- About

- Subscribe Now

- New York,

October 9, 2019

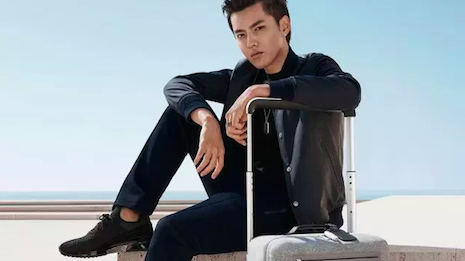

Kris Wu in Louis Vuitton Horizon Soft luggage campaign. Image credit: Louis Vuitton

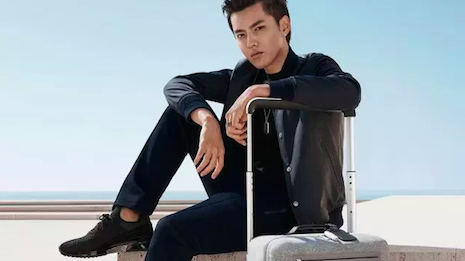

Kris Wu in Louis Vuitton Horizon Soft luggage campaign. Image credit: Louis Vuitton

China’s millennial and Gen Z audience is looking for brands to speak with them rather than at them, as a study shows they would rather be influential than feel influenced.

According to data from Agility Research & Strategy, 41 percent of millennials and 33 percent of Gen Z consumers say that they are planning to spend more on luxury in the next 12 months. While both age groups share traits such as a willingness to splurge and a sense of optimism, they differ in some key psychographics, preferences and behaviors.

"As a whole millennials and Gen Z consumers have some similarities – for example they’re quite individualistic compared with earlier generations of Chinese consumers and are more used to and sophisticated about luxury, having grown up with luxury brands, though there are differences in degree, and Gen Zs are in many ways more individualistic and into expressing themselves and their opinions," said Amrita Banta, managing director at Agility Research & Strategy, Singapore.

"Gen Zs do separate themselves in some ways, though," she said. "They view luxury through the lens of their quality of life and expressing themselves, where earlier generations used luxury more as badges of status and success.

"More so than millennials, Gen Zers view themselves as avant-garde trendsetters rather than as followers. Of course not everyone can really set the trend, and they follow KOLs and they are quite influential on their choices, but it’s a difference in mindset and how active they are in their relationship with brands.

"They don’t feel that they are being influenced directly only by the brand. Instead they cast their nets widely across different platforms like Red, Tik Tok and Bilibili and view the people they follow more as extensions of their friend circles and view themselves as more involved in a conversation rather than being on the receiving end."

Agility's research is based on a survey of 1,005 millennial and Gen Z consumers, split evenly between residents of Tier 1 and Tier 2 cities in China.

Tale of two generations

Gen Zers are currently between the ages of 15 and 24, and only 79 percent say they have a full- or part-time job. Comparatively, 99 percent of millennials are employed.

Even though many Gen Z consumers do not work, they often get allowances from their parents that they put towards luxury shopping.

Both generations tend to spend all of their income each month rather than saving, and 45 percent say they are willing to spend to have a better lifestyle. For these consumers, luxury is first and foremost something that increases their quality of life.

These age groups also link the idea of luxury to something that shows their taste. Individualism is very important to millennials and Gen Zers, and Gen Z shoppers in particular consider themselves trendsetters.

Rounding out the top five definitions for luxury are a feeling of indulgence, a well-known brand and a sense of status.

Both generations feel as though they are under pressure. Gen Z’s response to this is seeking to achieve both a feeling and an outward appearance of calm.

Fifty-six percent of millennials and Gen Zers are optimistic about the future. Their top goal is living a healthy life, which beat out aspirations related to their careers, love and finances.

Health is the number one aspiration for Chinese Gens Y and Z. Image credit: Lane Crawford

Health and sustainability are greater concerns among millennials, 31 percent of whom say that they consider the environment and ethics before buying luxury products. In comparison, only about a quarter of Gen Z consumers say the same.

Despite this interest in sustainability, resale and secondhand have not caught on in China as much as in Western markets such as the U.S. Only about one in 10 Chinese consumers has rented luxury goods or sold their luxury goods to a secondhand seller.

Gen Z does show slightly more openness to buying secondhand, with 15 percent saying they would consider it to millennials’ 10 percent.

"In interviews a key emerging area of interest is in vintage luxury. We are finding many younger consumers are becoming fascinated with luxury products from other time periods," Ms. Banta said. "They like the uniqueness and particular story behind vintage items that they have to go out of their way to find – in Japan and Milan, for instance."

Millennials are slightly more influenced by social media than Gen Zers, with 27 percent saying they have bought a luxury product because a key opinion leader suggested it. They are also more predisposed towards sharing their luxury purchases on social media than their younger counterparts.

For product inspiration, millennials are more likely to turn to Red, Tmall and Weibo, while Gen Z shoppers gravitate towards Weibo, Tik Tok and Red.

Chanel is one of the top brands. Image credit: Alibaba

Gen Z consumers show more interest and willingness to spend on streetwear. Thirty-nine percent of male Gen Zers say they are a big fan of athletic wear, compared to just 30 percent of millennial men.

Across both generations, the top streetwear brand is Adidas, followed by Nike.

While watches are the top passion of millennial males, the category does not break the top four for a Gen Z audience.

Some of the top brands for these generations include Chanel, Chow Tai Fook, Cartier, Longines, Rolex, Dior, Estée Lauder and Lancôme.

"[Gen Zers] are much more casual about luxury and for them luxury does not have to be formal and they really like to mix and match between 'the high-end luxury' and more niche and casual brands," Ms. Banta said. "So while Chanel and Dior rate highly as brands that they feel represent them, so do brands like Nike and Casio’s G-Shock watch brand."

Collaborate and listen

According to research from BCG and Altagamma, one of the key emerging trends in the luxury business this year is partnerships, as brands seek to bring a sense of newness to consumers.

These collaborations, such as Louis Vuitton’s link with Supreme to Chanel’s recent Pharrell Williams collection, are particularly finding favor with younger generations and Chinese shoppers. Across age groups and nationalities, luxury buyers show a heavy awareness of tie-ups and 50 percent have invested in special-edition merchandise, a figure that is likely to grow as Gen Z and millennial buyers grow their influence and purchasing power (see story).

Agility’s study found that about a quarter of millennials and Gen Z consumers have bought special-edition items. Millennials were more apt than Gen Zers to have bought products from a luxury collaboration with another brand.

Luxury brands Louis Vuitton, Bulgari and Cartier successfully reach digitally savvy Chinese consumers by effectively leveraging influencer relationships and Eastern social media platforms.

According to Gartner L2’s 2019 “Digital IQ Index: Luxury China” report, luxury adoption of Chinese ecommerce stores is on the rise. Brands that are more open to flexibility and collaboration are also partnering with Chinese business-to-consumer platforms that offer large audiences and logistical support (see story).

Even though brands have found success at tapping popular influencers such as Kris Wu and Liu Wen, luxury marketers need to develop a two-way conversation with young Chinese consumers.

"This may sound a bit simplistic, but the first way [to appeal to millennials and Gen Zers] is to talk to them, listen and engage with them directly," Ms. Banta said.

"Many luxury brands especially are more used to being on an elevated plane and communicating their vision in a formal way," she said. "Gen Zers like to be part of the conversation and on the same wavelength with brands that speak to them."

Share your thoughts. Click here