- About

- Subscribe Now

- New York,

April 9, 2020

YouGov Affluent Perspective: 2020 Global Study. Image courtesy of YouGov

YouGov Affluent Perspective: 2020 Global Study. Image courtesy of YouGov

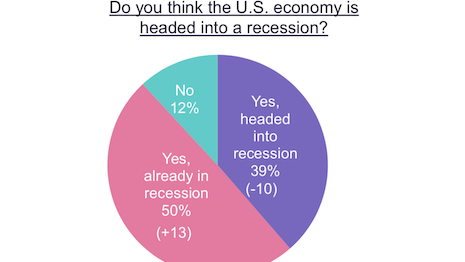

Half of affluent consumers think a recession in the United States has already begun, yet 88 percent feel confident they can endure the downturn.

Seventy-eight percent of consumers are concerned about the spread of the coronavirus, and another 18 percent are worried about losing their jobs, according to a newly released second wave study from YouGov. Ninety-three percent of all U.S. affluent consumers are sheltering in place or are in self-quarantine.

"The reality is with people being home, media use and online shopping are increasing," said Chandler Mount, vice president of business development at YouGov Affluent Perspective, Cheshire, CT. "The shift to time on devices is contributing to demand for online luxury purchases, particularly for those in 'self-quarantine,' where 42 percent have plans to buy personal luxury goods, significantly higher than the 29 percent found in total.

"The more intense of a lockdown you are in, the more eager you are to get out and pamper yourself," he said. "Online buying is reaching more consumers than ever before—all at once. This may very well lead to a shift to ultra-convenience as people become accustomed to curbside pickup and contactless delivery.

Per the YouGov study, 43 percent of U.S. affluent and 50 percent of U.S. luxury intenders agree with the statement, "I plan on shopping more online even after the pandemic ends."

YouGov is a leading market researcher known for its affluence research.

YouGov study asked affluent consumers if they think the US is headed into a recession. Image courtesy of YouGov

YouGov study asked affluent consumers if they think the US is headed into a recession. Image courtesy of YouGov

About half of affluent Americans (46 percent) think COVID-19 will subside in the U.S. in the second quarter, likely in June. An equal proportion see it running through the summer, consistent with YouGov's March 19-22 findings.

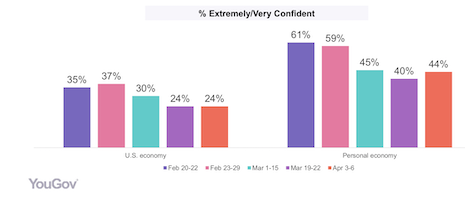

Confidence in the U.S. economy has leveled off at 24 percent over the past two waves of study conducted by YouGov. Personal economic confidence grew four points over the previous wave to 44 percent.

"The level of concern over the economy appears to have reached a new low, with 24 percent responding extremely or very confident in the U.S. economy, and 44 percent confident in their own personal economy, a key indicator for discretionary spending," Mr. Mount said.

Still, a downturn looms, with 88 percent of consumers thinking the U.S. is already in recession (50 percent) or is headed toward one (38 percent).

However, consumers have adopted changes since the Great Recession.

YouGov's April 3-6 study found that 88 percent of U.S. affluent consumers said, “I am in good shape to endure a recession.”

"The affluent have diligently saved and de-leveraged, growing their net worth and cash reserves," Mr. Mount said. "The Federal Reserve reports that at the end of 2007, before the low, net worth of all U.S. households was $71 trillion. By the end of 2019, that figure reached $118 trillion, with more than $13.6 trillion in deposits—66 percent higher than 2007.

"Whether the affluent will spend on luxury is another matter," he said.

"Forty-eight percent of consumers agree, 'I feel guilty purchasing luxury goods in the current economic environment' and for those who see the coronavirus lasting beyond June, the concern increases to 55 percent."

YouGov study asked: Has the economic confidence slide reached the bottom? Image courtesy of YouGov

YouGov study asked: Has the economic confidence slide reached the bottom? Image courtesy of YouGov

Bringing back confidence

Seventy-three percent of affluent Americans are looking for data to demonstrate a decline in new cases or further spreading before normal life returns, a higher percentage than the previous study.

The earlier study found that 35 percent of people thought a stabilized stock market would be an indicator, but this dropped 7 points.

Seventy percent think the availability of an effective treatment and 61 percent said a vaccine could bring things back to normal.

Government recommendation, the re-opening of schools and businesses, and reopening of workplaces all declined as indicators for resuming normal life activities from the previous study.

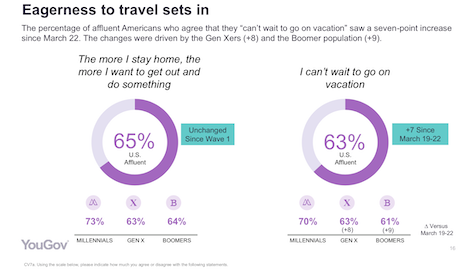

YouGov study found that 65 percent of U.S. affluents have an eagerness to travel. Image courtesy of YouGov

YouGov study found that 65 percent of U.S. affluents have an eagerness to travel. Image courtesy of YouGov

Pent up desire for travel

The number of affluent Americans who said they “can’t wait to go on vacation” saw a seven-point increase since March 22.

The changes were driven by the Gen-Xers (+8) and the boomer population (+9).

Sixty-three percent cannot wait to go on vacation.

Sixty-five percent of affluent consumers in the U.S. said that the more they stay home, the more they want to get out and do something.

Millennials skewed higher with 73 percent of this demographic looking forward to getting out and 70 percent looking forward to a vacation.

The percentage of those canceling vacations has risen to 51 percent, up six points since the previous wave report in March.

Additionally, people who have cancelled a trip and plan to reschedule was up seven points.

The report also revealed that 18 percent of affluent consumers have a trip booked that they are considering canceling, and 30 percent delayed booking a trip in response to the pandemic.

"It’s clear that consumers want to return to travel," Mr. Mount said.

"Those looking to reschedule a canceled trip told us March 19-22 they are eyeing 3-6 months (23 percent) and 6-12 months (40 percent) as the likely timeframe they will take that trip, making Q4 more likely than Q3 for increased demand," he said.

"Q2 does not seem likely for leisure travel, just 11 percent said within the next 3 months."

Share your thoughts. Click here