- About

- Subscribe Now

- New York,

December 10, 2019

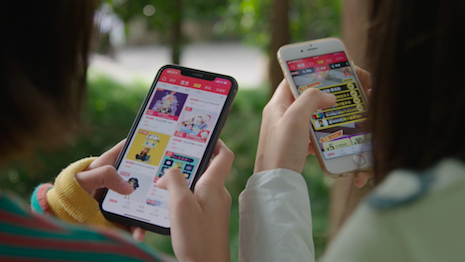

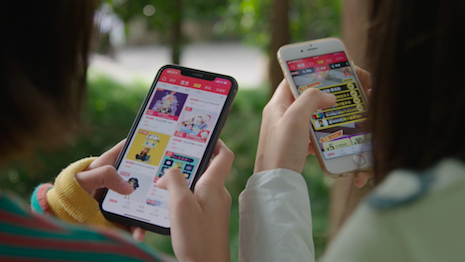

Consumers spent tens of billions in the 24 hours of Singles' Day. Image credit: Alibaba

Consumers spent tens of billions in the 24 hours of Singles' Day. Image credit: Alibaba

Growth in China’s first-tier cities is slowing as the markets mature, with smaller cities fueling more growth during Singles’ Day and beyond, according to a new report from McKinsey.

Singles’ Day, celebrated on Nov. 11, generated sales of $58 billion, up 31 percent from 2018. With sales surpassing those of Black Friday weekend, luxury brands can look towards Singles’ Day for inspiration at cutting through the noise to reach Chinese shoppers.

"Luxury brands have been expanding into lower tier cities, with most luxury brands already opening stores in select Tier 2 cities," said Daniel Zipser, senior partner at McKinsey and coauthor of the report. "However, the luxury store footprint today primarily concentrates in the top 15 cities in China, which covers only about 50 percent of the affluent households.

"Online engagement and travel retail remain critical tools to capture the full potential of lower tier city consumers," he said. "Most of these consumers are engaging with luxury brand through exposure in higher tier cities or foreign travel, but they also indicate much higher willingness to explore online channel.

"[We] believe they will remain a key growth driver as the luxury customer base expands in China."

Lower tier cities

One of the key trends during Singles’ Day was the significance of smaller cities such as Jiaozuo, Baoding and Quanzhou.

While market penetration for Alibaba in China’s biggest metropolitan areas stands at about 85 percent, only about 40 percent of those in tier 3 and 4 cities shop online with Alibaba’s brands including Tmall.

Additionally, about 8 in 10 of JD.com’s purchases during Singles’ Day came from smaller cities, pointing to the importance of these markets for ecommerce.

One of the ways through which ecommerce giants are reaching consumers in tier 3 and 4 cities is group buying. Following the success of Pinduoduo, which allows shoppers to join with friends to get deals on merchandise, Alibaba and JD.com have debuted rival platforms Juhuasuan and Jingxi.

Showing the potential for group buying, 40 percent of JD’s new users during Singles’ Day came from its Jingxi platform. Meanwhile, Pinduoduo’s share of sales during Singles’ Day rose from 3 to 6 percent.

While Singles’ Day is a prime time for promotions, with most brands offering between a 20 and 40 percent discount, some brands moved significant merchandise without dropping prices. For instance, Nike released a limited-edition Air Jordan 5 Retro Sngl Dy sneaker.

Similarly, some companies put the attention on freebies. For instance, L’Oreal focused on free gifts with purchase for its Revitalift eye cream.

Crowds at retailer Intime during Singles' Day. Image credit: Alibaba

"Singles’ Day is no longer just a discounting season, but also a festival that gives consumers a reason to shop, and a prime time for brands to capture the traffic," Mr. Zipser said.

"As luxury brands are more for emotional need and have to maintain the prestigious image, they typically do not do heavy discount during Singles’ Day," he said. "We recently see luxury skin care brands doing promotions with free samples and gifts, but seldomly direct discounting."

Nike was among the U.S.-based labels that saw positive sales results, despite ongoing trade tensions between the Trump administration and China. While there were concerns going into Singles’ Day that the trade war might make Chinese shoppers turn away from American brands, the fears did not come to fruition.

Compared to 2018, when 40 U.S. brands surpassed 100 million yuan, or $14 million, in 24 hours, 48 American labels reached this benchmark in 2019.

Live broadcast

One way that brands can engage Chinese shoppers is through live streaming.

About half of brands selling on Tmall used video to drive attention leading up to Nov. 11. Additionally, 7 percent of Alibaba’s total $38 billion in sales from Singles’ Day happened during live streams.

For the beauty category, live streaming is particularly lucrative, driving 16 percent of the sector’s Singles’ Day sales on Alibaba.

Estée Lauder was the top pre-sale label for the shopping holiday partly thanks to its live streaming strategy. Almost a month before the shopping holiday, the brand invited influencers and personalities to appear for sessions.

During the course of the campaign, Estée Lauder attracted 500 million viewers and drove $28 million in sales.

Kim Kardashian West also appeared in a live stream with key opinion leader Viya Huang, which gathered 13 million viewers for her KKW Beauty promotion.

“Live streaming used to be just one option for brands looking to reach Chinese consumers in new and engaging ways,” said Alvin Liu, import and export general manager at Tmall, in a statement. “But now, because it has become so integral to how people shop here, it’s incredibly important for any brand that wants to be successful in this market.”

As live streaming becomes an increasingly popular practice in China, Western labels and retailers are catching on to the tactic as a means of driving real-time interactions with consumers.

Acting as a digital, influencer-driven version of home shopping television networks, live streaming enables brands to showcase products and stores through personalities. As more luxury shopping moves online, live video offers a way to connect the physical and the digital, enabling shoppers to get feedback and make more confident decisions (see story).

From 2019 to 2021, Alibaba anticipates that live streaming will generate $70 billion in gross merchandise value.

Another aspect that is of growing importance in China is voice commerce. Alibaba says that 1 million orders were placed during 11.11 using its Genie voice assistant.

Tmall Genie. Image credit: Alibaba

By 2022, it is projected that 55 percent of households will have a virtual voice assistant, and the ecommerce market around these devices will reach $40 billion.

A survey from Digitas finds that millennials are more apt to show interest in purchasing products via a VVA than older generations. This is particularly true for categories including beauty, clothing, accessories and technology (see story).

"Luxury brands are already leveraging new media to drive engagement and sales," Mr. Zipser said. "It could be live streaming, could be short video platforms like Douyin or could be any other new media platform in the future.

"It is more about how to keep the pace with consumers on how they explore products and brands," he said. "Luxury brands should find the right platform, right influencers and the right way to engage with consumers in terms of both content and ways to interact."

Share your thoughts. Click here