- About

- Subscribe Now

- New York,

April 1, 2020

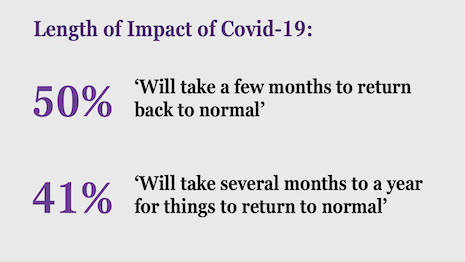

Agility Research & Strategy interviewed luxury executives about when COVID-19 shutdowns would end. Image credit: Agility Research

Agility Research & Strategy interviewed luxury executives about when COVID-19 shutdowns would end. Image credit: Agility Research

Half of luxury leaders expect the COVID-19 crisis to go on for a few months before things go back to normal, and another 41 percent think that it will take several months to a year, calling for a tepid outlook in the business.

The data comes from a new report called, “Through the Lens of Luxury Leaders,” from Singapore-based Agility Research & Strategy. The research includes insights from interviews with luxury leaders around the globe.

“As the restrictions on consumer behaviour stay in place for an extended period, it becomes increasingly likely that consumers will emerge on the other side of this transformed by the experience,” said Amrita Banta, managing director at Agility Research, Singapore. “We are already seeing shifts in attitudes of affluent consumers in markets in Asia.”

“Brands should continue to monitor and track the changes as well as stay connected to their customers and build a relationship beyond a transactional one,” Ms. Banta said.

Agility is one of the leading market researchers covering the luxury space in Asia.

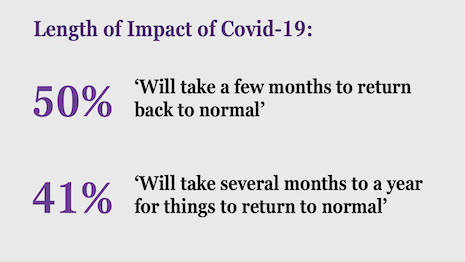

Agility Research found sustainability to be important theme for affluent customers. Image credit: Agility Research

Agility Research found sustainability to be important theme for affluent customers. Image credit: Agility Research

Sustainability even more important

While the current outlook is uncertain, luxury leaders still believe that consumer demand for more sustainable products and processes is still important to affluent customers.

The report revealed that 96 percent of leadership in the luxury sector said that sustainability is an important theme in their industry, and eco-friendliness is seen as the most important theme for their customers.

Minimizing environmental impact was a priority among consumers for 86 percent of those interviewed, and 57 percent said recycled material was a key concern.

"We are seeing consumers, especially millennials and Gen Z, increasingly demanding sustainability from the brands they use," Ms. Banta said. "This aligns with their own views on being highly concerned about topics like global warming and air pollution. Specific causes that they want brands to champion of course vary by market, so it is key that brands keep listening to their consumers."

Consumers are top of mind

As luxury brands try to navigate a constantly changing situation, they have been focusing on loyal customers.

Luxury brands have been staying in regular contact with these fans as a way to offer support and escapism during the crisis. This ongoing messaging can help brands with online sales today, as well as build loyalty for when consumers return to earlier consumption patterns.

Digital communication is also a key tactic this year, as brands are taking to email, Instagram and Facebook to stay in touch with their fans during these homebound times.

“Brands need to understand that consumers can feel insecure and many may be suffering financially from the outbreak," Ms. Banta said. "It is key to be both supportive and give key customers time to get back on track, such as by extending loyalty program status expiration dates, or offering free shipping and returns."

"They need to go beyond the transactional relationship with the consumer to a more humane one," she said.

Agility Research found that China will be a big opportunity for luxury marketers in 2020. Image credit: Agility Research

Agility Research found that China will be a big opportunity for luxury marketers in 2020. Image credit: Agility Research

China offers hope

China will remain a key market in the post-coronavirus economy. This is significant to luxury marketers who are looking for ways to maintain business in the current climate.

The latest report also found that India and the United States have gained importance for the luxury market, as compared to last year.

Affluent consumers in China have slowly begun to return to stores. Some of these consumers, who were locked down for a couple of months, have come back for “revenge shopping,” to make up for lost time, according to another recent Agility report.

The report found that 95 percent of malls had re-opened by March 13. High-end Hangzhou Tower Mall opened for five hours on Feb. 22 and had more sales than it experienced in a full day on the same day last year.

Domestic flights are also recovering in Asia, particularly China.

For instance, the Shenzhen airport saw flights resume to 70 percent of flight capacity by mid-February after 85 percent of all domestic flights were canceled (see story).

As economic life returns, luxury marketers are looking for ways to connect with these audiences.

“We are seeing a lot of positive news on luxury spending picking up in China, outside of e-commerce," Ms. Banta said. "As travel shopping will remain muted for some time to come it is key that brands interact and are available to Chinese consumers in venues where they can capture a share of the ‘revenge spending’ post the virus in China."

Share your thoughts. Click here