- About

- Subscribe Now

- New York,

April 10, 2020

The attention span of these consumers is growing shorter and the window of success for brands to successfully attract and retain their interest is shrinking. Image credit: Unsplash

The attention span of these consumers is growing shorter and the window of success for brands to successfully attract and retain their interest is shrinking. Image credit: Unsplash

By Lydianne Yap

As consumers grow increasingly discerning, how can brands adapt and evolve their content to stay relevant? The latest report from DLG (Digital Luxury Group) and JINGdigital delves into the topic and picks up key insights about the content performance of luxury brands on WeChat.

According to a 2019 study by McKinsey & Company, Chinese consumers spend as much as 44 percent of their time on social media apps – 33 percent of which is attributed to those of a more social nature including WeChat and Weibo.

As the amount of time users spend on these platforms continues to grow, so does the potential of these channels to inspire purchase behavior.

Half of the participants in this survey noted that they had become aware of a product on a social platform, and 25 percent said they made purchases through such channels. This figure represents a marked increase of 3.6 times compared to two years ago.

Clearly, there is a huge opportunity for brands to reach and convert audiences with content on social media channels.

However, the attention span of these consumers is growing shorter and the window of success for brands to successfully attract and retain their interest is shrinking. This is compounded by the fact that brands are overloading audiences with content.

According to DLG (Digital Luxury Group) and JINGdigital’s latest WeChat Luxury Index 2020 report, more than 67.52 percent of luxury brands on WeChat are pushing content to their followers four times a week – the maximum allowed for a Service Account.

This is a stark difference from to 2018, where only 17 percent of luxury brands did so. The sheer volume of content that consumers are bombarded with these days makes it that much harder for brands to stand out and carve an impression.

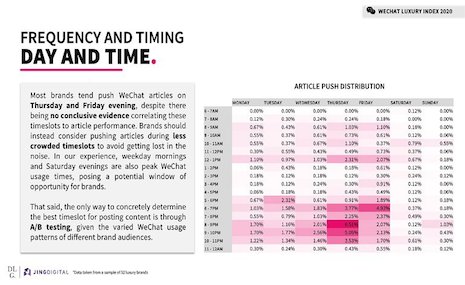

Frequency and timing: Day and time. Source: DLG, JINGdigital

Frequency and timing: Day and time. Source: DLG, JINGdigital

Understanding Reading Habits

Based on data collected from the months of January to December 2019, the study reveals that luxury brands tend to favor Thursday and Friday evenings for content pushes to their audience – despite there being no conclusive evidence that these time frames have an impact on content performance.

“This is interesting because we saw the same trend emerge in our previous report from 2018, indicating that there really hasn’t been any change when it comes to the content posting habits of brands,” said Pablo Mauron, partner and managing director for China at DLG.

Mr. Mauron said that there is a huge missed opportunity here for brands, as cloistering their content pushes around the same time creates unnecessary jostling for consumer attention.

Instead, he recommends looking into less saturated timeslots for pushing content on WeChat, such as weekday mornings or Saturday evenings.

However, relying on the process of elimination can only get you so far, cautions Mr. Mauron.

“The only way to determine the best time to push content to your audience is through A/B testing,” he said. “Through that, brands will be able to identify when their readers are most receptive to content, and decide on the most appropriate timeslot for their WeChat pushes.”

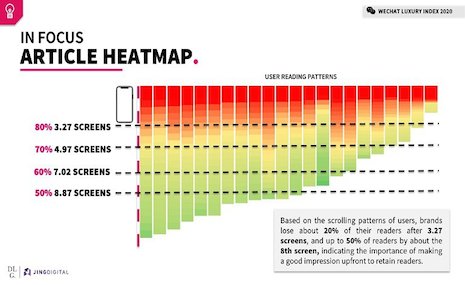

In focus: Article heatmap. Source: DLG, JINGdigital

In focus: Article heatmap. Source: DLG, JINGdigital

Capturing interest

Another interesting observation made in the report was that brands lose half of their readers after 8.87 screen lengths, indicating that WeChat articles should not be designed beyond this length to sustain the attention of users.

Based on the findings, it also appears that the attention spans of readers tend to fizzle out at approximately the third screen, suggesting that brands should focus their efforts on improving the content experience upfront so as to compel users to continue along the article.

The study also details that strong visuals and rich media – including videos and animations – can be considered for this purpose as articles with such elements tend to exhibit a better conversion rate.

“Brands tend to overestimate the potential of a piece of content in capturing the attention and interest of its WeChat followers,” Mr. Mauron said.

“As readers get more sophisticated, it is no longer just about creating content for the sake of creating content and meeting quantitative publication objectives,” he said.

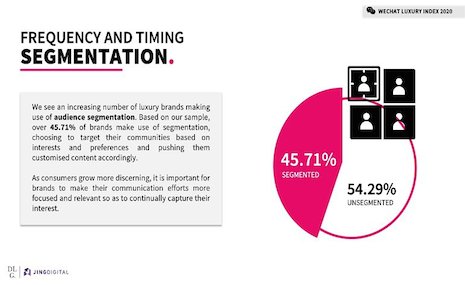

Frequency and timing: Segmentation. Source: DLG, JINGdigital

Frequency and timing: Segmentation. Source: DLG, JINGdigital

Content personalization

The report also touches on the area of audience segmentation, noting that a growing number of luxury brands are choosing leverage this function.

Last year, 45.71 percent of brands chose to segment their communities and personalize the content sent to them.

“We are seeing an acceleration in the sophistication of how brands are choosing to engage with their customers online,” said Kun Hsu, partner at JINGdigital.

“Besides social proof and virality, brands are also seeing value in creating personalized content to increase relevancy and customer loyalty,” he said.

By angling content in a way that appeals to them, brands are able to better capture their attention, he added.

This, however, is not to say that brands have to create entirely separate pieces of content for different audience segments, Mr. Mauron said.

Instead, the key is in optimizing existing content available so as not to drive up production costs.

“Simply by changing the featured image in the content teaser and crafting different titles to appeal to the differing interests and sensibilities of your different audience segments will already make a significant impact,” Mr. Mauron said.

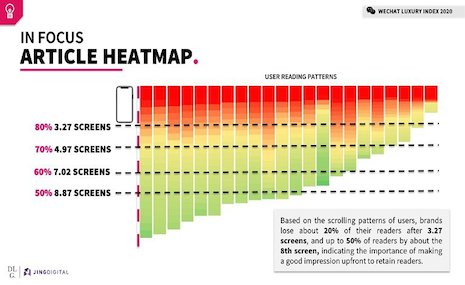

In focus: Article heatmap. Source: DLG, JINGdigital

In focus: Article heatmap. Source: DLG, JINGdigital

The report further elaborates on the best practices for brands looking to adopt this approach.

Beyond segmenting audiences, brands should also consider optimizing content and carrying out A/B testing.

“At the end of the day, WeChat is more than a social media and a specific approach to identifying and delivering the right talking points is required to maximize the returns on content investment,” Mr. Mauron said. “It is about quality, not quantity.”

The WeChat Luxury Index 2020 also touches on data and insights related to engagement and follower acquisition, all of which can be found in the complete and updated report available for download below.

Please click here to download a PDF copy of the report, WeChat Luxury Index 2020: Part III: Content

Previously released in the third and fourth quarters of last year, the WeChat Luxury Index Part 1: Engagement and WeChat Luxury Index Part 2: Acquisition can also be downloaded separately, each featuring quarterly data.

Lydianne Yap is China editor of Luxury Society

Lydianne Yap is China editor of Luxury Society

Published with permission from Luxury Society, a division of DLG (Digital Luxury Group). Adapted for clarity and style.

Share your thoughts. Click here