- About

- Subscribe Now

- New York,

June 6, 2018

Sparkling smiles. Image credit: De Beers' Lightbox

Sparkling smiles. Image credit: De Beers' Lightbox

After years of disavowing the authenticity of man-made diamonds grown in a laboratory, De Beers has suddenly seen the light and responded to consumer demand by offering a lab-grown diamond alternative under the Lightbox Jewelry name.

That is what the company would have you believe in its recent announcement that advancements in technology have now made it possible for De Beers to offer a more affordable alternative to mined diamonds.

“Lightbox will transform the lab-grown diamond sector by offering consumers a lab-grown product they have told us they want but aren’t getting: affordable fashion jewelry that may not be forever, but is perfect for right now,” Bruce Cleaver, CEO of De Beers Group, said in a statement.

“Our extensive research tells us this is how consumers regard lab-grown diamonds – as a fun, pretty product that shouldn’t cost that much – so we see an opportunity that’s been missed by lab-grown diamond producers,” he said.

Adding to the fun element in the Lightbox Jewelry line will be an emphasis on colored pink and blue stones to complement the traditional clear-white diamonds.

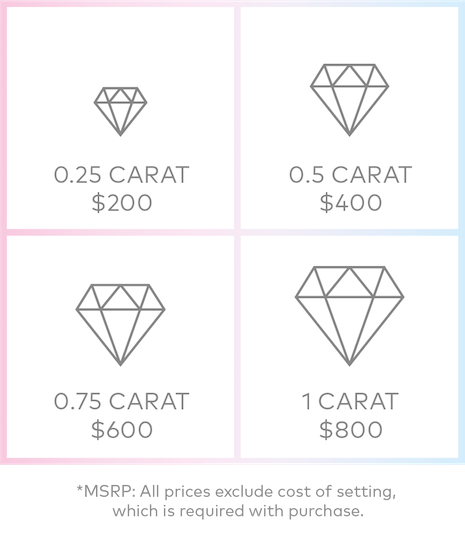

Prices will start at $200 for a quarter-carat stone to $800 for one-carat. These prices, however, do not include the cost of the jewelry setting, which will initially include earrings and necklace designs, not rings.

Many facets of pricing. Image credit: Lightbox

Many facets of pricing. Image credit: Lightbox

Lightbox jewelry will be available starting in September on the Lightbox Web site, with retail partnerships “to be announced in due course,” the company said.

To jump start its entry into the lab-grown market, De Beers will invest $94 million over the next four years in a new Element Six production facility near Portland, OR, which will join Element Six’s existing U.K.-based operation.

Element Six has been the production of arm of De Beers Group producing lab-grown industrial diamonds for over 50 years.

Disrupt yourself

In opening its doors to lab-grown diamonds, De Beers is giving credibility to a product that it has for years claimed is not the real thing.

“De Beers’ focus is on natural diamonds,” Simon Lawson, its head of research and development, said to Bloomberg in 2015. “We would not do anything that would cannibalize the industry.”

This is a classic “disrupt yourself before you are disrupted” move.

Glittery by association: De Beers' lab-grown diamonds set in earrings and pendants. Image credit: De Beers' Lightbox

Glittery by association: De Beers' lab-grown diamonds set in earrings and pendants. Image credit: De Beers' Lightbox

While the jewelry-quality lab-grown diamond industry is small today, estimated by Morgan Stanley to represent less than 1 percent of the global market for rough diamonds, with sales between $75 to $200 million, it predicts lab-grown diamonds could account for 15 percent of the gem-quality melee diamond market by 2020 – defined as less than a half-carat in rough form that can be ready for jewelry mounting by using industrial drill bits, saws and sanding equipment – and 7.5 percent of the larger diamond market.

In its mined-diamond business, De Beers has a lot to lose as laboratory-diamond sales grow.

The Economist reports that De Beers accounts for about one-third of global mined-diamond sales, down from 45 percent in 2007.

Among the many factors disrupting De Beers’ mined-diamond business, which declined from $6.1 billion in 2016 to $5.8 billion in 2017, are millennials’ concern about the environmental and human toll associated with extracting diamonds out of the ground. Laboratory-grown diamonds answer this objection.

“Millennials are even more concerned with the human factor impacted by [the] mining industry than their environmental concerns, which are great as well,” Marty Hurwitz, CEO of MVI Marketing, told me.

Mr. Hurwitz’s company recently conducted a study that found nearly 70 percent of millennials would consider a lab-grown stone for an engagement ring.

Disrupt the disruptors

By embracing lab-grown diamonds and calling them its own, De Beers is disrupting the industry’s stance against the numerous startup disruptors eating away at its market dominance.

These brands include Ada Diamonds, ALTR, Diamond Nexus, Diamond Foundry, New Dawn Diamonds and Pure Grown, among others, though no market-share leader has emerged as yet.

Sign of health: Pink Princess studs. Image credit: De Beers' Lightbox

Sign of health: Pink Princess studs. Image credit: De Beers' Lightbox

The diamond industry has been arguing for years that laboratory-produced diamonds are not “real.”

In a new study from the Diamond Producers Association conducted by Harris Poll, it reports: “A clear majority of American consumers recognize that diamonds created in a factory (also known as ‘synthetic’ or ‘laboratory-grown’) are not ‘real’ diamonds.”

Pushing back on the lab-grown industry’s narrative that the stones it produces are chemically and structurally the same as a mined diamond, DPA CEO Jean-Marc Lieberherr said, “At a time when everything ‘artificial’ aims to compete with, and replace, ‘natural’ and ‘real,’ these results show consumers care about inherent value, authenticity and symbolism that a diamond carries.”

While the De Beers’ Lightbox Jewelry announcement does not address the “real” versus “fake” controversy, it does distinguish between its mined-diamond offering as “forever,” as in “A Diamond Is Forever,” to its Lightbox alternative as for “right now.”

It also is notable that De Beers calls Lightbox “fashion jewelry,” positioning it as the lesser, more affordable alternative to “fine jewelry” quality defined by a natural, mined-diamond selection.

The official industry distinction between fine and fashion jewelry is that fashion does not have precious gemstones or precious metals other than plating, while fine jewelry is made with precious metals and precious gemstones.

In other words, lab-grown diamonds are not “precious,” whereas mined diamonds are.

This suggests the direction that De Beers will take as it moves Lightbox Jewelry into the market: “If you want fashion jewelry, Lightbox is your choice. If you want precious fine jewelry, then Forevermark and De Beers Jewellers is for you.”

Go big or go home

Rather than fight the rising tide against laboratory-grown diamonds that has found a consumer market ready, willing and able to embrace it, De Beers is getting in early to take a leadership position in an emerging category with no clear-cut leader.

Now it will have one, with De Beers’ mighty marketing muscle moving in to define the category and establish its positioning against the lab-grown upstarts, as well as elevating its mined-diamond precious jewelry offering.

DE BEERS SINGLE-HANDEDLY made diamonds what they are today.

Next, De Beers is going to make laboratory-diamonds what they will be tomorrow: a fun, fashion pretender to the real, rare, precious, natural, “forever” diamond.

And as it did with diamonds throughout its 130-year history, De Beers is going to use its power to establish prices for both the mined and laboratory-diamond markets. Its Lightbox Jewelry prices are way below current levels in the industry today, and given advances in technology and production processes, the costs to produce man-made stones will only fall.

Likewise, by establishing a low-price alternative to the real thing, De Beers will be able to drive up the prices for its natural stones. It is a very smart and bold move that would make South African icon Cecil Rhodes proud.

Pam Danziger is president of Unity Marketing

Pam Danziger is president of Unity Marketing

Pamela N. Danziger is Stevens, PA-based president of Unity Marketing and Retail Rescue, and a luxury marketing expert. Reach her at pam@unitymarketingonline.com.

Share your thoughts. Click here