.1 percent in August 2019 and peaking at 21.5 percent in November, according to data from the Office for National Statistics cited in the report.

Before the coronavirus issue, most consumers in the U.K. shopped online with 27.2 percent doing so 16-30 times a year and 24.1 percent shopping 6-15 times a year.

After the pandemic dissipates, 67.6 percent of consumers in the U.K. imagine going back to their previous online shopping habits, while 24 percent anticipate shopping the same way they have during the COVID-19 shutdown.

Online is expected to continue to grow although, due to the maturity of the U.K. market, growth will be at a slower rate than has been seen in previous years.

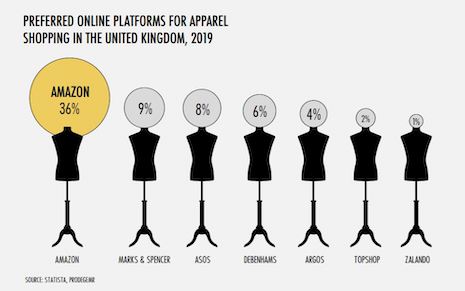

Shoppers are most likely to buy clothes and sports goods online (60 percent), followed by household goods (49 percent), holiday accommodation (44 percent), travel arrangements (43 percent) and events tickets (43 percent).

Amazon is the most popular site from which to order apparel, per the report.

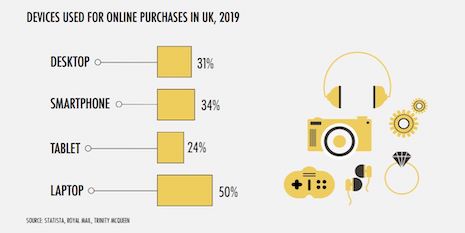

Laptops are the most common devices used to shop online in the U.K., according to United Kingdom 2020 Ecommerce Report by RetailX and Internet Retailing. Image courtesy of RetailX

Laptops are the most common devices used to shop online in the U.K., according to United Kingdom 2020 Ecommerce Report by RetailX and Internet Retailing. Image courtesy of RetailX

Half of online purchases are made on a laptop, followed by 34 percent made on smartphones and 31 percent on desktop computers.

Mobile commerce is increasing over time among U.K. consumers.

“Since purchases are as likely to be made from a mobile phone as from a desktop PC, consumers expect retailer sites to look good and provide a similar experience on all devices,” the report said. “This has led to retailers taking a mobile-first approach to design.”

The majority of U.K. online shoppers prefer Amazon to buy apparel, according to United Kingdom 2020 Ecommerce Report by RetailX and Internet Retailing. Image courtesy of RetailX

The majority of U.K. online shoppers prefer Amazon to buy apparel, according to United Kingdom 2020 Ecommerce Report by RetailX and Internet Retailing. Image courtesy of RetailX

Delivery demands

Because the U.K. market is so mature in terms of omnichannel retailing, consumers expect products to be delivered in a convenient manner.

“The era of waiting in all day for a delivery is long gone,” read the report.

Delivery by post or delivery by courier are the main fulfillment methods.

However, consumers also expect to be able to buy or reserve items online and then pick them up in store. Delivery lockers and convenient store pickup are also available, though not as common.

Average online order delivery takes 4.9 days, but next-day, same-day, specified-day or specific timed deliveries are also available.

Sixty-one percent of RetailX’s Top500 retailers offer next-day delivery, with a median standard delivery charge of £4.50.

Consumers expect a fast and easy return process. Thirty-eight percent of the Top500 retailers in the U.K. offer prepaid returns, up from 22 percent in 2018.

“Should details of the delivery method, cost and returns processes not be displayed before checkout, many U.K. shoppers will abandon an order and shop elsewhere,” the report said. “If an order doesn’t arrive when it’s expected, they are unlikely to buy from the site again.”

“Transparency and good communication throughout the pre- and post-sales period are vital parts of the customer experience,” per the report.

United Kingdom 2020 Ecommerce Report by RetailX and Internet Retailing. Image courtesy of RetailX

United Kingdom 2020 Ecommerce Report by RetailX and Internet Retailing. Image courtesy of RetailX

Retail growing pains

While the most consumer spending still takes place in physical stores, online shopping is hurting high street retailing.

Many retailers have been slow to adapt to digital opportunities, leading some to go out of business.

“This serves as a warning to the uncertainties of changing economic circumstances and consumers behavior, while also showing the potential to capture market share from established, yet vulnerable, retailers by those focusing on niche markets or new retail models,” the report said.

Retailers with savvy have been adapting to digital-friendly retail models such as enhancing online ordering while turning stores into more entertaining destinations.

“While online is a great facilitator to buy what you already know you want to buy, the real world is better at stimulating spontaneous sales,” said John Rapp, chief strategy and partner officer at Attraqt, London, in the report.

“There is a lot of experimentation going on to improve customer experience in-store through entertainment,” he said.

Share your thoughts. Click here