- About

- Subscribe Now

- New York,

March 6, 2018

Looks from Chanel's spring-summer 2018 make-up collection. Beauty is one of the few categories that Chanel sells online. Image credit: Chanel

Looks from Chanel's spring-summer 2018 make-up collection. Beauty is one of the few categories that Chanel sells online. Image credit: Chanel

Online is the next frontier for luxury brands. It is where luxury brands can find their next path to growth, but for a variety of reasons they have been notoriously slow to follow it.

As an industry steeped in heritage and tradition, change does not come naturally to the luxury business. But in today’s dynamically changing consumer market, that is exactly what luxury brands must do. While luxury brands have accepted that they must market online, they have been much slower to accept that they must sell there as well. That remains their stumbling block.

“A big part of luxury brands’ hesitance to embrace sales online has been how to keep that luxury aspect of the brand, if it is so easily available,” said Lori Mitchell-Keller, global general manager for consumer industries at SAP.

“Keeping that perceived cachet of luxury in the online world have made them slow to migrate there,” she said.

But migrate sales online is what they have to do for assure a prosperous future.

What's on the line

Bain & Company recently reported online luxury sales growth is phenomenal, increasing by 24 percent in 2017. Yet it still accounts for only 9 percent of the total personal luxury goods market worldwide.

On the surface, online’s less-than-10-percent market share might not seem compelling, but the industry’s perception may not match consumer reality.

Compare that meager market share with luxury consumers’ preferences in where they like to shop and a totally different picture emerges.

In a global survey of affluent consumers with annual incomes of $150,000 per year or equivalent, the Luxury Institute found that 21 percent of those surveyed prefer to shop luxury online, and another 27 percent had no preference between online or in-store shopping. Just shy of a majority of luxury consumers do not shy away from doing so online – rather they actively embrace it.

Lori Mitchell-Keller is global general manager for consumer industries at SAP

Lori Mitchell-Keller is global general manager for consumer industries at SAP

“Luxury brands will lose share if they are not able to interact in the way the world is changing and the way customers want to interact with them,” Ms. Mitchell-Keller said.

While heritage luxury brands drag their feet, plenty of others are jumping in unburdened by fears of losing their luxe on the Internet.

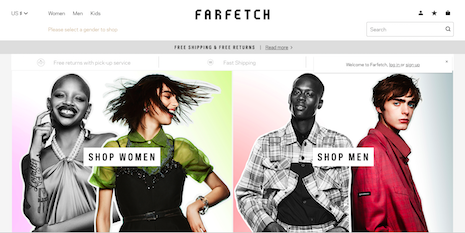

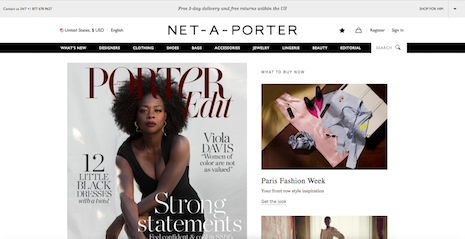

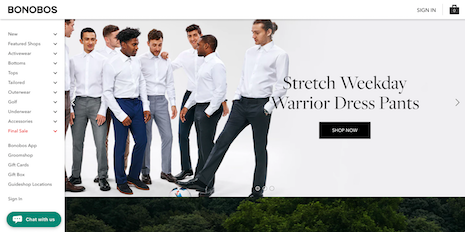

“We are seeing a lot of luxury brands being created online, companies like Farfetch, Net-A-Porter, Bonobos, that have much more of an online than physical presence,” Ms. Mitchell-Keller said.

“And other more traditional brands, like Badgley Mischka and Gucci, have figured out how to create, maintain, even enhance their luxe cachet online,” she said. “There is no secret or easy answer how they’ve been able to do that, but it can and is being done.”

Two of these born-on-the-Internet brands, she noted, have recently been acquired by other companies – Yoox Net-A-Porter by Cartier parent Richemont and Bonobos by Walmart. Farfetch has just signed deals with Fendi, Burberry and Chanel in advance of an expected IPO in New York this November.

Such deals are expected to pick up in the future, Ms. Mitchell-Keller said.

“The main reason physical luxury brands are acquiring digital brands is because they haven’t figure out the online equation yet,” she said. “They are looking for help to reach the digital customer.”

Putting our heads together, we think these five brands best exemplify the future of luxury online.

Farfetch goes further

Founded in 2008 as an online luxury fashion platform, Farfetch seamlessly blends in-store access to fashions across the globe with Internet convenience.

With offices in 11 fashion hubs from which it offers same-day express delivery, Farfetch lists products from more than 700 boutiques and fashion brands. It carries a multitude of heritage and emerging designer brands, including Dolce & Gabbana, Givenchy and Chloé.

Farfetch's edge over rivals is its wide global footprint for product delivery and also the fact that it does not carry inventory. Image credit: Farfetch

Farfetch's edge over rivals is its wide global footprint for product delivery and also the fact that it does not carry inventory. Image credit: Farfetch

Having acquired the London-based Browns boutique in 2015, Farfetch used that platform to introduce its technology-enhanced “Store of the Future” concept that marries the digital and personal experience that luxury shoppers desire.

Given its chops in digital luxury marketing, Farfetch also initiated a white-label digital service called “Farfetch Black and White” for brands that want to use its platform to power their own branded online presence.

Numerous heritage brands are coming on board in one way or another, including Burberry to list all inventory in its marketplace, Fendi for customized handbags, Gucci for 90-minute delivery service and, most recently, Chanel.

But tellingly, Chanel was quick to point out that its Farfetch partnership will not include selling fashion online, rather using its proprietary in-store technology for physical retail.

“We are not starting to sell Chanel on the Farfetch marketplace – I want to be very clear on that,” said Chanel president of fashion Bruno Pavlovky in announcing the deal.

To which Ms. Mitchell-Keller asks, “How much share will they lose while they are trying to figure online out?”

Chanel's recent fashion show. The fashion brand is highly protective of its distribution and sales channels, reflective of a desire to maintain the allure and mystique typically reserved for high-luxury brands. Image credit: Chanel

Chanel's recent fashion show. The fashion brand is highly protective of its distribution and sales channels, reflective of a desire to maintain the allure and mystique typically reserved for high-luxury brands. Image credit: Chanel

Such reluctance to embrace full-on digital access for customers is indicative of an industry attitude that has to change to ensure a vibrant future. It is ridiculous for a brand such as Chanel to force its 21st – century customers to shop like they did back in the 1980s.

Net-A-Porter brings it

Just acquired by Richemont following a merger with YOOX in 2015, Net-A-Porter, founded in 2000, takes a more heavily content-driven strategy than its closest competitor, Farfetch.

But like Farfetch, Net-A-Porter offers white-label digital support to designer brands through its YNAP platform that Richemont says will continue to operate as a separate entity.

Nonetheless, it will make strange bedfellows, since YNAP operates flagship online stores for many competitive Kering brands, including Bottega Veneta, Balenciaga and Saint Laurent.

Net-A-Porter's leadership in luxury ecommerce was a key factor in its complete acquisition by Cartier parent Richemont. Image credit: Net-A-Porter

Net-A-Porter's leadership in luxury ecommerce was a key factor in its complete acquisition by Cartier parent Richemont. Image credit: Net-A-Porter

While Ms. Mitchell-Keller admires Net-A-Porter, she thinks its Outnet Web site that offers discounted fashions in flash-sale format is especially in tune with how the next generation wants to shop.

“My son, who is totally a millennial, had me log-on to order a pair of gold Nike shoes, which I understand are status items for the college crowd,” she said.

“So here we are logged in at midnight for the countdown and find out we are No. 500 in line to order. It is such a different experience than I am used to where luxury brands pamper you in the store, but millennials don’t necessarily want that. They want this.”

Outnet makes it fun for millennials. It is fast, it is limited, it is accessible and it is cheaper.

Bonobos shows men how to wear it

Bonobos is one of those born-on-the-Internet fashion brands, or near-luxury for those who want to quibble, that have captured the loyalty of affluent men shoppers, a hard demographic to attract into the store. It has achieved that by not just selling clothes, but showing men how to dress fashionably. It is also helped by offering casual-luxe styles that modern men favor.

“I’m intrigued by the way Bonobos shows their clothes,” Ms. Mitchell-Keller said.

“It’s not just a guy standing there like on most Web sites,” she said. “You can see the movement and men interacting with each other. It is a much different experience than just going online and seeing picture after picture of clothes. It’s engaging.”

As a result, Bonobos caught the eye of a big company suitor, Walmart, which acquired the company last year, and with it a thought-leader in the next generation of retail fashion, Andy Dunn, who joins another ecommerce powerhouse, Marc Lore, at Walmart to give it a leg up into new Internet markets.

Bonobos merchandises and styles differently online and on mobile, catching the eye of Walmart, the world's largest retailer that is in mortal combat with Amazon. Image credit: Bonobos

Bonobos merchandises and styles differently online and on mobile, catching the eye of Walmart, the world's largest retailer that is in mortal combat with Amazon. Image credit: Bonobos

While Walmart just announced that its recent quarterly online sales growth slowed, up only 23 percent compared to a year ago versus the 50 percent growth enjoyed throughout the first nine months of the year, it continues to project a 40 percent uptick through the rest of the year, with Bonobos and a recently announced online partnership with Lord & Taylor showing that this low-end leader aspires to reach higher.

Badgley Mischka dresses its models with tech

While the Badgley Mischka brand has long maintained a vibrant online ecommerce presence, co-owner and co-designer James Mischka is described by Ms. Mitchell-Keller as a “technology geek.”

Being as attuned to tech as fashion, he partnered with SAP to create a runway application for the recent New York Fashion Week where those in the audience could vote on each look as it walked down the runway.

“In nine minutes they got feedback that usually takes them six months to get,” Ms. Mitchell-Keller said.

The results were eye-opening for the fashion label which discovered that a dress it has not thought would make much of a splash turned out to be the second-most popular look, allowing the company to place sufficient orders to get it into the stores in record time.

The audience in turn loved the ability to get all the fashion details on their phones instantaneously. The models loved it, reading the results backstage and competing to see whose look scored highest. And the other designers present at the show were envious and lined up afterwards to get an app for their next runway show.

Badgley Mischka's app allowed attendees at its recent New York Fashion Week show to comment instantly on runway looks, delivering feedback that shaped product delivery to stores. Image credit: Badgley Mischka

Badgley Mischka's app allowed attendees at its recent New York Fashion Week show to comment instantly on runway looks, delivering feedback that shaped product delivery to stores. Image credit: Badgley Mischka

Thinking about new ways that consumers can interact and engage with a luxury brand is what makes Badgley Mischka an important luxury brand for the future.

“Too many luxury brands aren’t thinking about the technology,” Ms. Mitchell-Keller said. “They are thinking about product, which is important, but they have to understand how their brand is being consumed differently than it used to be consumed.”

The Badgley Mischka fall-winter 2018/19 fashion show at New York Fashion Week

Gucci breaks out of the luxury culture

One cannot finish this look at luxury online without mentioning Gucci.

In an interview on business television channel CNBC, Kering chairman/CEO Francois-Henri Pinault said the group’s Gucci brand is doing about 50 percent of its sales with millennials.

In recognition of its online success, L2 Research, which specializes in data-driven analysis, gave its top spot for best-performing digital fashion brand to Gucci in 2016 and 2017.

Gucci's partnership with Sir Elton John for a capsule collection of T-shirts and tote bags is available for pre-order exclusively on Gucci.com, marking yet another reason to appeal to the fashion brand's millennial customer base. Image credit: Gucci

Gucci's partnership with Sir Elton John for a capsule collection of T-shirts and tote bags is available for pre-order exclusively on Gucci.com, marking yet another reason to appeal to the fashion brand's millennial customer base. Image credit: Gucci

I have written extensively about Gucci, but suffice to say that Gucci’s success online is thanks to Gucci CEO Marco Bizzarri giving free rein to its young creative director, Alessandro Michele, who understands how to connect with this digitally native generation.

Thus Gucci has broken out of the inbred, digitally averse culture that plagues so many other luxury brands.

MS. MITCHELL-KELLER AND I see a whole digital transformation that is going to happen in luxury, just as it has happened in other markets.

While we recognize that the experience of in-store shopping and the pampering luxury consumers can find there is not going to be replaced by digital engagement, customers today also value the luxury of convenience that online delivers.

“The time issue is a huge one,” Ms. Mitchell-Keller said.

“It’s not just that everyone is now on social media,” she said. “Everybody also has huge demands on their time. It’s a very different world than 20 years ago when these brands started to become popular.

“Luxury brands have to adapt to the way that consumers want to interact with their product now, and that increasingly is going to be online.”

Pam Danziger

Pam Danziger

Pamela N. Danziger is Stevens, PA-based president of Unity Marketing and Retail Rescue, and a luxury marketing expert. Reach her at pam@unitymarketingonline.com.

Share your thoughts. Click here