- About

- Subscribe Now

- New York,

September 25, 2018

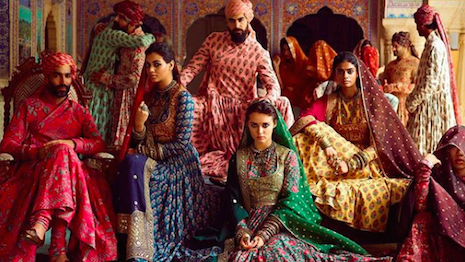

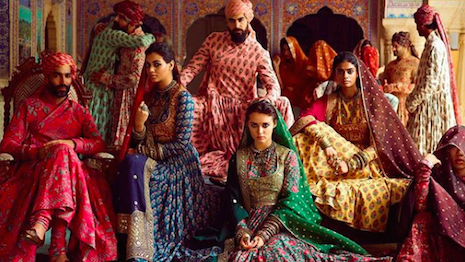

Sabyasachi Calcutta dresses models up in its highly-embroidered pre-wedding collection for the henna ceremony. Image credit: Sabyasachi Calcutta

Sabyasachi Calcutta dresses models up in its highly-embroidered pre-wedding collection for the henna ceremony. Image credit: Sabyasachi Calcutta

By Abhay Gupta

The luxury fashion and lifestyle market in India is one of the world’s most multifaceted, exciting and tricky businesses.

Brands and retailers that want to capture a share of this rapidly evolving market need to learn to adapt, or risk missing one of the next greatest untapped opportunities for the luxury business.

The idea of luxury today has evolved into a complete lifestyle, spanning fashion, food, travel, hospitality, health and wellness, and even technology.

Yet, it is also a well-established fact that fashion remains the fulcrum of luxury and that all other sectors prey onto fashion as a category to drive, growth, inspiration and value additions.

Hence, when it comes to luxury, the first thing that most people think of is fashion, which itself is a broader concept spread across the realms of apparel, footwear, jewelry, timepieces, eyewear and fragrances.

However, in the present era of democratization of almost everything, the luxury fashion industry is finding itself in a strategic dilemma.

Abhay Gupta is founder/CEO of Luxury Connect and Luxury Connect Business School

Abhay Gupta is founder/CEO of Luxury Connect and Luxury Connect Business School

The commercial demands of business have begun to take a toll on the creative aspects of the designer community, while the rapidly evolving business landscape is also compelling luxury brands and retailers to rethink and adapt, as they strive to preserve themselves in the quintessence of luxury amid creative and business disruptions.

The phenomenon is prevalent the world over, including India. Importantly, the luxury market in India is still nascent, but definitely growing, and is peculiar in its own way.

Enduring creative disruption

The very essence of luxury fashion lies in deep-rooted research: emphasis on new textile blends; inspiration, or the eureka moment for every designer; silhouettes perfected via multiple prototyping; and collections large enough to satisfy every global patron.

The essence over the last few decades has got slightly tweaked, however.

Luxury fashion first faced disruption way back in 1975 when fast-fashion brand Zara transformed the very process of how luxury fashion ought to be created – in a slow, relaxed and cyclical manner.

Luxury fashion brands thwarted the onslaught by quickly downscaling to introduce entry-level elements of eyewear, perfumes and accessories such as footwear, scarves, ties, belts and even bijou jewelry. Experimentations of associations/special lines for the likes of H&M were resorted to by a few established names of the luxury fashion space.

However, the core fulcrum of apparel fashion stood the test of time until recent times when corporate-led brands began to demand fast fashion from established luxury brands. This has led to a further disruption in luxury fashion to date – no clear path seems to be emerging.

Attempts to “See now, buy now” introduced by a few top names such as Burberry have yet to prove themselves and may not find favor among true connoisseurs.

Collaboration: Way forward?

Caught in creative disruptions, global luxury fashion and lifestyle brands and companies have been trying to find and define a success formula that can ensure commercial success without compromising on carefully crafted brand positioning, ethos and value propositions.

Some have gone on to collaborate with designers, artists and even hotels and auto companies to further their popularity, revenue as well as prestige.

Historically, Western luxury brands have quite frequently and successfully used collaboration methodology. French fashion house Louis Vuitton has had several such associations, while various other have also explored the genre.

Here, are some of the most successful fashion tie-ups of the West.

Over time, the trend has permeated the Indian market as well.

Several Indian designers have entered into collaborations with international and homebred lifestyle brands or companies, adding a new dimension to the country’s luxury space.

Listed below are some of the notable tie-ups in the Indian context:

Withstanding business disruption

Amid creative disruptions, luxury brands have a lot to deal with on the business front as well.

Some long-established business models are on their way out, paving way for newer and innovative concepts.

Who would have thought that luxury items would someday be available through virtual shops, or that the world order would undergo a drastic change with the emergence of new luxury consumption centers such as China, Japan and now also India, while traditionally rich Western countries would slow down in purchases?

Even consumer attitudes are now changing at a much faster pace than before.

Liberalization of the Indian economy in 1990s and policy changes thereafter have been a rollercoaster ride for foreign and homegrown companies across sectors, including luxury.

However, some sweeping developments that unfolded over the last three to four years have again transformed country’s business milieu. Let us take a look at them:

Digitization of financial services and demonetization: Both these government initiatives aimed at weeding out the alternate, parallel economy from the system came as a big blow to various sectors.

Luxury, however, was gainfully impacted during the initial window of relaxations during the demonetization drive launched in November 2016. Transactions peaked for a few hours when accessories, jewelry, watches, real estate and other high-value goods ended up being bought by stashed-away cash. Thereafter, there were mixed reports as to the positive or negative impact of demonetization where the central government overnight pulled 86 percent of India’s rupee bills out of circulation.

Most brands now feel that the initial slowdown was replaced by more balanced cashless transactions, bringing in more control and ease of doing business at the store-front level.

Goods & Services Tax (GST): The single-most key factor driving mixed emotions post-demonetization has been the implementation of GST. With multiple slabs, laborious paperwork and lack of clarity, GST spawned a resistant trade blockage, in general.

Luxury brands operating in malls found their overall costs coming down due to inputs being credited for GST paid for imports or real estate rentals. With a uniformity of taxes across stores in various states, the margins could be healthier, too. Clearly, well-implemented GST can give a boost to the luxury trade.

Foreign direct investment (FDI) policy changes: While FDI was technically opened up in 2012, complex sub-clauses on sourcing norms, investment size and location had restrained brands from announcing their plans.

However, recent changes in single-brand retail norms and relaxations on sourcing restrictions have been welcome by global luxury and superior premium brands.

Ease of doing business: With several positive announcements regarding new company formation, single-window clearances and faster approval of permits, India’s ranking has significantly improved in the World Bank's ease of doing business index.

Moody’s also has upgraded India’s sovereign rating to Baa2 from Baa3, putting India on a similar footing as the Philippines and Italy.

As a collective result of the aforesaid, over 250 to 300 foreign brands have announced their plans for India.

Creation of mass affluence: With increased focus on infrastructure development, employment generation and growth in smaller cities are imminent.

Rapid urbanization has led to increased awareness and a new demand for premium-to-luxury goods.

Brands such as Zara and H&M have now become household names in most middle-class families in tier II and even tier III towns.

Luxury brands have begun to proliferate via trunk shows, private sales and events that cater to the rich and affluent classes.

Sabyasachi Calcutta illustrates the art of crafting East Bengal Chandbani

Success in evolving landscape

Keys to success in Indian luxury next year and beyond include:

THE INDIAN LUXURY SECTOR is growing at compounded annual growth rate of around 25 percent.

Last projected at $18.7 billion, it is expected to reach $180 billion by 2025, as per federal planning body Niti Aayog’s CEO, Amitabh Kant.

The growing number of Indians climbing up the affluence ladder and many more turning into aspirational customers presents a massive market potential for luxury and affordable luxury fashion companies.

Significantly, Indian origin premium-to-luxury brands are also making their presence felt.

The likes of Titan and PC Jewellers have made it to the international legion of top 50 luxury goods firms that was topped by Louis Vuitton.

Even as there is some way to go for India to become the next luxury fashion destination, the good news is that the country’s business environment is becoming ever more conducive to luxury businesses. Undoubtedly, India growth story is indeed promising.

Sabyasachi's Kesaribai Pannalal campaign for its 2018 jewelry and couture collection

Abhay Gupta is founder/CEO of Luxury Connect and Luxury Connect Business School, Gurgaon, Haryana, India. Reach him at abhay@luxuryconnect.in.

Share your thoughts. Click here