- About

- Subscribe Now

- New York,

June 13, 2017

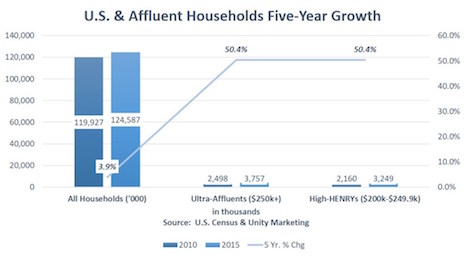

U.S. and affluent households' five-year growth. Source: U.S. Census and Unity Marketing

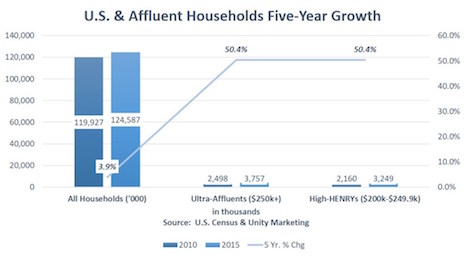

U.S. and affluent households' five-year growth. Source: U.S. Census and Unity Marketing

Luxury brand executives must be breathing a sigh of relief after reading the recent headlines from Bain & Company that the luxury goods market is predicted to grow 2 percent to 4 percent in 2017.

Claudia D’Arpizio, a Bain partner and author of the new study, is quoted by The New York Times in a eye-grabbing headline, “Luxury Goods Market Will Return to Growth in 2017,” saying, “The luxury business looks in a much better place than it was this time last year.”

But dig a little deeper into the report and Bain’s good news is driven primarily by the growing appetite for luxury indulgence among the Chinese consumers.

Bain also sees hope in the European market, which I for one am more skeptical about.

The only dark cloud on the horizon anticipated in the report is the United States market:

Still the largest market for personal luxury goods, the U.S. is facing a combination of factors, which hamper growth. A slowdown in tourism, a still-unsettled political climate and a challenging outlook for department stores create a perfect storm for luxury brands.

Being the world’s largest market for luxury, a falloff in luxury goods consumption in the U.S. could mean a tsunami-sized hit to the luxury market. That perfect storm for luxury brands predicted for the U.S. market could sink an awful lot of ships.

Demographic shifts should power a U.S. luxury market boom

Given demographic shifts in the U.S. consumer market, we should be experiencing a luxury boom, not a bust.

The number of affluent U.S. consumers who can afford the luxuries that the brands are pedaling is rapidly growing.

Indeed, the households at the top of the income pyramid, i.e. those with household income of $200,000 and above, are the fastest growing income segment of all.

Yet the affluent are holding tight to their cash and carefully allocating their luxury indulgences to the categories where they get the greatest happiness return on their investment, which increasingly is through experiences.

As Messrs. Stanley and Danko very ably proved in their best-selling book The Millionaire Next Door, people do not get rich by spending their money, but by saving it.

Having come through the recession, American affluents are keen on growing their wealth and not telegraphing their affluence through flashy luxury brands.

Today, affluent shoppers get bragging rights from how much money they save, rather than the conspicuous display of owning the latest Louis Vuitton handbag or Gucci loafer.

Indeed, they are exceedingly smart shoppers and know how to game the system to indulge their cravings for luxury for less or by making strategic substitutions for lesser-known and lower-priced brands with comparable quality, if less social status.

But then, they already have plenty of status without having to wear a showy luxury logo or a status-symbol watch.

Out with old luxury, in with the new

The fundamental challenge for luxury brands targeting the U.S. affluent consumers is that their underlying value system has changed.

In the mindset of American affluents, the qualities that luxury brands have used traditionally to drive appeal and demand for their brands is meaningless.

Old luxury is, well, old and its ideas are outmoded. Today’s affluent Americans demand luxury in a brand new style.

The traditional positioning for luxury brands has taken on a sinister hue being associated with the demonized 1 percenters.

Speaking in political terms, traditional luxury brand positioning has high negatives associated with elitism, extravagance, conspicuous consumption, exclusivity and status seeking.

A perfect example of old luxury is Joe Namath in his over-the-top fur coat worn at the Super Bowl.

Personally, I think Broadway Joe looks great, but then he is old now. It is a look that screams extravagance and indulgence that is out of step with today’s luxury consumer mindset.

Contemporary American affluents are looking for a more understated expression of luxury.

Rather than conspicuous consumption and status symbols that proclaim one’s wealth, the affluent are embracing brands that give them bragging rights to how smart a shopper he or she is.

Luxury does not have to come in a fancy package that you have and own, but in an experience that one shares and enjoys. And that experience does not have to be a stay at a five-start luxury hotel, but more often it is an Airbnb lodging where the travelers are embedded in the local culture, far removed from the tourists.

Airbnb’s “Don’t go to Paris, don’t tour Paris and please, don’t do Paris. Live in Paris” is spot on for the new luxury mindset.

Traditional luxury brands get the idea of exclusivity wrong, too.

Exclusivity in new luxury style is not about excluding people from enjoying and participating with the brand.

Rather by participating with a luxury brand, consumers self-select to join an exclusive community where members are linked by shared values and ideas of quality and craftsmanship that the brand represents.

Take a brand such as Canada Goose. Bikini-clad Kate Upton famously modeled a Canada Goose fur-accented jacket on the cover of the 2013 Sports Illustrated cover. Her jacket kept her just as warm as Broadway Joe’s, only it did it in new luxury style.

New luxury style is functional and practical, not extravagant and excessive. And, importantly, it is a smart money choice too, since that Canada Goose jacket, while premium priced, is a mere fraction of what Joe’s fur coat cost.

Predictions for luxury goods sales in the U.S. for 2017

The latest Bain study predicts a 2 percent decline to 0 percent growth in personal luxury goods sales for the U.S. in 2017. That comes after a 3 percent decline in 2016.

My guess is the U.S. luxury market will decline further, especially with the struggles we are seeing from the U.S. luxury market leaders such as Tiffany and upscale brands including Ralph Lauren and Michael Kors, combined with the restructuring of the U.S. retail market in general.

THE REAL PROBLEM in the United States luxury market currently is that luxury brands are simply out of touch with the evolving mindset and values of the American affluent consumers.

The rapidly growing base of affluent consumers with plenty of money to spend look at what the luxury brands offer and see that they are heavy on marketing, but light on authentic values that really mean something to them personally and in their current lifestyle.

Americans crave luxury in a brand-new style and brands that give it to them will get the business, while those that remain stuck in the past will continue to see their U.S. sales slide.

Pam Danziger is president of Unity Marketing

Pam Danziger is president of Unity Marketing

Pamela N. Danziger is Stevens, PA-based president of Unity Marketing and a luxury marketing expert. Reach her at pam@unitymarketingonline.com.

Share your thoughts. Click here