- About

- Subscribe Now

- New York,

March 13, 2020

Shopper return to Chanel Shanghai on March 8. Image courtesy of Agility Research & Strategy

Shopper return to Chanel Shanghai on March 8. Image courtesy of Agility Research & Strategy

While the outcome of coronavirus has shaken Asian markets, millionaires from that region are returning to stores and the hospitality sector with an appetite for luxury and a new form of so-called “revenge spending.”

As they come back, millionaires are increasingly prioritizing health and wellness and financial success, according to a new report from Singapore-based market researcher Agility Research & Strategy.

"Overall, we do see wealthy millionaires as being more secure and resilient in the face of major events like this, even compared with affluent people who are not at the millionaire level," said Amrita Banta, managing director at Agility research & Strategy, Singapore.

"We see a similar situation with millionaires in Hong Kong who showed close levels of confidence at the end of 2019 as they did at end of 2018, despite the major disruptions from the demonstrations there last year," she said.

“As the number of new cases in China slows and some restrictions ease, we see initial signs of offline activity resuming and an appetite to spend,” read the report.

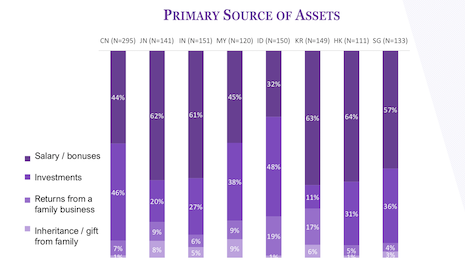

Primary source of assets among Asian millionaires. Image courtesy of Agility Research & Strategy

Primary source of assets among Asian millionaires. Image courtesy of Agility Research & Strategy

Pent-up demand

High-end Hangzhou Tower Mall opened for five hours on Feb. 22 and had more sales than it experienced in a full day on the same day last year.

Ninety-five percent of shopping malls in Shanghai have re-opened and shoppers have been returning after weeks of lockdown.

Domestic flights are also recovering in Asia, particularly China.

For instance, the Shenzhen airport saw flights resume to 70 percent of flight capacity by mid-February after 85 percent of all domestic flights were canceled.

“Brands that stay strong through a crisis will be winners,” the report said. “Brands should not go dark, but use this time to build awareness via digital as clients have more free time and are spending it online.

“Millionaires are a resilient group and have pent-up demand for luxury goods and experiences. Appetites are likely to return once circumstances change.”

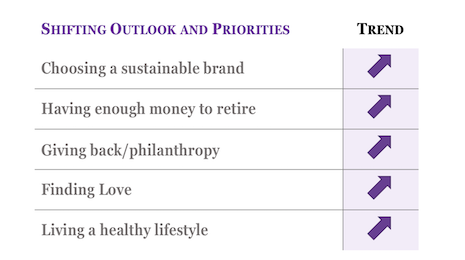

Shifting priorities among millionaires in Asia. Image courtesy of Agility Research & Strategy

Shifting priorities among millionaires in Asia. Image courtesy of Agility Research & Strategy

Shifting priorities

Agility Research & Strategy’s latest TrendLens 2020 report focuses on affluent and luxury consumers.

The data comes from interviews with 1,250 millionaires across eight Asian markets between December and February.

Among affluent consumers, millionaires have shown the most resilience overall in spite of major recent events. This group continues to show optimism about their own incomes, investments and spending, according to the report.

However, the new situation is leading to a shift in priorities and mindset.

Health is seen as a luxury today in China. Chinese millionaires are prioritizing health and wellness, along with their children's education and having enough money to retire.

"The coronavirus period has given Chinese consumers a real period to reflect and think about the bigger issues," Ms. Banta said. "I think they have been moved by many of the sacrifices that have been made and in a way participating in things like self-quarantine has given them a feeling of helping a greater cause."

"So that has them thinking a lot more about things like charitable giving, sustainability, social responsibility, and of course their own health and wellness," she said.

As these affluent consumers enter the marketplace, they are looking especially for brands that are socially responsible and deliver sustainable products and services.

Social responsibility in which brands conduct their behavior in ethically responsible ways is expected by millionaire consumers in Asia.

Indonesia topped the list at 84 percent, China followed at 81 percent and India at 78 percent of millionaire consumers demanding socially responsible practices from the brands they patronize.

Sustainability is also a key factor among wealthy consumers in Asia.

Ninety-two percent of Asians (Chinese), 79 percent of Indians and 74 percent of Malaysians in this income bracket said they would pay more for eco-friendly and sustainable brands.

Asian pride

Asian millionaires are increasingly looking to Asian brands, not just Western designers, for luxury, the report found.

In China, 57 percent of luxury purchases were among Asian designers and brands, and 62 percent were from Western designers and brands.

In India, 55 percent came from Asian designers and brands, and 57 percent were purchases of Western designers.

Still, in Japan and Hong Kong, the appetite for Western brands remained.

In Japan, only 13 percent of millionaires reported purchasing Asian designers versus 33 percent who bought from Western designers.

In Hong Kong, 62 percent of millionaires purchased Western brands and only 43 percent bought Asian designers.

Millionaires in most markets are interested in seeing more collaborations between brands and artists going forward.

In India, 59 percent of millionaires and in Indonesia 57 percent of millionaires said they have purchased items that featured a collaboration between a brand and an artist.

Another 66 percent of those surveyed in India and 75 percent of those surveyed in China said they would like to see more collaborations.

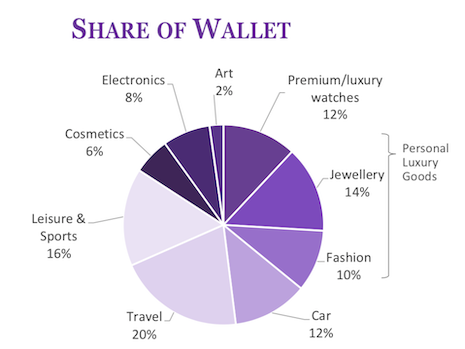

How millionaires in China spend their income. Image courtesy of Agility Research and Strategy

How millionaires in China spend their income. Image courtesy of Agility Research and Strategy

Indo-China powers ahead

China continues to have the most millionaires, but Indonesia and India are seeing a rising number.

There are 4.447 million millionaires in China. These consumers have been spending their wealth mainly on personal luxury goods and cars.

WeChat, ecommerce platforms such as Tmall Luxury Pavilion and RED are Chinese millionnaires' key digital touch points with luxury brands.

Indonesia is home to 106,000 millionaires. They focus their spend on personal goods and cars. Their digital touch points with luxury brands are Instagram, YouTube, Facebook, brand Web sites and Twitter.

India counts 759,000 millionaires and they spend on cars, increasingly on travel, as well as on gyms, nightclubs and live sport events. Their digital touch points for luxury are YouTube, Instagram, Brand Web sites, Facebook and Twitter.

Chinese and Indonesian millionaires are most likely to have built their wealth through investments, according to the report.

“Markets like Indonesia and India are huge opportunities and cannot be ignored,” the report read.

Share your thoughts. Click here