- About

- Subscribe Now

- New York,

February 7, 2017

Opening doors for wealthy African consumers

Opening doors for wealthy African consumers

The African market has been underserved by a lack of presence in luxury brands in most of the countries. This has prompted an opportunity for concierge services to bridge the gap. There is a growing gap between luxury brands and African luxury consumers, with demand being fueled by an increasingly wealthy population in sub-Saharan Africa.

Luxury business veteran Zakary Chanou in 2003 launched UUU, a Paris-based concierge services company. The company now has a global client base.

The dialogue below details Mr. Zakary’s focus on Africa and the growth of concierge services:

What is the size of your company, UUU, and its operations?

The company has more than 20,000 partners globally working 24 hours a day, seven days a week, irrespective of the location and the time zone.

Currently, UUU has more than 8,000 private customers and 200 corporate clients such as private banks, family, offices, financial institutions, and oil and gas companies from all over the world.

How do you acquire new clients from the African market?

I travel a lot to various African clients to attend events where I meet potential clients.

In addition, we get our clients through referrals and word of mouth from our current clients.

We also look for partnerships that are relevant to our DNA such as private members clubs, luxury marketing companies and other market relevant firms.

If client acquisition is done mostly through word of mouth and referrals, does that greatly reduce the marketing costs, especially in terms of advertising?

Having being in the business for several years, our brand name and our capabilities have been well established and recognized globally. This means we have gained the trust of our clients.

The high-net-worth individuals work on a basis of trust, mostly. After they gain your trust, they make the referral.

This is a high communications tool for the business. That does not mean we don’t invest in marketing, as we engage in various marketing activities that are relevant to the DNA of this business.

We partner with companies that cater to the wealthy individuals to provide them with services.

Zakary Chanou

Zakary Chanou

With your growing base of African clients, does this imply there is less use of digital apps such as Uber or apps that are used to book hotels to flights or diners? Does a concierge service have an impact of digital usage by the African luxury consumer?

Yes, it does. There is a limit to what an application can do in luxury. I can give you a few examples.

Some of our clients want to be picked and dropped at Charles de Gaulle Airport in [Paris] France or at Le Bourget, the airport that caters to private jets in France. An app can get you the car to pick you up, but the app cannot do your taxes for you, carry your luggage for you to the check-in desk or escort you up to the first class lounge or business class lounge.

This is what we offer our clients: pick-up, carry their luggage into the airport, manage their taxes, check-in the luggage and escort the person to the business class or first class lounge.

If you have a client who wants to spend some time in Paris but doesn’t know where to stay, we provide the information and he or she researches on it digitally. But the next step is ours: to communicate with him, and do all the bookings for him, and ensure it’s a luxury service all the way and VIP welcome everywhere.

Therefore, digital will be used mostly to research and communicate, but it has its limitations.

There are a lot of wealthy Africans who prefer the face-to-face communication and a tailor-made service. They like that treatment.

There are not many luxury brands represented in most of the African countries except South Africa, with representation in markets such as Nigeria, Angola and Ivory Coast. Does this position you as a very influential sector to the wealthy African luxury consumer?

Yes it does. A lot of clients rely on us to advise them on where on stay, such as private chateaus, or to access the limited Hermes Birkin bag, or what timepieces to view. We are their tastemakers, and guide them on what else they can purchase.

Many Africans like bespoke and individualized products, less accessible items, not products that everyone has and is easily accessible. We provide the advice and make the contacts to these stores for the clients.

Luxury products consumption is on the rise and alongside it is the business of luxury services, to be more precise, concierge services. These companies play a role to their clients as opinion formers, experienced tastemakers, and important links between the luxury brands and the clients who purchase from these brands.

Is there significant growth of the African high-net-worth and ultra-high net-worth individuals?

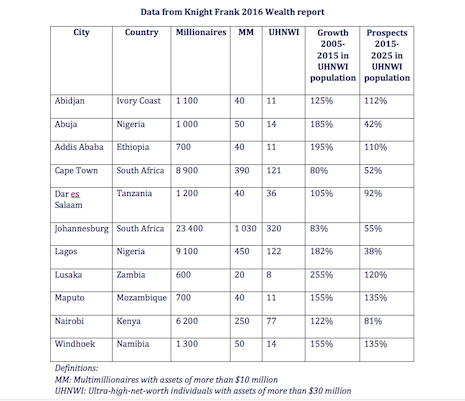

Earlier last year, Knight Frank published a report about the wealthy globally. The report further stated there are various African countries that have and will have significant growth in wealthy individuals.

If you look at Abuja in Nigeria, there are 14 ultra-high-net-worth individuals (UHNWI). These individuals have more than $30 million in assets.

In Johannesburg, South Africa, there are 320 UHNWI and there was 83 percent growth of this category from 2005 to 2015.

Ethiopia is also interesting as it has 11 UHNWI and this grew by 195 percent in the same years, too.

Nairobi, Kenya has very significant data with 77 UHNWI, which is one of the highest numbers in most sub-Saharan African countries.

The more the increase of the wealthy individuals, the more need for concierge services.

There are busy people who are very time poor. Also, due to the lack of luxury retail in most countries, thus the greater need for our services.

Data from the Knight Frank 2016 Wealth report on the African affluent market

Data from the Knight Frank 2016 Wealth report on the African affluent market

Is there a focus on collectibles?

Many of these individuals purchase collectibles such as fine art, wine, Cognacs, stamps and and coins, timepieces and jewelry. They want an experienced eye to locate these pieces for them and manage the purchase.

Knight Frank stated that 4 percent of the UHNWI have 4 percent of their wealth allocations portfolio for these collectibles. This is another reason as to why the concierge is important.

In many of these Africa counties, people purchase racing horses, vineyards, high jewelry and art as part of their portfolios. We also play an advisory role in this case and provide the relevant networks to the clients.

What are your expansion plans for the African market?

There are plans to open in the Abidjan, Ivory Coast, a country with an ever-increasing number of high-net-worth individuals.

We are also looking at markets such as Nigeria, Kenya and South Africa as part of our business plans.

Many countries have had a positive economic growth through well-known sectors and sectors that have developed in recent years such as mining and agriculture. Now we have technology and the film industry, among others.

More people have disposable income in sub-Saharan Africa and feel they need to be taken care through luxury services.

There is a recession in Nigeria and economic challenges in commodities in markets such as Angola and South Africa. Has this had a negative impact on your business?

No, it hasn’t. We have a growing demand from Nigerians who want concierge services. The demand has increased with the recession.

Globally, African customers are in demand for more luxury, bespoke services and exclusive experiences.

Maryanne Maina runs The Business of African Luxury blog

Maryanne Maina consults and writes on the African luxury market on her blog, The Business of African Luxury. She is based in Paris. Reach her at maryanne.njeri@gmail.com.

Share your thoughts. Click here