Ecommerce is accelerating in beauty report. Image courtesy of Euromonitor International

By Dianna Dilworth

Consumers are increasingly looking online for luxury beauty products in a category that was once challenged by digital sales because of difficulty testing new products virtually.

Sixty-nine percent of consumers said that digital engagement influenced them to make a purchase in the category, according to a new report from Euromonitor International.

The spike in direct-to-consumer (D2C) skin care brands is pushing sales in the online beauty space.

These newer startup companies are driving a culture of online influencers and beauty advisors who share recommendations, which is a trend that more traditional luxury cosmetics brands are following.

Additionally, the spike in augmented reality and 3D cameras that can enable consumers to virtually try on new colors is helping increase sales.

Digital searches spike

Skin care has the most ecommerce sales globally in the beauty sector, capturing 15 percent of sales in 2018, followed by color cosmetics which garnered 13 percent market share and baby products that accounted for 10 percent.

More consumers are relying on digital channels to discover new beauty products.

The report revealed that only 36.7 percent of consumers looked for new cosmetics in stores, down a bit from 38.1 percent in 2016.

In China the difference is even more pronounced where only 30.2 percent of consumers looked in stores for these items, down from 37.3 percent in 2016.

At the same time, online searches for beauty products are on the rise globally.

Some 32.8 percent of consumers searched online for these items, up from 21.6 percent in 2016.

In the United States, 24.4 percent searched digitally, up from 17.4 percent in 2016.

In China, more than half (50.7 percent) took to digital channels to find new cosmetics in 2019, up from 32.6 percent just three years earlier.

“Mobile apps, voice commerce, personalised promotions, in-store scanning technologies and marketing activities that generate brand awareness (e.g. influencers, blogs, vlogs, videos, contests, home assistant skills or tips, etc.) will become even more influential to future purchase decisions,” the report said.

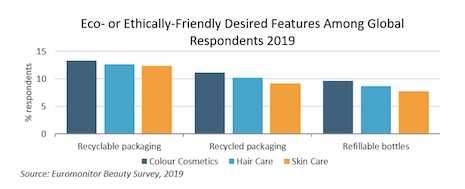

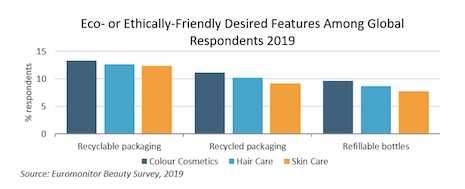

Eco- or ethically-friendly packaging desired. Image courtesy of Euromonitor International

Eco- or ethically-friendly packaging desired. Image courtesy of Euromonitor International

Opportunities and obstacles

While private-label brands are often correlated with the performance of the retailers in stores, this association is not necessarily the case.

Retailers and private labels have the potential to create new products and sell them online, particularly in markets with high ecommerce beauty sales, such as in China.

Private label’s biggest opportunity? Skin care.

“Opportunities in private label skin care include developing basic skin care products that consumers can add to their beauty routine, such as a first- or last-step product that can be priced more competitively, or adopting a clean beauty positioning,” the report said.

“Amazon’s Belei skin care line brings private-label wellness at mass price points, while Walmart’s Uniquely J on jet.com focuses on premium baby and child-specific products,” the report pointed out.

One of the challenges with ecommerce is the negative environmental association with single-use protective packaging used in products ordered online.

While not exclusive to the beauty industry, materials such as corrugated boxes and bubble wrap can be a turnoff to consumers looking to be more ecological.

Brands should consider this when promoting products online and opt for recycled packaging or packaging that does not require extra layers when shipped.

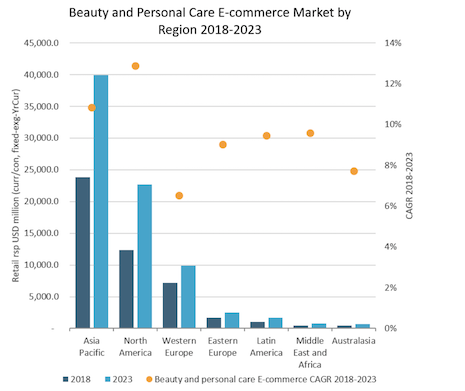

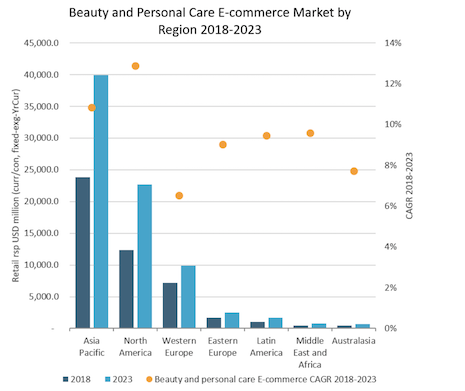

Beauty and personal care ecommerce outlook by region. Image courtesy of Euromonitor International

Beauty and personal care ecommerce outlook by region. Image courtesy of Euromonitor International

Growth markets

The beauty category is only beginning to penetrate the ecommerce market.

Globally, the category has a huge opportunity to grow over the next three years.

Despite the advances in Asia Pacific and North America, beauty and personal care ecommerce still has room to grow in these regions.

Hair care ecommerce sales passed online fragrances in North America in 2017.

Hair care is now the third largest ecommerce beauty and personal care category, generating $1.3 billion in 2018. This increase has been driven by more high-end professional beauty brands being available online.

India and Indonesia have big opportunities for growth, too.

Beauty and personal care ecommerce in India is projected to grow 27 percent from 2018 to 2023, reaching $1.3 billion and making it the 15

th largest beauty and personal care ecommerce market globally.

This growth will likely come from players such as Flipkart, Amazon and Nykaa building out their online capabilities.

“As current trends such as Ayurvedic beauty continue to transform India’s skin care market, there are opportunities to overlap ecommerce and trend-driven skin care growth,” the Euromonitor report said.

Ecommerce is accelerating in beauty report. Image courtesy of Euromonitor International

Ecommerce is accelerating in beauty report. Image courtesy of Euromonitor International

Eco- or ethically-friendly packaging desired. Image courtesy of Euromonitor International

Eco- or ethically-friendly packaging desired. Image courtesy of Euromonitor International Beauty and personal care ecommerce outlook by region. Image courtesy of Euromonitor International

Beauty and personal care ecommerce outlook by region. Image courtesy of Euromonitor International