- About

- Subscribe Now

- New York,

March 23, 2020

Willis Towers Watson's 2019/2020 Global Benefits Attitudes Survey. Image courtesy of Willis Towers Watson

Willis Towers Watson's 2019/2020 Global Benefits Attitudes Survey. Image courtesy of Willis Towers Watson

More than half of employees said they would work for less if they had better healthcare and retirement benefits, and luxury brands that can offer such forms of security may be able to save money while attracting and retaining top talent during the global pandemic.

Fifty-seven percent of U.S. employees said they would sacrifice extra pay in exchange for more generous retirement and health care benefits, according to the Global Benefits Attitudes Survey by Willis Towers Watson.

“Luxury employers can better maximize the value of their benefits by providing choice in benefit programs to better meet diverse employee needs,” said Jennifer DeMeo, senior director of retirement at Willis Towers Watson.

“For choice to be effective, it is important to understand the preferences and needs of your workforce, offer appropriate choice – not too much, not too little – and provide decision support tools to engage employees and help them make good decisions based on their own needs,” she said.

Willis Towers Watson's 2019/2020 Global Benefits Attitudes Survey. Image courtesy of Willis Towers Watson

Willis Towers Watson's 2019/2020 Global Benefits Attitudes Survey. Image courtesy of Willis Towers Watson

People seek security

As the economy continues to spiral out of control due to coronavirus travel bans, shelter-in-place orders and overall fear of getting out, people are looking to their places of employment to provide security over big paydays.

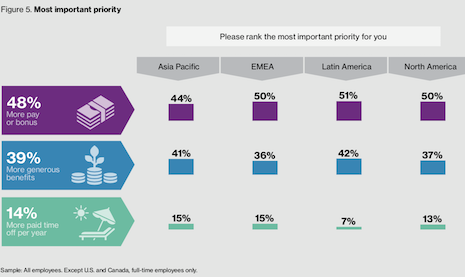

The survey found that 37 percent of employees would rather receive more substantial benefits and 13 percent would prefer more time off than additional pay or bonuses.

Some 57 percent of respondents said that their benefit package is more important to them than ever before, driven largely by their desire for greater security.

Sixty-seven percent of people interviewed said that they are willing to pay a higher amount each month for more comprehensive retirement benefits. This figure is up from 55 percent in 2011.

“Employees are interested in a wide range of options including core retirement and healthcare benefits, as well as broader benefit options,” Ms. DeMeo said.

Some examples of broader benefit offerings include budgeting, student loan management and other tools to support employees’ financial wellbeing, access to onsite medical facilities or gym discounts to help support overall health and wellbeing, flexible work arrangements, broader family leave and time off policies, and voluntary benefits and perquisites.

Most important priority slide by region in Willis Tower Watson's 2019/2020 Global Benefits Attitudes Survey. Image courtesy of Willis Towers Watson

Most important priority slide by region in Willis Tower Watson's 2019/2020 Global Benefits Attitudes Survey. Image courtesy of Willis Towers Watson

Health care is crucial

Some 42 percent of employees said they would sacrifice additional pay each month for a more expansive health benefit plan, up from 27 percent in 2013.

The number is likely to continue to increase as the global workforce is faced with the biggest pandemic in more than a hundred years.

The report also found that only 40 percent of employees feel the resources their employer provides to support their health and wellbeing meet their needs. And 32 percent said employer resources to help them manage their finances met their needs.

While 70 percent of all employees surveyed say their health care benefits meet their needs, among those with poor health, only 56 percent said their plan met their needs.

Some 64 percent of those employees surveyed said they want a moderate number of benefit choices, suggesting that people want choices but too many can feel overwhelming. Only 20 percent of people said they wanted a large number of options from which to choose.

“We see employers focusing on offering core healthcare, retirement and time off benefits, in conjunction with increased choice and flexibility to better meet the needs of a diverse workforce,” Ms. DeMeo said.

“A one-size-fits-all approach will fail to cater to the wide range of employee needs and preferences,” she said.

“Offering core benefits supported by flexibility and choice among voluntary benefit options can help to meet differing employee needs and preferences.”

Age factor

Age has been a factor in how employees want to be compensated.

Younger employees prefer higher salaries than big benefits packages.

Half of Generation Z employees ranked more pay as their highest priority, compared with 35 percent that wanted more generous benefits. Only 15 percent of this group said they wanted additional time off.

Interestingly, 46 percent of employees said they would be interested in purchasing a home and car insurance if offered by their employer.

Another 36 percent are interested in purchasing long-term care insurance at work.

Baby boomers are most interested in long-term care insurance compared with millennials – 46 percent versus 28 percent – while millennials favor auto and home insurance (52 percent) more than baby boomers do (35 percent).

“Across all age groups, employees’ desire for security has continued to steadily increase for the past decade,” Ms. DeMeo said.

“Employer provided healthcare and retirement programs are key components of employees’ security and overall well being,” she said. “Many employees say they would be willing to exchange less cash pay for more generous retirement, healthcare or time-off benefits.”

Share your thoughts. Click here